With the end of last week, Thursday, April 18, the Saudi index closed 9196 points, a slight decline of 0.45%, we are still following the cautious rise expectations in previous reports where the goal of 9200 points was achieved, technical indicators indicate And the current rise to the state of the steam rise of the market with clear negative breakthroughs on the indicators suggests an approaching time for profit taking, technically the level of 9340 - 9400 points are levels of resistance to the market that are not easy to overcome in light of the current times and the approach of the holy month of Ramadan, in general the Bukhari rise continues cautious As long as 9045 points left

Technical look and recommendations for some Saudi stocks, based on dozens of technical reports issued by the programmed platform of the Namazun program, after the closure of the past week and technical expectations for the coming days

The picture is more informative and the platform speaks for itself , Let's continue together

ITU 7020, positive targeting 23.23 riyals

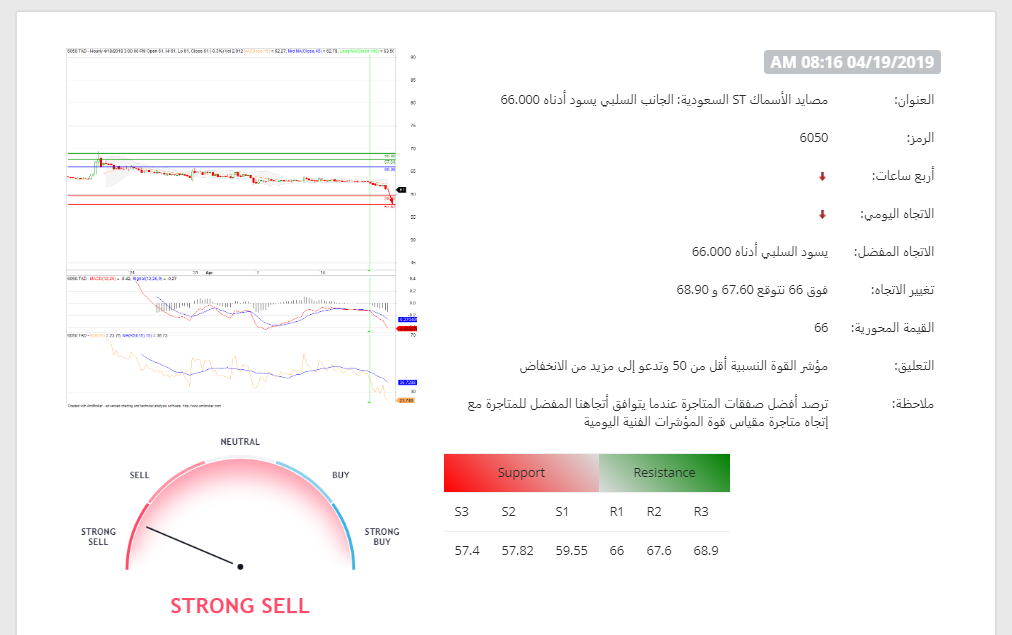

6050 fish stock, further negativity targeting 57.82 riyals

Dar Al-Arkan 4300 share, positive targeting 11.33 and 11.50 riyals

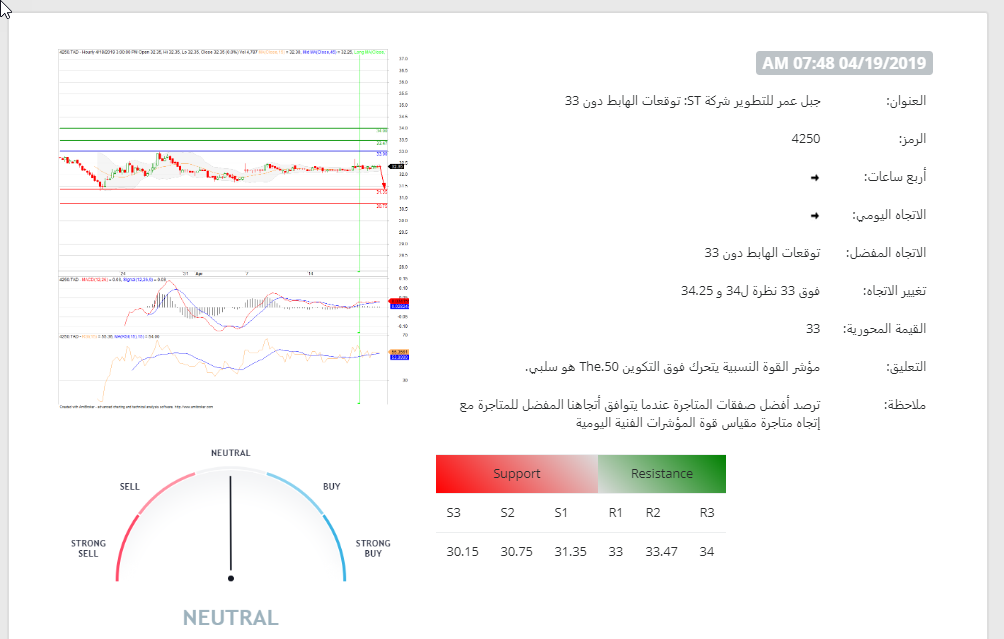

Jabal Omar Development Company share 4250, negative, neutral, targeting 31.35 riyals

Aldrees 4200 share, we prefer caution with an upward slope of about 31.29 SAR

Exports shares 4140, negative targeting 75.2 and 73.9 riyals

Petro Rabigh 2380 stock, targeting 20 and 19.75 SAR

Cayan 2350 share, negative and targets at 13.80 and 13.60 riyals

Yansab 2290 share, negative, targeting 71.30 and 70.75 riyals

Savola Group 2050, we prefer caution with a bullish slope targeting 34.65 and 35.29 riyals

Saudi piping share 1320, we prefer caution with a bullish bias targeting 24.55 riyals for