Accelerated growth in revenue with excessive activity and chaotic expansion of the business eventually leads to an increase in borrowing, then sales subside, debt burdens increase, and the bubble begins to burst, and it may take on its way victims who have no choice or sentences.

A scenario that we have seen a lot in global markets, and the Chinese real estate giant Evergrande has become the latest example of this, after it fell under the weight of default, so what is the story and is its repercussions only local or an infection that spreads to the world?

After a rapid development in crises and events that we will list later, the crisis of the most indebted companies in the world with financial commitments exceeding $300 billion has worsened, after it defaulted on one of the interest payments on an international bond worth $1.2 billion earlier this month, and this happened for the first time Not at all, said major credit rating agency Fitch, which means that the crisis has reached its climax and a crash is imminent, if not already happening.

This crisis raised the fears of investors who fear the transmission of infection through the real estate and banking sectors in China, the second largest economy in the world, and even further, especially as it brings to mind bad memories that were the spark of the outbreak of the global financial crisis in 2008, when Lehman Brothers bank collapsed, As a result of the mortgage crisis in the United States.

How did the crisis start?

The fears of the crisis come from the enormity of the company, because Evergrande is not only one of the largest real estate developers in China, the company, which was established in 1996, diversifies its business in several areas such as manufacturing electric cars, food, wealth management, etc., but with regard to real estate, Evergrande has 778 projects in 233 Chinese cities by the end of June 2021, according to the latest reports on the company's official website.

At a time when the Evergrande expanded significantly through borrowing, debts began to accumulate, the Chinese authorities became aware of the huge debt problem by real estate companies, which made them take new measures, to control the borrowing process and control the amounts owed to large companies, and these rules, which were established last year , got the Evergrand in trouble, becoming the biggest victim of the ruling Communist Party's efforts to rein in high debt levels that Beijing sees as a potential threat to the economy.

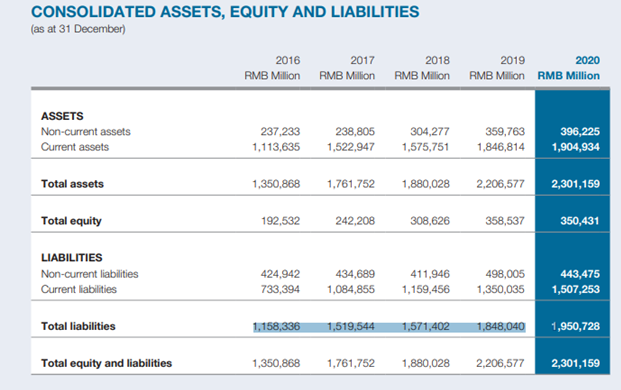

And the Chinese real estate giant sold its properties at significant discounts so that it could pay off its debts, but these measures were not enough, especially at the time of the spread of the Corona virus, and from here the crisis emerged, as the company is still struggling to meet the interest payments on its debts, at a time when it is declining Profits have increased significantly since 2018, when it recorded 66.54 billion yuan, doubling from previous years, and in 2019 and 2020, it reached 33.54 and 31.4 billion yuan, respectively, which shows the deterioration of the company's financial performance.

In the midst of declining profits, the company's financial obligations were constantly rising, reaching 1.95 trillion yuan ($304 billion), by the end of last year, up from 1.5 trillion yuan in 2018, when profits were high, which shows the enormity of the crisis that total liabilities equaled Approximately the total balance sheet of Evergrande, which is 2.30 trillion yuan ($ 372 billion).

In an attempt to avoid the negative repercussions of the crisis, the Chinese company has continued to sell assets in recent months to collect the money it owes to customers, investors and suppliers. Nevertheless, the company said in a statement this month that despite all attempts, it cannot guarantee the performance of its financial obligations.

local or global

Certainly, there are several reasons behind the seriousness of the Evergrande crisis at the local level. The problem is not the collapse of one company, because if the Evergrande collapses, the construction companies and suppliers that deal with it will suffer great losses that may force them to bankrupt, especially since the Chinese company defaults, which means that banks have to The lending process is restricted, and companies then struggle to borrow money, which ultimately leads to a credit crunch that hits the Chinese financial system.

Real estate and related industries account for up to 30% of the gross domestic product of China's economy, and a crisis such as this would shake the second largest economy in the world, which could also affect the global economy, but in fact monetary policy makers in the United States and Europe reduced From the repercussions of the Evergrande crisis at the global level.

As the Evergrande crisis became more prominent, Federal Reserve Chairman Jerome Powell said last September that the Chinese real estate giant's debt crisis appeared to be largely about China, while Christine Lagarde, president of the European Central Bank, indicated that the crisis centered on China. And it will have a very limited impact on Europe.

But also in September global markets woke up to fears that Evergrande could default, and we saw a massive sell-off in the financial markets, not on the China or Hong Kong exchanges, where the Chinese company is listed, but it was global.

However, we saw that when Evergrande actually started defaulting on its debt payments, this month of December, global stocks did not care about this news, as investors became confident that the Chinese authorities would not allow the company to collapse, especially with it taking measures on the ground, the latest of which was reducing The required reserve ratio with banks, which frees up more liquidity in the markets, indicating that the state plays a greater role in the future of the real estate giant, including potential debt restructuring.

stock performance

On the other hand, news of default deepened the wounds of Evergrande stock, falling to an all-time low last week at 1.7 Hong Kong dollars, and in the December 6 session, the Chinese company's shares collapsed by more than 19%, with the company's statements that it does not guarantee the fulfillment of its financial obligations.

* Performance of Evergrande stock in 2021

The stock continued its losses this week at new lows of 1.55 Hong Kong dollars on Wednesday, December 15th, bringing its losses this month only to more than 44%. In general, the Evergrande stock has been covered in red since the beginning of this year, with losses of nearly 90%, amid the announcement of the downgrading of the company's credit rating by major agencies, the last of which was Fitch, which classified it in a state of limited default.

In the end, will China do everything so that the Evergrande does not collapse, as it fears the domino effect on other companies and sectors, or will we see the real estate giant declare bankruptcy soon?