Asian stocks fell as Nvidia Corp.'s earnings failed to impress investors, while results from Chinese companies helped extend a sell-off in the country's technology companies.

MSCI’s Asia-Pacific index fell 0.5%, dragged down by declines in chipmakers such as Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc., while China’s technology index fell more than 2% in Hong Kong. Nvidia shares fell more than 8% in after-hours trading after its sales forecast disappointed some Wall Street analysts.

The forecast suggests the AI euphoria that has powered global tech stocks for much of this year may be slowing. Nvidia is a major beneficiary of the race to upgrade data centers to handle AI software, and its sales forecast has become a bellwether for that spending boom. China’s earnings also weighed on sentiment in Asia, underscoring the sluggish state of consumer demand in the world’s second-largest economy.

Traders' Disappointment

“Nvidia’s strong results and guidance didn’t impress the markets, due to high expectations rather than poor performance,” said Charu Chanana, head of FX strategy at Saxo Markets. “This may carry over to the Asian tech sector today, but there is little reason to expect any divergence in AI developments or Nvidia’s continued presence as a backbone for AI development and deployment.”

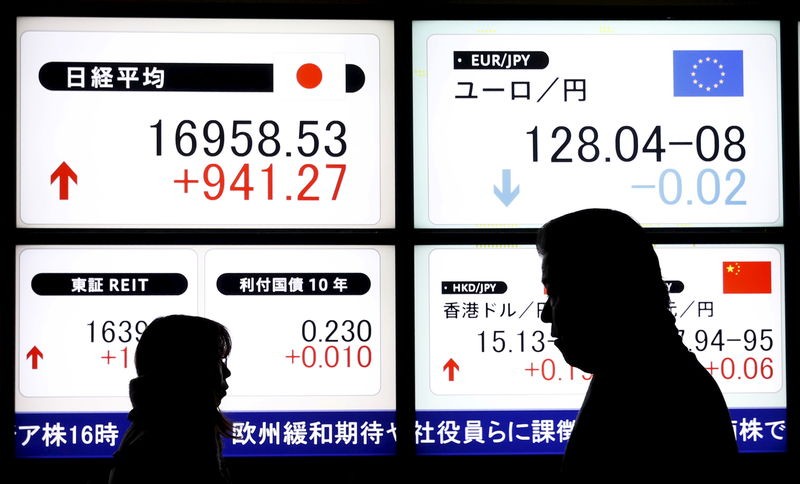

The yield on the benchmark 10-year Treasury note was steady after rising 1 basis point to 3.84% in the previous session. The dollar fell after broad gains amid speculation that investors were buying the greenback to rebalance their portfolios. The New Zealand dollar strengthened after business confidence in the country jumped to a 10-year high.

Chinese electric-vehicle maker Li Auto Inc. was the biggest drag on the Hang Seng Tech index, with shares falling nearly 15% after it missed expectations. BYD also fell despite posting a 33% jump in profit.

Pessimism in China

Pessimism about China has deepened after UBS Group cut its growth forecast for the country for this year and next, saying the downturn in the property market was deeper than expected.

Elsewhere, Japan’s Nippon Steel plans an additional $1.3 billion investment in plants operated by U.S.-based United Steel, as the Japanese company steps up efforts to win union support for a takeover bid that has been opposed by both U.S. President Joe Biden and presidential candidate Donald Trump.

While Nvidia’s expectations fell short, revenue more than doubled to $30 billion in the second fiscal quarter that ended July 28. The Santa Clara, California-based company’s board also approved an additional $50 billion in share buybacks.

Later Thursday, investors will turn their attention to key U.S. data including GDP growth, personal spending and weekly jobless claims, to help bolster bets that the Federal Reserve will ease monetary policy quickly this year. Atlanta Fed President Raphael Bostic said the time may be right for a cut, but he was still waiting for additional data to support a rate cut next month.

In commodities, oil prices steadied after a two-day slide, as equity markets offset a drop in U.S. inventories and supply disruptions from Libya. Gold traded near record highs, heading for a monthly gain.