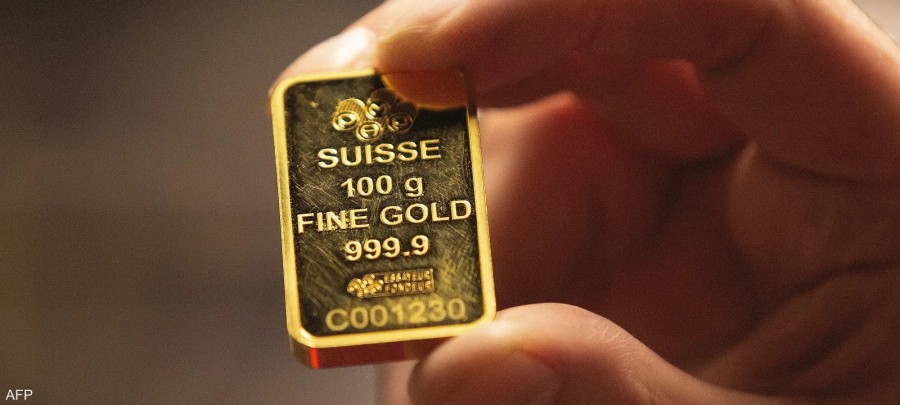

Gold prices rebounded, recovering some of their losses after a sudden collapse in a record-breaking rally that had sent prices tumbling 13% in just two days. Silver prices also rose.

Gold rose as much as 2.9% in spot trading to near $4,800 an ounce, after having fallen by about 5% in the previous session, continuing a sharp decline on Friday that was the largest in more than a decade.

Silver rose as much as 5.1% to above $83, after having fallen 7% on Monday, marking its biggest intraday drop ever on January 30.

Precious metals surged to record highs last month in a rapid rally that surprised even seasoned traders. Investors flocked to gold and silver amid renewed concerns about geopolitical turmoil, currency depreciation, and threats to the independence of the Federal Reserve.

Chinese investors are supporting prices

A wave of buying by Chinese speculators helped accelerate the rise, but this trend reversed on Friday as the US dollar recovered. The extent to which Chinese investors are willing to buy on dips plays a pivotal role in determining the market's direction.

Over the weekend, buyers flocked to Shenzhen, China's largest gold market, to purchase jewelry and bullion in preparation for the Lunar New Year holiday. Chinese markets are scheduled to be closed for more than a week starting February 16th due to the holiday.

Meanwhile, some banks are still betting on a gold recovery, with Deutsche Bank writing in a note released on Monday that it is sticking to its forecast that the metal will rise to $6,000 an ounce.

By 8:10 a.m. in Singapore, gold had risen 2.5% to $4,778.16 an ounce, while silver had climbed 4.3% to $82.69.

Platinum and palladium prices also rose. Meanwhile, the Bloomberg Dollar Index fell 0.1%, after closing 0.3% higher in the previous session.