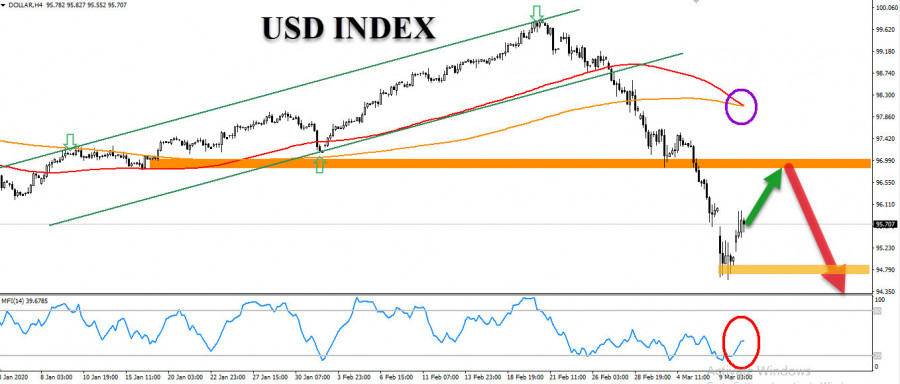

Expected scenario: The dollar index witnessed a rebound during the current week's trading, from the support levels at 94.60, to begin to take a corrective retracing wave, targeting the 97 in the short term, and then return to the general bearish trend in the short term, And re-test 94.60, so it is possible to centralize short-term long positions, to target the 97, and then follow the developments and data to return to the dips again.

Alternative scenario: As for if the price continues to rise, breaching the 97 barrier, which is the least likely possibility at the present time, we will witness a positive change in the general trend, with more gains leading to 97.90 then the 99 .

Expected general trend: bullish (corrective)

Estimated traffic range: 95.80 to 97