Oil prices have rebounded in recent weeks, with Brent crude close to re-entering $100 a barrel levels, as investors somewhat over-reacted fears of an economic recession, with US interest rate hikes continuing unabated, and now more focused on a looming supply shortage.

And a perfect storm formed for the rise in oil prices with the approaching entry of the European embargo on Russian oil, as well as the setting of a ceiling on its prices by the Group of Seven next December, which will significantly affect Russian oil exports already affected by Western sanctions, in addition to the decision of the OPEC + alliance to cut production. Two million barrels per day starting from this November.

Crude prices started this week’s sessions, trading at $99.52 a barrel for Brent crude, the highest level since the end of last August, while West Texas Intermediate crude recorded $92.92, a level that US crude has not seen since October 7, after the green color dominated the trading, both of which recorded gains. Weekly more than 5%.

These gains come after prices received a heavy blow from recession fears and the continuous restrictions of the closure in China since last June, which erased their gains in the wake of the Russian invasion of Ukraine, and pushed them to fall from levels of $ 112 a barrel, Brent to slightly above $ 80 in late September, but it returned to the trend The bullish since then, as concerns about slowing demand for crude subsided and fears of a lack of supply began to drive the market.

Crude prices have risen by about 35% since the beginning of this year, but they are still less than the highest level recorded this year, which is also the highest since 2014, at $139 a barrel, and it is not expected to return to it at least in the near term, as the hopes of the bulls are Oil is currently over $100 levels.

* The performance of Brent crude since the beginning of 2022

Supporting factors

In fact, the current market fundamentals represent a fertile environment for high oil prices, as OPEC + was able, with its recent decision, to eliminate the impact of the gloomy expectations of the global economy, which if it penetrated the minds of producers and investors, prices would have been trading at lower levels than the current, as the group announced last October the start of It cut crude supplies by 2 million barrels per day from November to December 2023, in a decision that angered major consumers led by the United States and strained relations between Washington and Riyadh.

The International Energy Agency also saw that the OPEC + decision threatens to deepen the energy crisis and push the global economy to the brink of recession, especially since it is mainly suffering from inflationary pressures, expecting a slowdown in global oil supply growth to 170,000 barrels per day during the fourth quarter of this year, down from 2.1 million barrels per day during the third quarter of the same year.

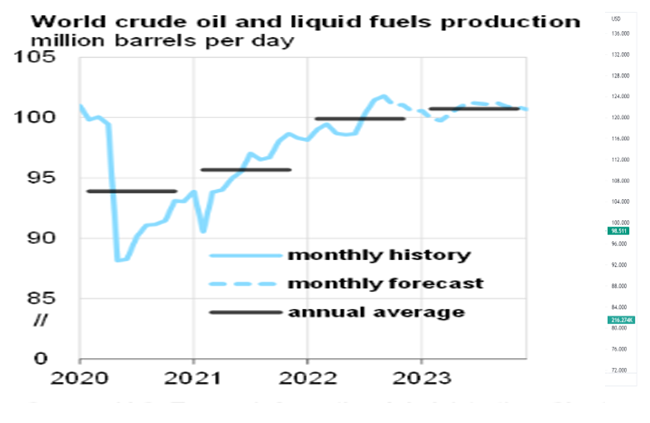

US Energy Information Administration forecasts for global oil production

In front of that, this decision was the beginning of turning the rudder in favor of the factors supporting the rise in crude prices, especially since it coincided with the end of withdrawals from the US strategic reserve of about 180 million barrels over a period of 6 months, starting from last April, in addition to the approaching entry into force of Western sanctions that restrict oil exports. Russia at the end of this year.

In addition to the European Union's decision to ban Russian oil imports, which represent 45% of Europe's needs, the G7 aims to put an end to Russian crude in order to reduce Moscow's oil revenues while maintaining the continued presence of Moscow's oil in the global market to avoid a further rise in oil prices. the prices.

This is about supply. As for demand, the markets received somewhat contradictory news last week. Prices fell by 2% in last Thursday’s session (November 3), following the Federal Reserve’s decision to increase interest rates by 75 basis points for the fourth time in a row. to 4%, and more importantly for the markets, US Federal Reserve Chairman Jerome Powell's statement that it is too early to consider halting interest rate hikes temporarily, which undermined market speculation about a slowdown in the rate of interest rate hike.

But these speculations quickly returned again the next day after the disappointing jobs report showed that the US unemployment rate rose to 3.7% last October from 3.5% previously, with the rate of job addition slowing from 315,000 jobs to 261 thousand jobs in the same month, which It indicates some decline in labor market conditions that may push the Federal Reserve to shift towards smaller increases in interest rates, which is an important signal that may prompt us to watch more conservative policies towards raising interest rates in December.

In addition, the US jobs report pushed the dollar lower, which increased the demand for crude from holders of other currencies, at a time when reports emerged that China may ease the restrictions related to the Corona epidemic soon, all these factors made prices rise 5 % in the last Friday session (November 4).

What about expectations?

Despite the recent positive developments in oil prices, economic recession fears with the Fed's hawkish tone continuing to remain at the forefront of downside risks to crude, although the lack of supplies will continue to support prices in the coming year.

JPMorgan analysts agree with this vision, expecting that Brent crude will trade near $80 a barrel next year if economic growth slows, but the lack of oil supply may push prices to $150, especially if the OPEC + alliance does not achieve production goals and high demand. on raw.

On a less optimistic note, Deutsche Bank sees the global economy moving into stagflation as central banks continue to raise interest rates in order to win their battle against high inflation, which will cast a shadow over oil price movements.

The German bank expects oil prices to reach $100 per barrel by the end of this year, to decline to $95 during the first half of 2023, before continuing to decline to $90 on average during the second half of the year.

On the technical analysis framework

As in the attached chart, we notice a departure from the general ascending channel from the bottom of April 2020 near the levels of $10, thus supporting the idea of starting a general price correction for the entire ascending wave IorA. $65 and $55 over the next few months, and we believe it will be before mid-2023 through a triple downside move to complete the formation of the IIorB wave.

As for the current speculative range, with trading today, Tuesday, November 8, at levels of 90.27 for US crude, the wave pattern indicates that we will most likely see a return near the $100 level in the next short weeks before returning to continue the bearish trend at the beginning of 2023

finally

Given the uncertainties surrounding the oil market currently, and the uncertainty, the future outlook for oil prices will be clearer to everyone in the coming weeks with the announcement of the Federal Reserve's decision on interest while monitoring global supplies and demand and fears of entering into stagflation