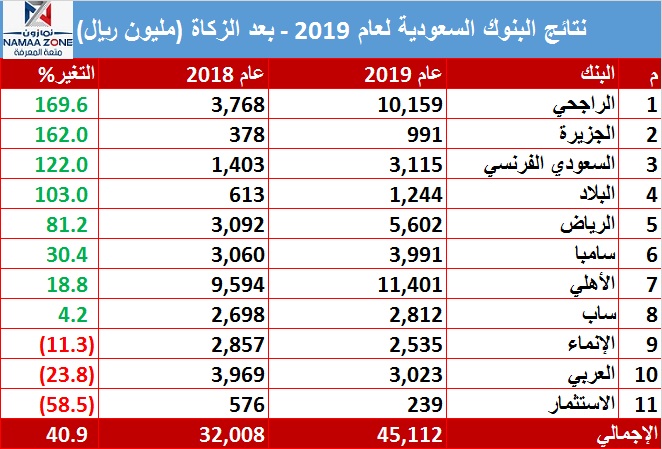

According to a statistic conducted by (Namazon), based on the financial statements of banks, the profits of 11 banks listed on the Saudi Stock Exchange increased dramatically in 2019, while profits declined Those banks, before deducting zakat settlements.

All Saudi listed banks announced net profits exceeding one billion riyals in 2019, with the exception of Al-Jazira Bank and the Saudi Investment Bank.

All banks registered net profit growth during 2018, with the exception of only two banks, the Saudi French Bank and the first bank, and this was the case in the fourth quarter.

<8 style = "text-align: right;"> 8 banks announced net profit growth last year, compared to the previous year, with rates of increase ranging between 170% to 4.2%, compared to 3 banks that recorded a decline in profits.

Al-Rajhi at the forefront

Al-Rajhi Bank was able to record the highest rate of growth in net profits, after its profits after Zakat jumped by 169.6% to 10.16 billion riyals in 2019, compared to 3.77 billion for 2018 . Al-Rajhi Bank pointed out that the rise in net profit in 2019 is mainly due to a decrease in Zakat expenses by about 81.7% compared to the previous year, because in 2018 the amounts of the Zakat settlement amount were from Previous years through 2017. He pointed out that the increase in net profit is also due to the increase in total operating income, as a result of the rise in special commission income, bank transaction fees, and income from foreign currency conversion. >The second position was in terms of the highest net profit growth rate for Al-Jazira Bank, which announced its net profit growth of about 162% in 2019 to 991 million riyals, compared to 378.3 Million riyals for the year 2018.