The US Added Less Jobs Than Expected in April After a Soft Employment Data Week

The dollar lost upward momentum after the U.S. non farm payrolls (NFP) report showed a gain 160,000 jobs after a forecast of 205,000 jobs. The U.S. unemployment rate remained at 5 percent and in a positive note the hourly wages were inline with expectations at 0.3 percent on a monthly basis and a 2.5 percent gain since last year. The wage rise is not enough to make the case for a rate hike in June, but is enough to offset the disappointing headline figures from the report as the Fed has given more weight to inflation metrics. The next hurdle for the U.S. economy will be the release of retail sales data on Friday, May 13 at 8:30 am EDT.

Wild fires continue to rage near Fort McMurray, the oil sands capital of Canada, driving the price of energy higher around the globe. The Canadian economy fundamentals have come in weaker with higher trade deficit and low employment which added to this ongoing natural disaster has the USD advancing on the CAD. Oil prices have bounced around after the production freeze agreement failed to crystallize at the Doha meet. The Kuwait oil strike drove prices higher as it managed to reduce oil supply, which is something that is happening this time with the fires in Alberta.

The Bank of England (BoE) will host another Super Thursday on May 12 at 5:00 pm EDT. The central bank will release its inflation report, minutes and summary from the Monetary Policy Committee and the official bank rate. There are no surprises expected from the BoE but as one of the only central banks that are active during the month of May the text and press conference will get more attention than usual as the market is looking for guidance.

The USD had a strong week after starting on the wrong foot. The oversold trend broke suddenly and the U.S. dollar gained almost across the board. The biggest gains came against commodity currencies with the USD/CAD gaining 3.292 percent in the week to trade at 1.2919 and knocking on the 1.30 price level as the Canadian fundamentals deteriorated after a bad jobs report on Friday. The NZD and AUD fared no better against the greenback with the AUD/USD losing 3.623 percent trading at 0.7355 and the NZD/USD depreciating 2.209 percent down to 0.6825.

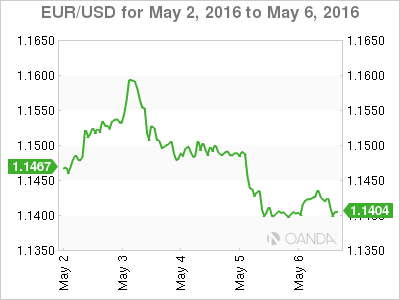

The EUR/USD ended flat after the disappointing NFP data with a slight loss of 0.155 sapped some of the momentum from earlier in the week. The pair is trading at 1.1416 after touching the weekly low of 1.1386. Economic fundamentals have been weak in Europe and the U.S. as all eyes were on the NFP to provide some hope of a June FOMC rate hike, but so far it all points to the U.S. Federal Reserve sticking to a cautious strategy and not trigger another rate hike until there are no doubts the economic growth warrants it.

Analysts updated their forecasts after the NFP miss with Barclays and Goldman Sachs abandoning the possibility of a rate hike after the June Federal Open Market Committee (FOMC). September becomes the next likely candidate but its impaired by its proximity of the U.S. presidential elections. That leaves the December FOMC as the next best option although the one that would put more egg on the face of the Fed as it would be a year since the last rate hike. Economic conditions have changed but the Fed will catch some of the blame as their Fedspeak did not offer any guidance as monetary policy become reactionary instead of proactive in 2016.

U.S. retail sales will be delivered on Friday 13 and although they are expected to fall again by 0.3 percent when including auto, the core retail sales are forecasted to grow by 0.6 percent excluding the volatile transportation component. Consumer spending and sentiment remain in a paradox. Consumers are still confident about the economy creating a positive leading indicator, but the reality of retail sales questions how accurate the survey measuring confidence really is. Retail sales and the University of Michigan’s consuming sentiment preliminary survey will be released on Friday.

"مبادلة" الإماراتية تقود جولة تمويل لصالح "ويفوكس" الألمانية للتأمين بـ400 مليون دولار

جمعت ويفوكس (Wefox)، وهي شركة لتكنولوجيا التأمين أ.. كامل النص

المراكز العربية السعودية توزع أرباح على المساهمين عن النصف الثاني من 2022 باجمالي 356.25 مليون ريال

أقرت شركة المراكز العربية بتوزيع أرباح نقدية على المساهمين ع.. كامل النص

أكبر الصناديق السيادية: "جهاز أبوظبي للاستثمار" يتقدم للمركز الثالث عالميا بأصول قدرها 708.8 مليار دولار

تقدم جهاز أبوظبي للاستثمار الى المركز الثالث في قائمة أكبر ا.. كامل النص

خسائر متراكمة تضع شركات إماراتية بشاشة "الفئة الثانية" انتظارا للمجهول

تقرير خاص ـ (نمازون): تسير مجموعة من الشركات المدرجة بأسو.. كامل النص

تفاصيل 142 مبادرة سعودية لمواجهة تداعيات "كورونا" بـ214 مليار ريال

تقرير خاص ـ (نمازون): أعلنت الحكومة السعودية، خلال الفترة ا.. كامل النص

هل سيظل الذهب من الأصول التي تعمل كملاذ آمن؟

لطالما كان الذهب مصدراً للجدل والخلاف بين الاقتصاديين والمست.. كامل النص

توقعات بتراجع التجارة العالمية خلال الأشهر المُقبلة

قال قسم الاقتصاد في بنك قطر الوطني (QNB) إن المؤشرات الرئيسي.. كامل النص

تحليل.. كيف ستستجيب البنوك المركزية الكبرى لتزايد حالات عدم الاستقرار المالي؟

تشهد بيئة الاقتصاد الكلي العالمية بعض الأوضاع الأكثر صعوبة و.. كامل النص

اليورو دون الدولار.. أدنى مستوى منذ 20 عاما

لأول مرة منذ 20 عاما، هبط سعر اليورو إلى ما دون دولار واحد،.. كامل النص

"أوبك".. ضغوط نقص المعروض مستمرة العام المقبل

توقعت منظمة البلدان المصدرة للبترول أوبك زيادة الطلب العالمي.. كامل النص

Week Ahead in FX: USD Rally Stops After Disappointing Jobs Report

نمازون متعة المعرفة

إتجـاه سهمـي |

خدمة مجانية لإستشارات التحليل الفني |

مستشـارك الخـاص |

خدمة مجانية لمساعدة المستثمرين على اكتشاف الفرص في الأسواق المالية |