The results of the Australian Federal Reserve monetary policy meeting held on February 4 indicated that the bank has reviewed the need for a further interest rate cut but decided not to make this decision in order to discourage further borrowing as house prices rise. < / p>

The Australian Reserve also expects the spread of the Corona virus to affect export growth during the first half of 2020, and the results also released today show that it is difficult to assess the indirect impact of this epidemic on The economy over and above the impact of the wildfires in Australia that broke out in the summer.

Despite these concerns, the bank still maintains its bias of the possibility of maintaining interest at low levels for a long time, and the Australian reserve has cut interest 3 times during the past year to reach record lows It is 0.75%.

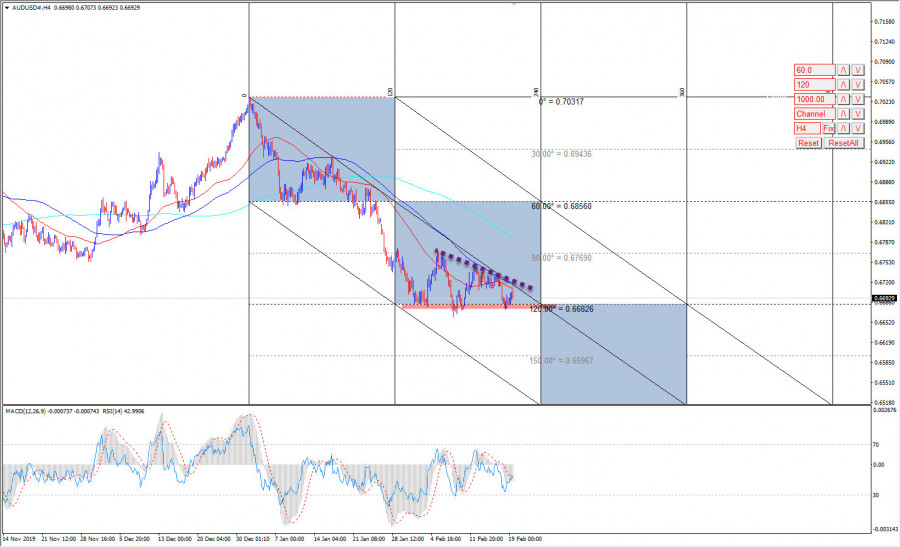

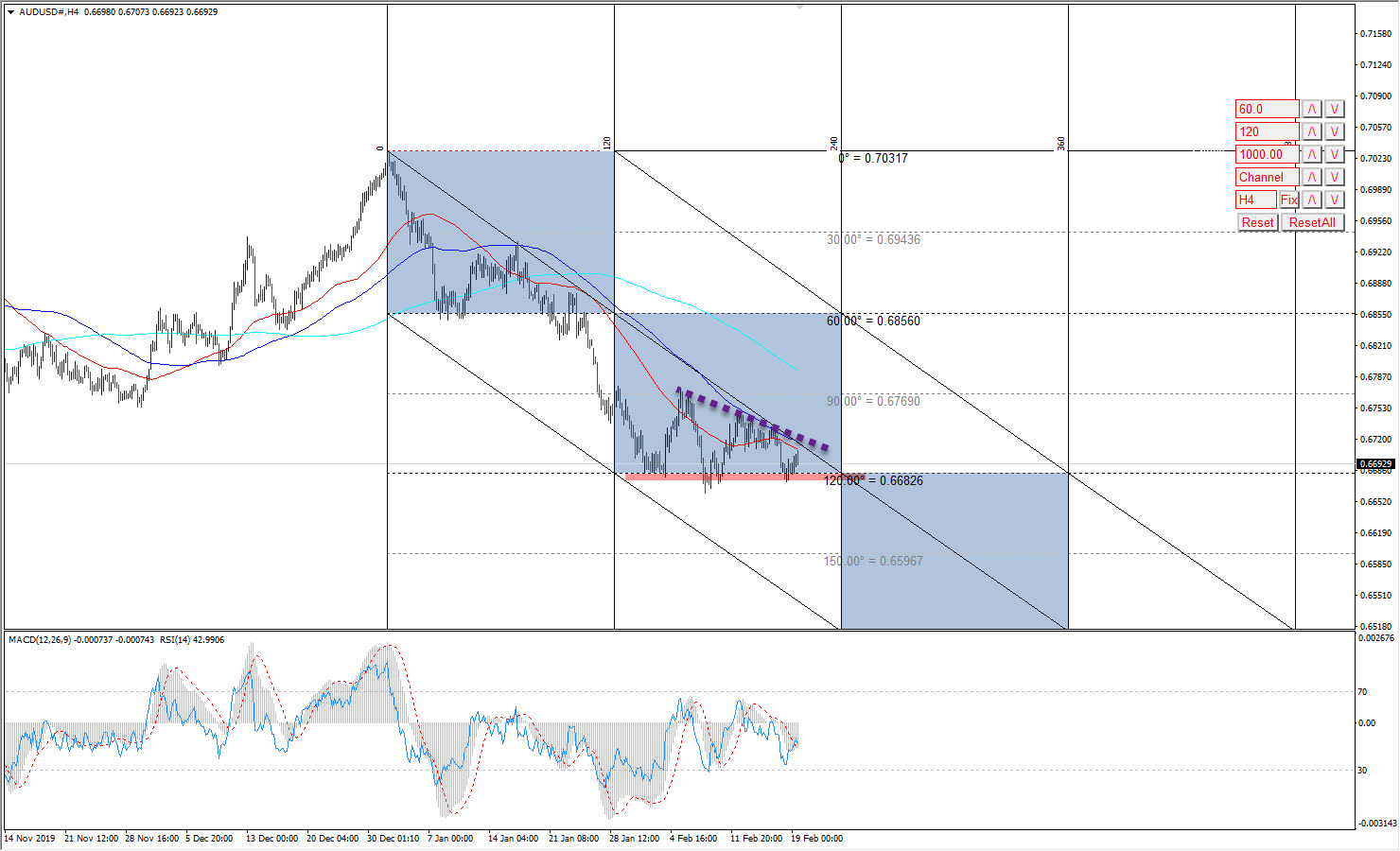

The Australian dollar versus the US dollar trades near the 0.6670 level, and we wait for this level to be broken to confirm the continuation of the bearish trend in the intraday and short term, where our next target is located at 0.6597.

RSI and SMA 50 provide negative signals that support chances of achieving the required break, so we keep our expectations for the downside direction for the coming period provided that the price maintains its stability below 0.6754 level.

The expected trading range for today is between 0.6650 support and 0.6720 resistance

Expected trend for today: Downside