Among the major advanced economies, the euro zone - especially Germany - may be among the most vulnerable to Chinese demand, and certainly more vulnerable than the United States. The euro zone's manufacturing sector was already suffering long before the outbreak, and data this week confirmed that the sector's weakness continued into December. Eurozone industrial output fell 2.1% during the month, the largest drop since 2016, with widespread declines in all major economies in the region. The data also showed that German real GDP was steady in the fourth quarter, indicating that the largest economy in the eurozone bore little momentum in the first quarter even before the outbreak of the virus.

Technical analysis

Technical analysis

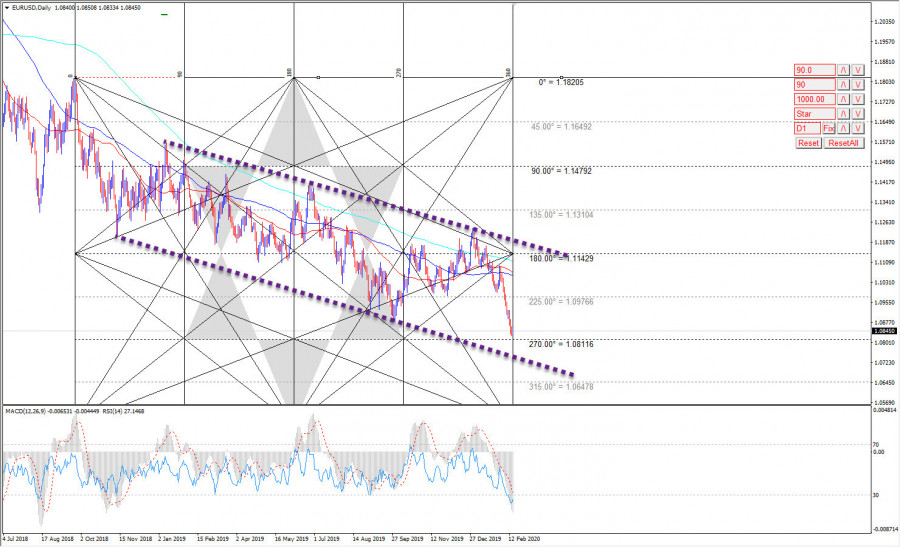

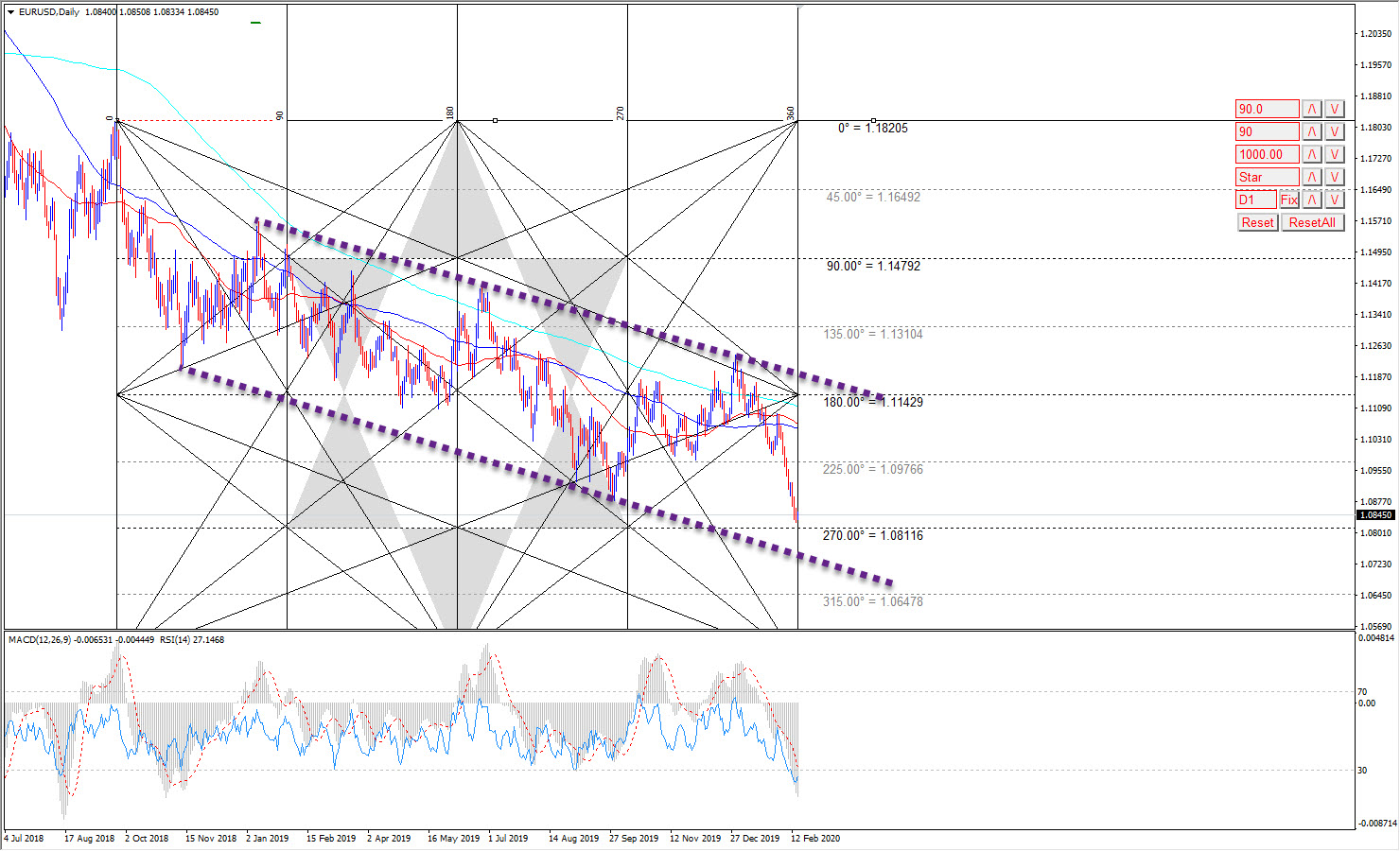

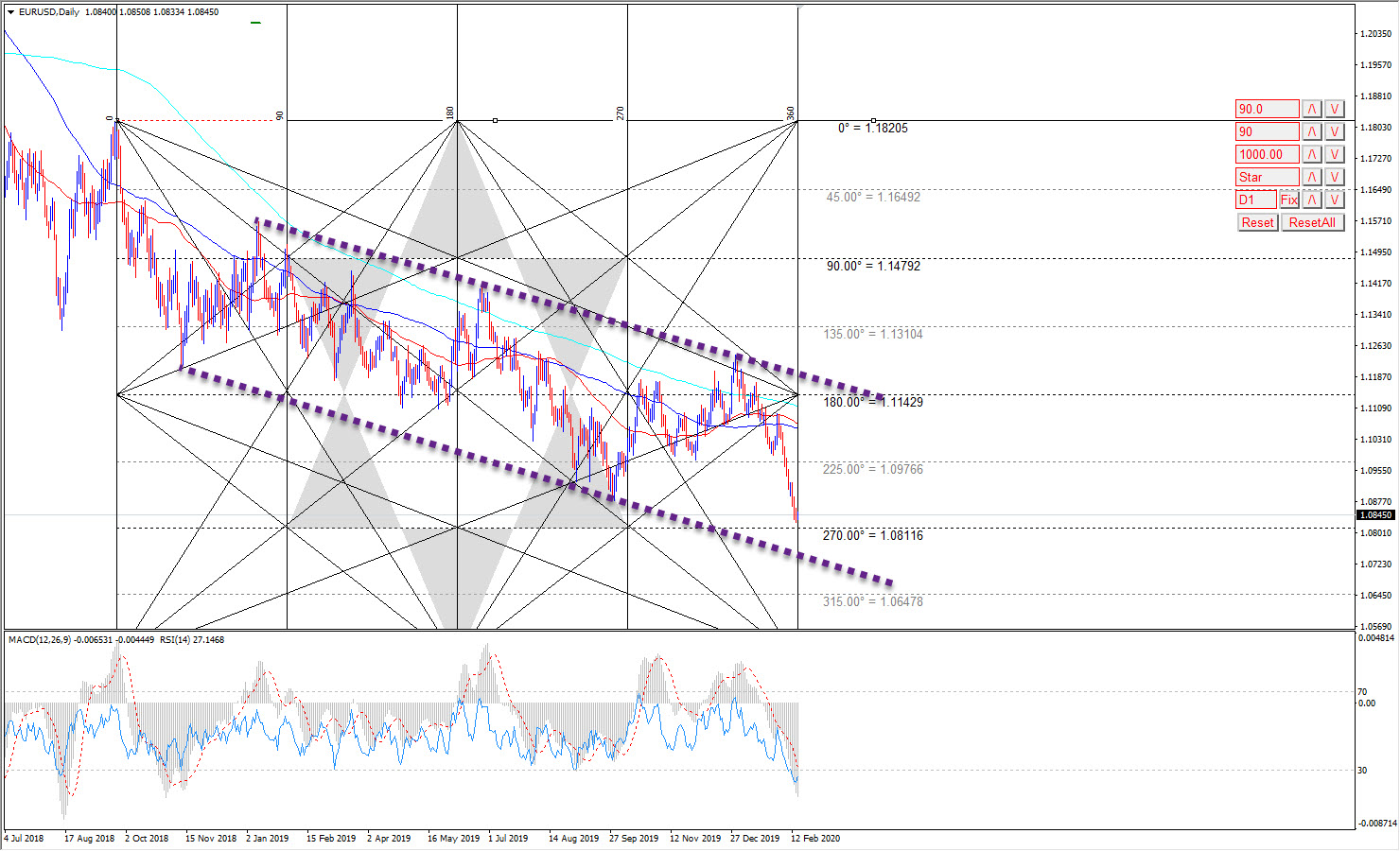

The pair continues to trade in the descending channel on a daily basis to reach support levels at angle 270 and the price is 1.0780 - 1.0830. It is worth noting that the euro ended the time cycle of the descending wave from the top 1.1820.

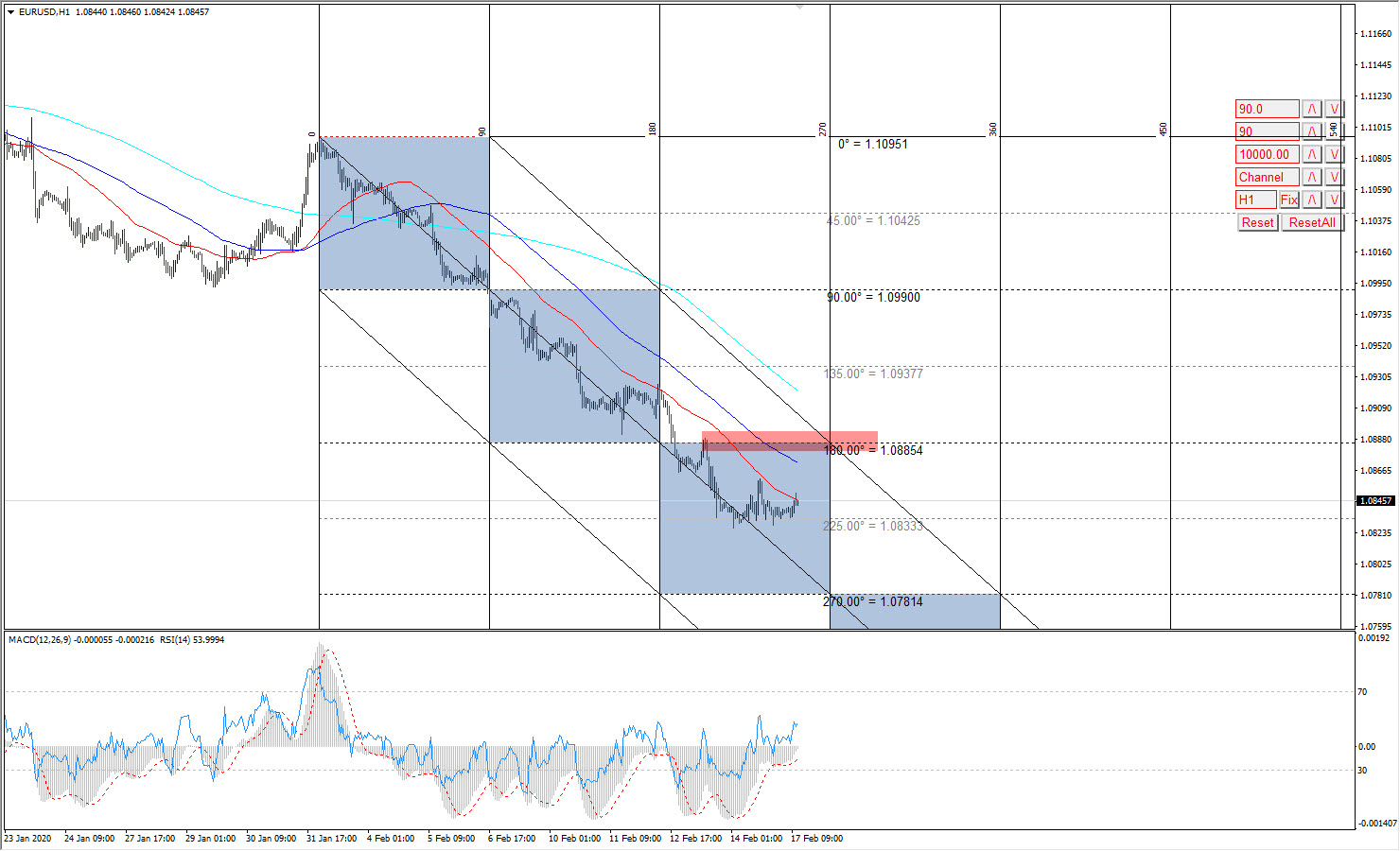

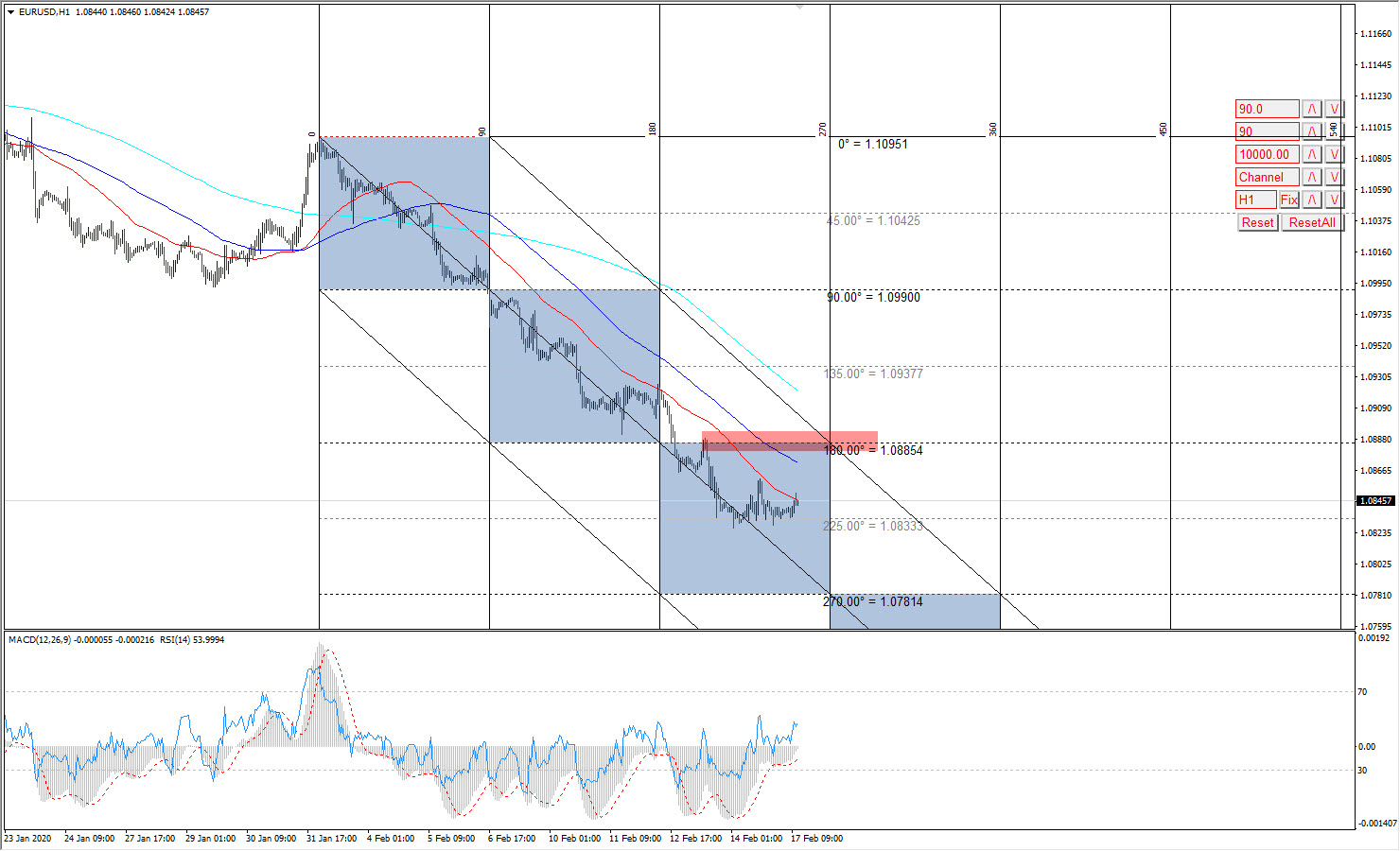

In the short term and on the hourly time frame, the pair is trading at the support levels 1.0830 and the angle 225 The continuation of trading below the angle 180 and the price 1.0885 presses negatively on the price supported by the arithmetic averages so it is expected to continue the decline to target the support 1.0825 and breaking it will open the way to target the angle 270 At the price 10781.

Technical analysis

Technical analysis