Special report - Amazon:

Saudi Abdullah Al-Khudari Sons Company has experienced strong fluctuations and important milestones, during the recent period, a marked reflection on the stock's performance.

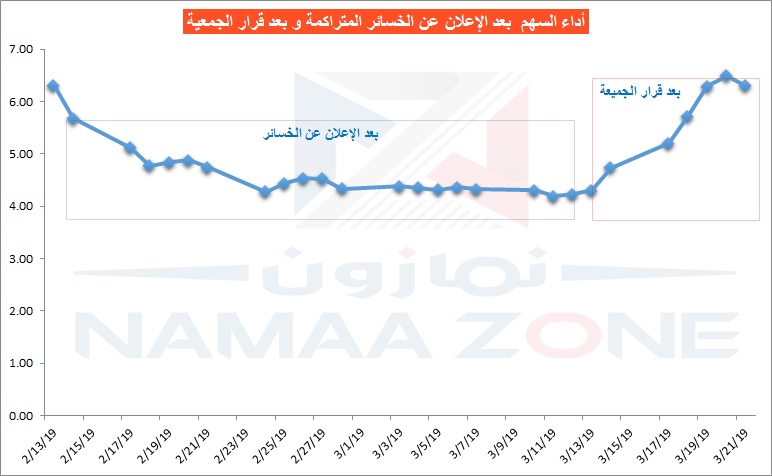

Namazin reviews the most prominent stations that the company has gone through, especially after announcing the rise in accumulated losses to nearly double the capital, and how the stock interacted with these events.

Accumulated losses

The company’s first important milestone, when the company announced on February 13, 2019, was that its accumulated losses rose to about 1.1 billion riyals, representing 198.52% of the capital.

The company said that the causes of the accumulated losses are directly attributable to formally stopping work on a number of projects, or operating at a slow pace, which increased the total cost of these projects.

She indicated that it contributed to the exacerbation of losses, the large increase in labor costs, given the high financial compensation for work licenses, as well as the costs of visas associated with labor recruitment.

The company laid off more than 15,000 employees and more than 1,000 assets (cars and equipment) during a 3-year period from 2015 to 2018.

The main activity of the company is in contracting and construction, infrastructure projects, public facilities and residential and entertainment projects, maintenance and operation.

The company’s CEO, Fawaz Al-Khudari, said, after announcing the losses, that the board of directors will submit its recommendations to the association, to choose the best way to solve the company's crisis.

The company’s board of directors decided to invite the general assembly of the company to an extraordinary meeting, on March 13, 2019, to vote on the restructuring of the company’s capital, to address the accumulated losses, or to dissolve the company before the specified term. < / p>

Negative interaction

During that period, and in anticipation of the decision of the General Assembly, which could have been directed to dissolve the company, the stock suffered strong declines, which fell to its lowest levels since listing in the Saudi market, on October 23 2010.

The stock fell by about 10% (maximum ratio), in 3 consecutive sessions, after announcing the accumulated losses, before the retreat rate decreased in the fourth session, go for consolidation in two sessions. p>

The stock lost about 40% of its value in 20 sessions, during the period from the announcement of the accumulated losses, on February 13th, until the assembly’s decision on March 13.

The stock fell from the level of 7.01 riyals, at the end of the February 12 session, before announcing the losses, to close at 4.23 riyals, at the end of the March 12 session.

crucial decision

NamaaZone " The Power of Knowledge"