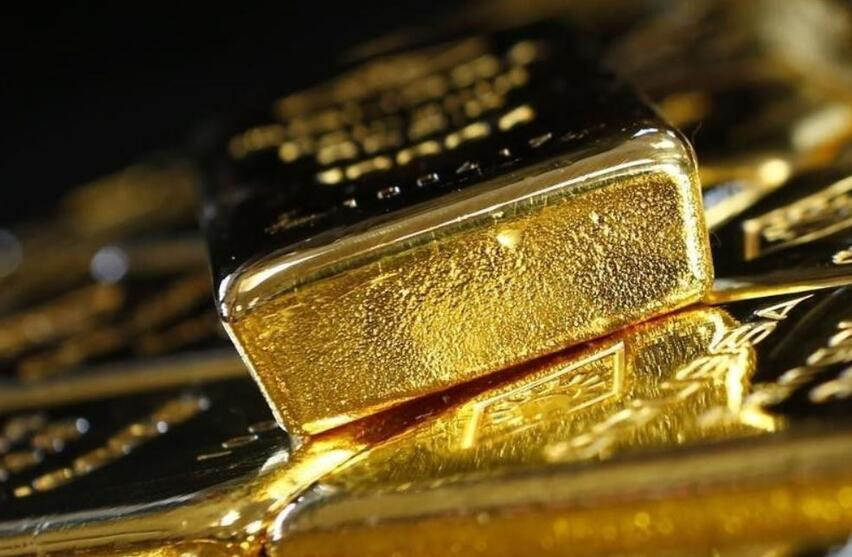

Gold prices rose, supported by a decline in US bond yields and concerns about a continuous rise in infections with the mutated strain Delta, but the rise of the dollar curbed the gains of the yellow metal.

Gold rose in immediate transactions 0.2 percent to $ 1815.61 an ounce, after hitting a one-week low of $ 1794.06 in the previous session. And US gold futures gained 0.5% to $ 1817.90.

The gold market is breathtaking due to the very low yields, said Stephen Innes, managing partner at SBI Asset Management. But gold is competing with the dollar for safe haven demand, so this will limit the bullish momentum in the short term. Record US Treasury yields are stuck near a five-month low. Lower returns reduce the opportunity cost of acquiring the yellow metal that does not generate returns.

The rise in coronavirus infections in the United States and other countries has fueled fears that the pandemic will worsen again, causing shockwaves across stock markets, at a time when It appears that the mutated strain Delta is firmly established.

Gold is often used as a safe store of value during times of political or economic uncertainty.

But the dollar's safe haven gains limited the attractiveness of gold, as the dollar index consolidated close to its highest level in three and a half months against its rivals. The rise of the dollar leads to an increase in the cost of gold for holders of the rest of the currencies.

With regard to other precious metals, silver fell 0.3 percent to $ 25.12 an ounce, and palladium gained 0.5 percent to $ 2607.38, and platinum settled at $ 1075.52. /span>