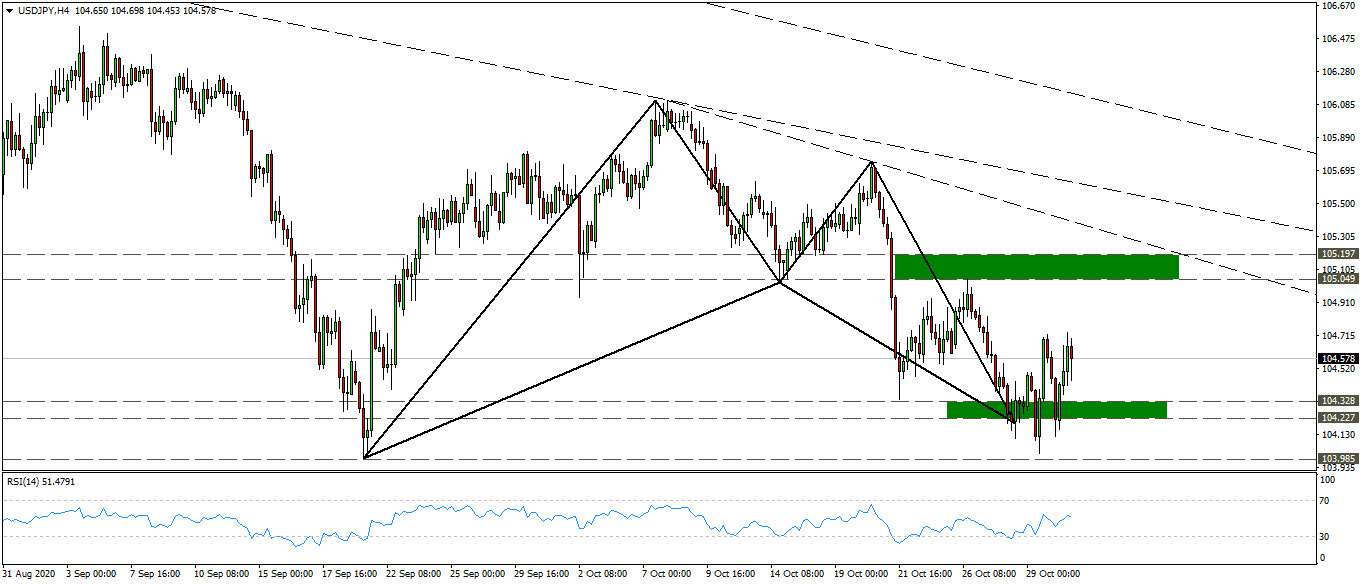

Focal point: 105.35

Preferred scenario: Short positions below 105.35, targeting 104.20 levels

Alternative scenario: stop loss and change direction by breaking 105.65 levels, targeting 106.10 levels

Comment: We have published an analysis of the dollar yen pair from here

Where the pair fell on the four-hour frame from the descending trend line from the top of October to complete the descending process until it reached support levels of 104.20-104.30, with oversold saturation on the momentum indicator rsi

The pair was also moving in a harmonic bat pattern with 88% fibo of the xa leg at the same support levels

Indeed, the pair rose to its targets, and we are now waiting for corrective selling operations before completing its upward trend.