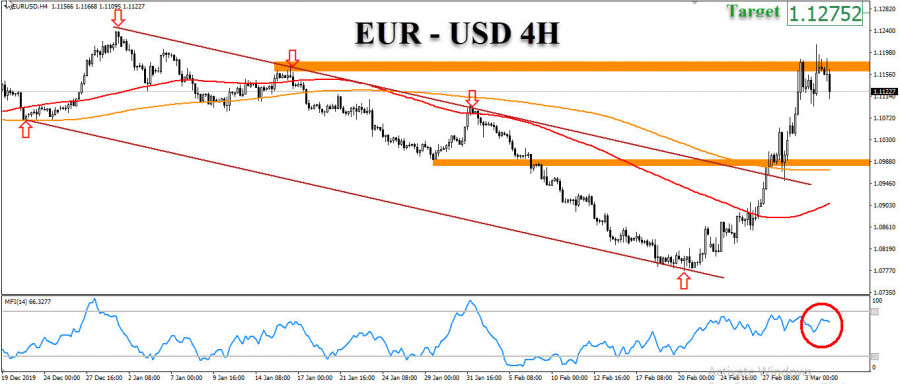

Expected scenario: Following yesterday's announcement of the surprising decision by the US Federal Reserve to cut interest rates to 1.25%, the single European currency witnessed further rises as optimism prevails regarding the European Central Bank taking more quantitative easing In light of the fears of a stagnation in the growth of the global economy, to rise to the 1.1200 levels, which constitute price resistance, represented by strong supply areas, therefore we will likely witness a correctional wave down to the levels of 1.1000, and then bounce to try to breach the resistance of the 1.12000 Once again, so are the 1.1000 levels Good for repositioning and targeting the previously mentioned areas.

Alternative scenario: In the event that the euro continues to rise, and the resistance of the 1.12000 is breached, we will witness more gains during the trading this week, to reach the levels of 1.1240 then the 1.1295, in the short term.

>

Expected (bearish) corrective trend.

Estimated traffic range: 1.1000 to 1.1250