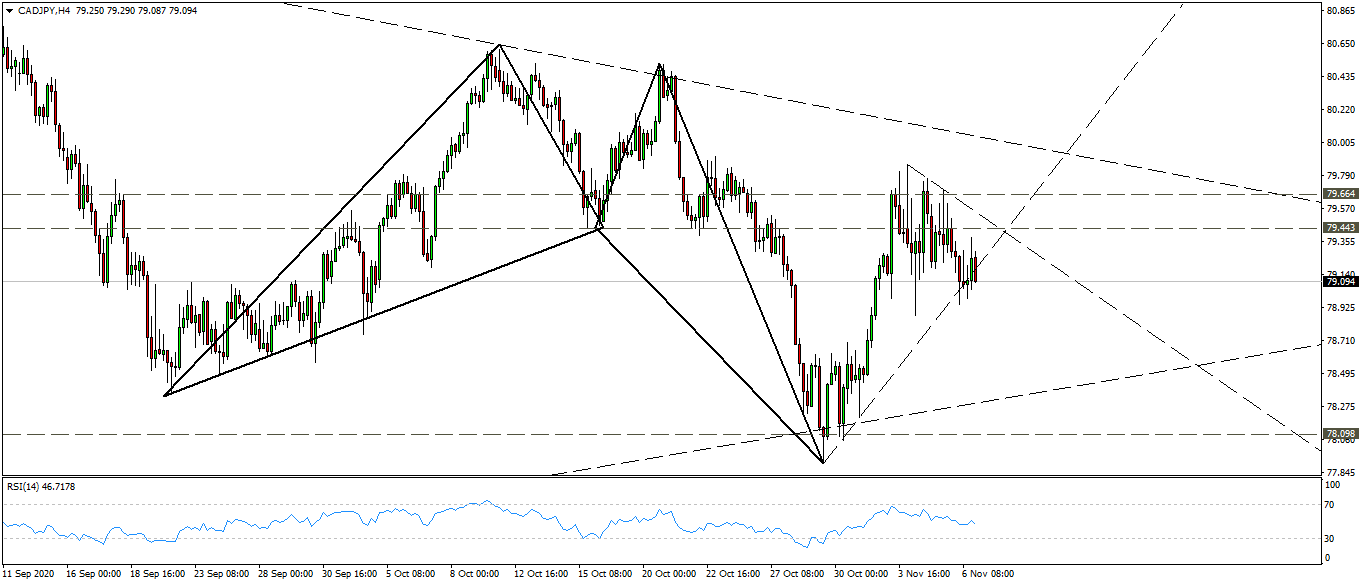

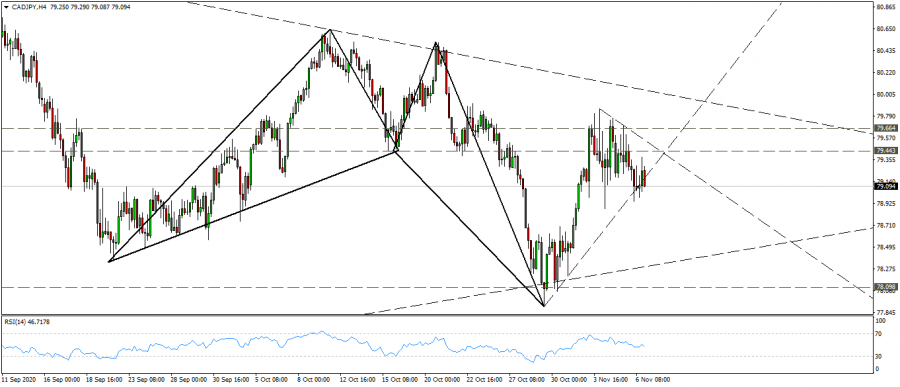

Pivot point: 79.45

Preferred scenario: Short positions below 79.45, targeting 78.10 levels

Alternative scenario: Long positions above 79.65, targeting 80.50 levels

Comment: We have published an analysis regarding the Canadian yen pair from here

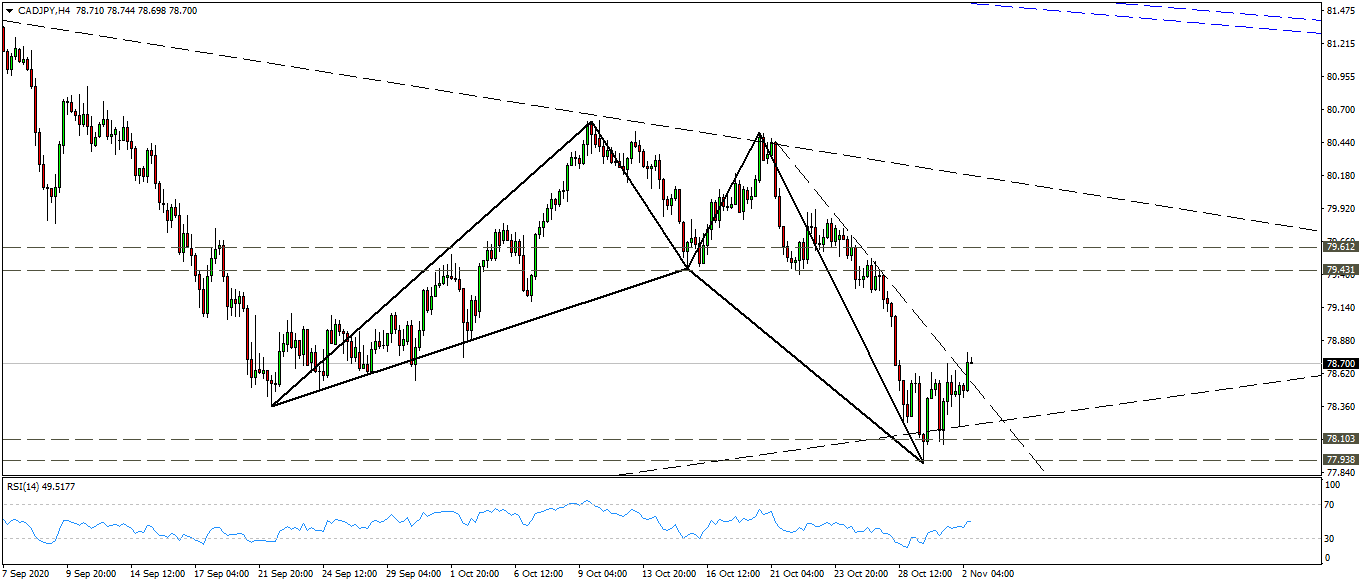

Where The pair fell on the four-hour frame from the descending trend line from the top of August to continue the descending process until it reached support levels 78.10-77.90, with oversold saturation on the momentum indicator rsi

The pair was also moving in the harmonic alt bat pattern with 113% fibo from xa leg at the same support levels.

Indeed, the pair rose to the targets of the pattern at levels of 79.45-79.60, and it is expected that the price will decline after reaching this area to reach level of 78.10