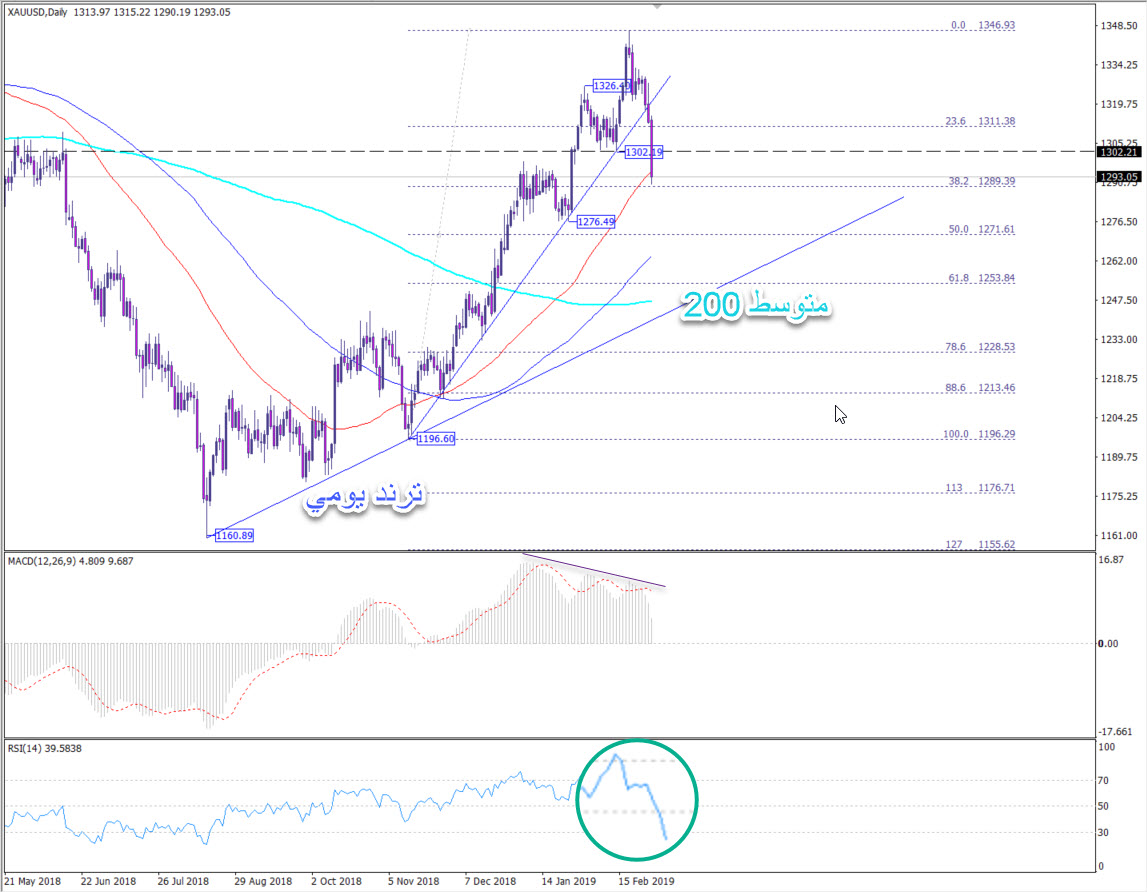

- The yellow metal managed to break 1320 and achieve our goals with the previous analysis, and is currently trading at strong support 1384, and the bearish trend is expected to continue trading below 1311 and targeting 1272 HGJD JLEG Fibonacci 50 for the wave 1196 - 1346.

- Gold is expected to find support above the 200 SMA and Fibonacci 61.8 for the same previous wave in addition to the daily bullish trend from the bottom 1160 at 1246 to end the current corrective wave.

- Breakthrough 1305 will restore prices for 1311 resistance levels and by breaching it will retest key level 1322.

Gold is going on the eight octagon and the last correction appeared in conjunction with the timeline 135 daily candles and achieved its main goal at the tip of the lower triangle as with the drawing and by breaking the triangle the gold will try to reach the angle 90 and the price 1272, which is a correction expected to The bottom of the intersection line ends in red below 1311 and if penetrated, it targets the 1320 retest.

Back above 1320 means that gold refused to break the triangle and contented itself with this correction.