As Bitcoin breaks new records one by one and dominates news headlines, there is an ongoing heated dispute between the US Securities and Exchange Commission (SEC) and the company that owns the cryptocurrency Ripple, which is traded under the symbol (XRP).

The cryptocurrency that was created in 2013 suffers from strong losses in recent weeks and has fallen to seventh in the list of digital currencies after it was the third largest currency by market value, mainly due to the lawsuit that it filed The Securities Commission against Ripple and pushed its price to collapse to about 17 cents in late December before it recovered to 70 cents in the last sessions, but it is still far from its great position among other digital currencies, which is witnessing strong gains recently, especially Bitcoin, which has reached levels of 85 thousand Dollar.

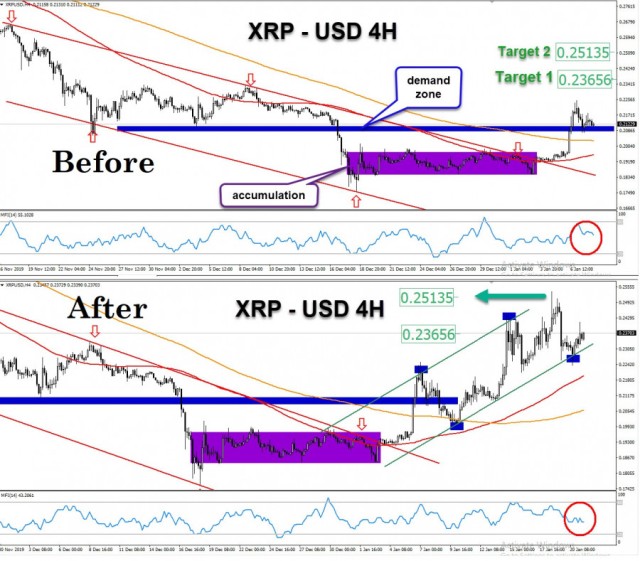

center dir = RTL> * Ripple's performance in the last 3 months

We will not talk much about the technical performance of the clear price movement, which expresses weakness that extended for many months even before the issue, and also wasted the valuable opportunity to rise within the general positive atmosphere of the market, which did not correct even 23% of its historical peak

We will try, through the following questions, to focus and clarify the issue of Ripple and the US Securities Commission, simply because it preoccupies many investors who love cryptocurrencies because the end of this issue may be important to other digital assets.

Why did you accept SEC to sue Ripple?

Ripple Labs and two of its executives faced a lawsuit by the US Securities and Exchange Commission over allegations of violating investor protection laws represented in the sale of XRB - the symbol of the Ripple digital currency - as the authority sees it as a security Not licensed.

The authority stated that Christian Larsen, co-founder of the company, and Bradley Garlinghouse, CEO, raised more capital to fund Ripple's business with more than $ 1.3 billion starting in 2013 during the sale of the digital currency XRB, in addition to Larsen and Garlinghouse Also, the implementation of unregistered personal sales of the cryptocurrency totaling about $ 600 million without registration, which is a violation of the registration provisions in the federal securities laws, according to the lawsuit.

And here, regardless of the allegations about Ripple being a security or digital currency, this does not negate the fact that the Ripple Company sold $ 1.3 billion and its managers also sold $ 600 million worth of money, all under the pretext of developing the network and business !! ??

But the strange thing is that the lawsuit was filed on the last working day of the Chairman of the Securities Commission Jay Clayton on December 22, which raises many doubts about this lawsuit, especially since Ripple announced that it sought to settle the matter Before the lawsuit was formally initiated, but it seems that it did not respond to the authority’s requests for a settlement.

And the strangest thing is that Ripple has been in public circulation for about 8 years without any legal problems, ...