Amid the Russian-Ukrainian war, stock losses and fears of stagflation, which the global markets are witnessing, a fertile environment in which gold is supposed to shine, a safe haven in times of political and economic uncertainty, but the performance is still largely lackluster, so the yellow metal soon shines for several sessions , until it falls back down again in a very volatile year so far for prices.

Despite the presence of factors supporting the rise in gold prices, the pressure of the dollar, which stands at the highest level in two decades, and the increase in interest rates, had a greater impact in turning the compass of the yellow metal to the downside, in an environment surrounded by many doubts about the future of the global economy. .

The fluctuations of gold and markets in general reflect the difficult equation that global central banks, led by the Federal Reserve, are trying to achieve by striking a balance between curbing inflation by raising interest rates and maintaining economic growth rates at the same time.

Gold prices fell to their lowest level since February 10, at $ 1800 an ounce, at the opening of today’s session (May 16), to erase all the gains it had made, as a result of the Russian invasion of Ukraine, which pushed the yellow metal to exceed levels of $ 2000 an ounce, For the first time in a year and a half

In fact, the beginning of this year was not good for gold, as it was struggling to stay above $ 1800 levels, with pressures of the rise in the dollar and US bond yields with bets on tightening monetary policy at a rapid pace, to end the precious metal the first month of the year down by more than 13% from the level The record recorded in August 2020, though, gold prices took a strong upward path and crossed the $2000 level by the end of February, after the Russian escalation against Ukraine and the start of the war that had not ended yet, so that the invasion of Ukraine served as a lifeline for the yellow metal from the pressures of high interest rates. .

Last March, the US Central Bank began an expected series of interest rate increases, with it raising it by about 25 basis points, for the first time since 2018, to combat the acceleration in inflation in the United States, which recorded 8.5% during the twelve months ending last March, which is The highest rate since December 1981.

* Gold prices since 2016

Despite inflation fears, which support gold as a store of value and a performance to hedge against rising prices, interest rate pressures were stronger, and pushed it to suffer again and traded slightly higher than the $1,900 level per ounce during last April, recording the first monthly decline since January by about 2.2% .

This comes with the fact that higher interest rates increase the opportunity cost of holding the non-yielding metal, as well as boosting the dollar's rise, making gold more expensive for holders of other currencies, and this is a point that must be carefully considered.

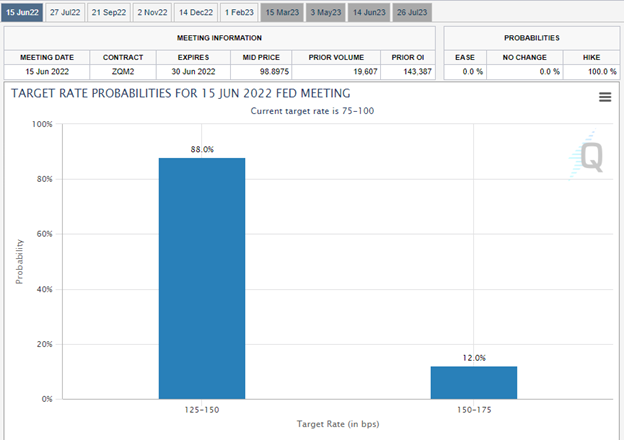

Investors expect interest rates at the June meeting

Risks remain on the yellow metal this year, amid market expectations to raise interest rates by another 50 basis points at next month’s meeting, even after data showed a slowdown in the increase in the inflation rate in the United States during the past month, reaching 8.3% on an annual basis, down from 8.5% in the previous March.

As for the technical analysis of the movement

We raise the banner of warning against any operations to buy the yellow metal for investment, and we believe prices will continue to decline, as we notice the formation of negative breakthroughs on the weekly frame with the formation of a double top at the price of 2070, which represents a resistance level pressing down that prices have reached their ceiling, and therefore we expect to see a return to the 1690 level. Dollars, and I think technically that prices may head to the level of 1450-1500 dollars during the next few months to represent a buying range that may motivate investors to enter and perhaps more than wonderful opportunities if prices reach the level of 1360 dollars, which is a support that prices may drift to.

Gold currently remains at the crossroads of the global economy. It is possible that the Fed’s aggressive policy will push the economy into a recession, and fail to combat inflation, and this may support the precious metal to limit its downward momentum, but in any case, we believe that gold has made its peak in 2022 and needs a lot. Time to come back and shine under the spotlight again

Iyad Abu Aref

Founder of the Namazon website