Special Report - (Namazone):

A group of companies listed in the UAE capital markets are heading towards the unknown, after their accumulated losses have worsened, and they have become required to find quick solutions to address their conditions, to get out of the crisis.

> The Emirates Securities and Commodities Authority announced, on July 5, the launch of the second category screen, to trade the shares of troubled and suspended listed companies.

The authority said, in a statement, that the shares of these companies will be traded separately from the main market, to allow investors the opportunity to decide on their investments in troubled companies while taking adequate guarantees to protect them. .

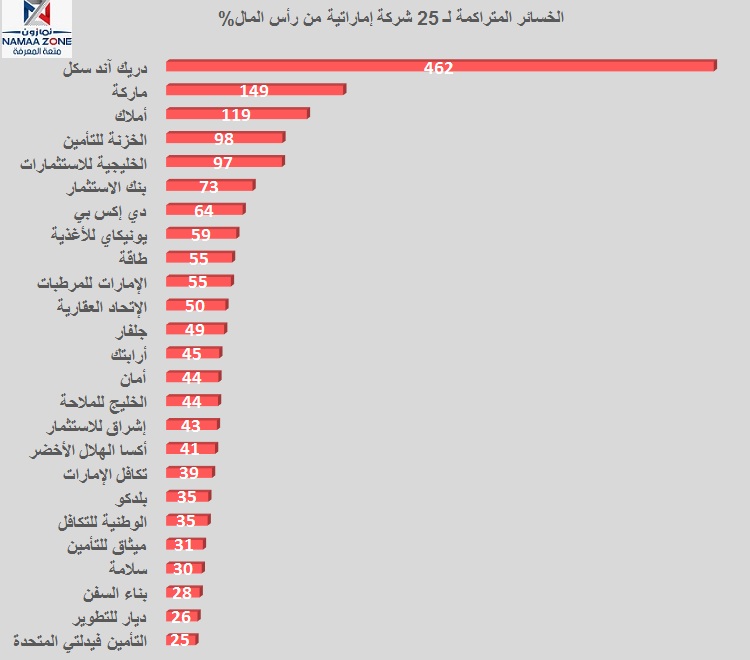

According to the data available on the website (Namazon), the number of companies that have accumulated losses reached 20% or more of its capital, within the companies listed in the UAE market 25 companies, according to the latest data Corporate Finance.

Dubai Companies

Drake & Scull revealed, last June, that the accumulated losses were due to allocations for projects under construction, and contracts receivable in old projects in the UAE, Saudi Arabia, Qatar, Sultanate of Oman and India .

She pointed out that the reasons for exacerbating the accumulated losses are also due to the write-off of the full value of the goodwill and the trade name on December 31, 2018, and the costs of project delivery exceeded budgets significantly.

The company stressed that it will focus on completing and delivering old projects and refocusing on basic activities to win new projects to address these losses, while completing negotiations with banks and creditors to reach settlements, and follow up on issues Legal action against previous administration.

according ...