The Tesla stock has always attracted the attention of investors and analysts, because of the strong and rapid movements that it has witnessed over the past years, until the company has become the fifth largest American company in terms of market value, and is also on the throne of the electric car manufacturers, so does Tesla deserve the momentum surrounding it? This is what we will highlight in this report from a fundamental and technical point of view, so that we can finally come up with an investment decision that benefits people

In fact, the bet on Tesla stock is often on the company's future by increasing sales of electric cars with efforts to reduce greenhouse gas emissions, which requires moving away on gasoline and diesel vehicles, and here Tesla enjoys a competitive and even leadership position in the global market, so we often see a higher profitability ratio From the number 100, before it retreated recently as a result of the price drop, to become today around 78 times, let's see what happened?

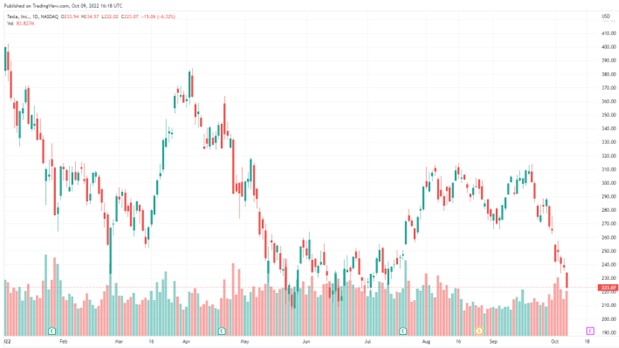

Before talking about the fair valuation of the stock and to what direction the stock price is headed? We review the movements of the Tesla stock in the recent period, especially in the midst of the significant decline in the stock and even the stock market as a whole, due to the political and economic turmoil that the world is currently experiencing.

The red color hangs over the Tesla arrow

Tesla's stock suffered strong losses this year, for several reasons, some of which are related to the stock market in general, with the continuous interest rate hikes by the Federal Reserve, which prompted investors to take shelter in the US dollar and stay away from risky assets; Fearing an economic recession, others are related to disappointing sales of Tesla cars and fears that the company's financial performance will be affected by its founder's interest in buying Twitter.

The electric car maker’s share has lost about 37% of its value since the beginning of 2022, and more than 45% since the stock recorded a record closing at $409.9 on the November 4, 2021 session. The stock posted gains of nearly 700% in 2020, followed by another 50% in the past year.

Tesla stock currently stands at $ 216, the lowest level in nearly 4 months, after recording the largest weekly losses since March 2020 by 16%, despite the Standard & Poor's index rising in the same week by about 1.5%, and this decline pushed the company's market value to fall below 700 billion dollars, after it was above 1.2 trillion dollars in November 2021.

*Tesla stock performance in 2022

The recent losses for the stock came after Elon Musk announced his desire to resume the Twitter purchase deal, which raised concerns about the possibility that Musk might give up more of his shares in Tesla in order to finance the acquisition, and this also coincided with the announcement of car deliveries figures during the third quarter, which It came in lower than analysts' estimates.

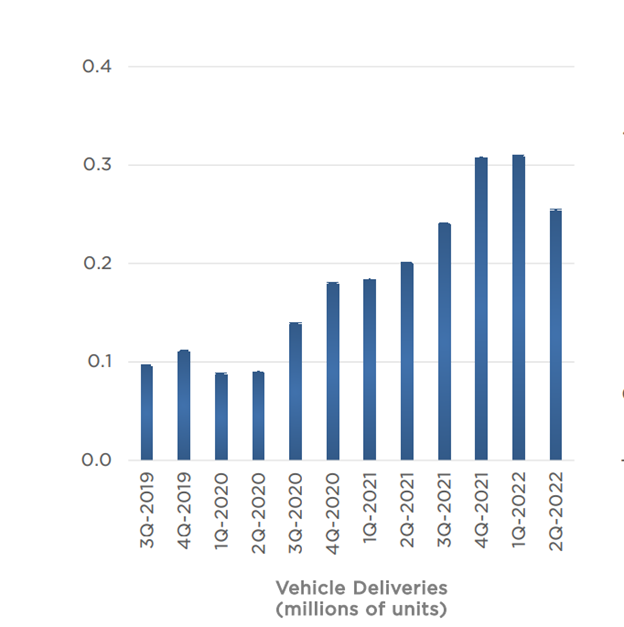

Where Tesla announced the delivery of 343.8 thousand cars in the third quarter of this year, an increase of 35% on an annual basis, but the numbers came below expectations, which were indicating 364.6 thousand cars, taking into account the supply chain disruptions and rising costs after the Russian invasion of Ukraine. However, Tesla temporarily shut down most of its Shanghai factory production last July, to make upgrades at the plant.

While the American company produced 365,000 cars in the third quarter, the total has increased since the beginning of 2022, close to last year's total production of 930,000 cars, although Tesla's production appears to be behind Elon Musk's pledges to produce one and a half million cars this year.

The rate of delivery of Tesla cars until the second quarter of 2022

Where is Tesla heading?

The disappointing delivery rate of Tesla cars affected the price target for the stock at $299 according to the median forecast of Wall Street analysts who are interested in covering Tesla stock, down from $301 previously, and representing a 25% increase over the current share price, while 55% of analysts are still They recommend buying the stock.

So far, there are still significant differences between analysts' expectations for Tesla stock, with Bernstein analysts setting a target price for the stock at $150, which is a 32% drop from the current price, with Tesla failing to achieve 50% year-over-year growth. in the car delivery rate.

While Deutsche Bank analysts were more optimistic with a target price for Tesla stock at $400 per share, which is up 79% from the current share price, with expectations that the company will make significant progress in terms of humanoid robotics.

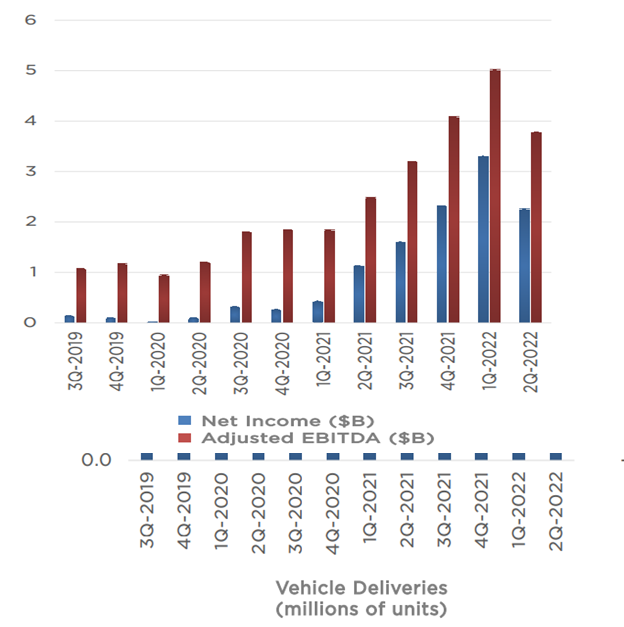

Faced with this difference about evaluating the fair and target price, taking into account some basic numbers such as the book value of the stock, which now stands at $11.65 and its recurring 19 times, as well as the sales multiples of 11.40 times, in addition to the set of asset, liquidity and profitability ratios, we finally arrive at our own opinion

Where we believe in the research center of the Namazon economic site that the fair value of the Tesla stock stands at around $150, and any decrease below this level may represent a good opportunity to own the stock with the aim of investing and keeping for the next five years.

This is expected to affect the quarterly earnings report for the third quarter of 2022, due to be announced on October 19, with Tesla expected to achieve revenue of $ 22.4 billion, which would be the highest level ever, an increase of 62% compared to the same quarter of 2021. and about 32% on a quarterly basis.

In contrast, earnings per share are expected to be $1.04 in the third quarter, but it will be lower than the $1.86 reported in the same quarter, and lower than the $2.27 earnings per share reported in the second quarter of this year.

*Tesla earnings on a quarterly basis

Last week, Standard & Poor's raised Tesla's credit rating to BBB, an investment grade, after it was at a non-investment grade or scrap with a BB+ rating previously, with optimism about the company's leadership in the electric vehicle market, with strong manufacturing efficiency that supports profit margins and operating cash flow. .

In terms of technical analysis of price movement

We see that the November 2021 peak at the level of $414 may represent a historical peak that we believe will remain for quite some time as the price enters a major correction path for its entire technical movement extending since the stock was launched in 2010. We also note the formation of a classic negative pattern on the weekly frame known as the head and shoulders The double, which usually forms at the end of the bullish rally, to announce the beginning of a new stage of correction

The price stops with the closing of yesterday, October 11, at 216 dollars and at the bottom side exactly, and therefore any closing below the 210 level during the next few days will announce the activation of the technical pattern of the head and shoulders, which we believe is wave and technical, targeting the level of 150 dollars and 108 dollars, which is more logical than the classic target

In the end, Tesla will remain a pioneer of new ideas that harness modern technologies in the service of humanity as well as achieving returns for its investors, with Elon Musk’s out-of-the-box approach, which is one of the strong fundamentals of Tesla’s stock in the long term and a permanent attraction for investors looking for good opportunities in good timing

Iyad Aref

Founder of the Namazon website