The UAE’s KBBO Group announced that it has appointed consultants to restructure company-based liabilities.

According to Reuters, the company said in a statement that it had appointed Trussbridge Advisors and WBC Middle East as two financial experts, and Hadef and Associates Ltd. and Clare Gottlieb Steen and Hamilton L LP Legal Advisers.

She did not disclose the size of the debts owed on her.

It is worth noting that the Chairman of the Board of Directors of the company is a major shareholder in the struggling NMC Health Group for hospital management.

The group said it was facing a challenge to be exposed to NMC in addition to the Covid-19 outbreak, which affected various operations. The group did not provide details of the exposure on NMC.

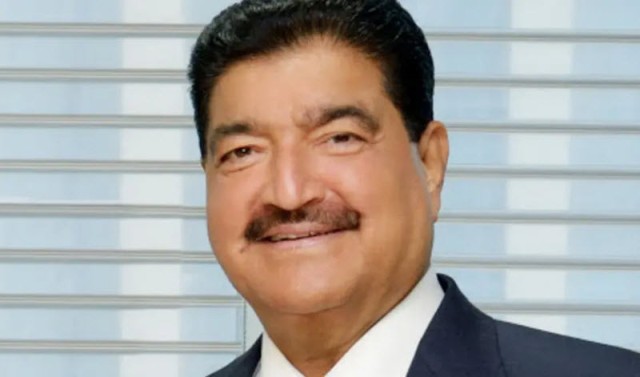

Khalifa bin Butti, chairman of KBBO, had resigned this year from the position of deputy chairman of NMC's board after she said: British regulatory bodies are investigating the company’s order after news that its founder and chairman, BR Shetty, revealed the size of his stake in the company inaccurately.

NMC, the largest private company operating hospitals in the Emirates, said this year that the contribution of Shetty, Betti and another large investor, is Saeed Butti Al Qubaisi, in The company collectively is 30 percent less than it was previously disclosed.

This led to a change in the terms of the debt facility of NMC, which affected the arrangement of a two billion dollar loan and certain other facilities. Shetty, Batti, and Al Qubaisi adjusted their stake in NMC later to cut regulatory disclosures.

In the past few months, NMC, which has been subject to administrative guardianship, adjusted its debt position to $ 6.6 billion, which is much higher than the previous estimate of 2.1 One billion in June last year.