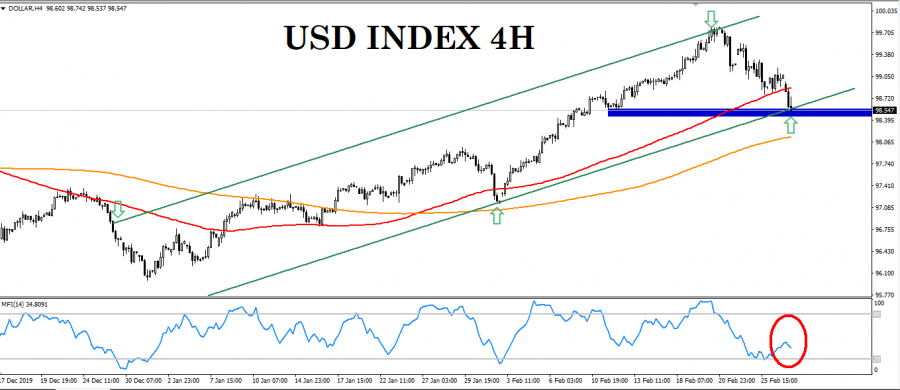

Expected scenario: The US dollar index came close to the end of the corrective wave that it witnessed recently, to touch the price with the support represented by the bullish general trend line in the medium term, which pushes the expectations for consolidation at the current levels (98.50), And then complete the bullish trend again, targeting 99.80 then 100.40 levels, with the possibility of positioning long positions at the current levels.

Alternative scenario: In the event that the dollar index fails to consolidate above the 98.50 levels, and stability below it, we will witness further declines, with a negative change in the general direction, targeting the 98 levels and then the 97.10, based on Short-term.

Expected general trend: up (if stability above 98.50).

Expected traffic range: 98.50 to 99.80