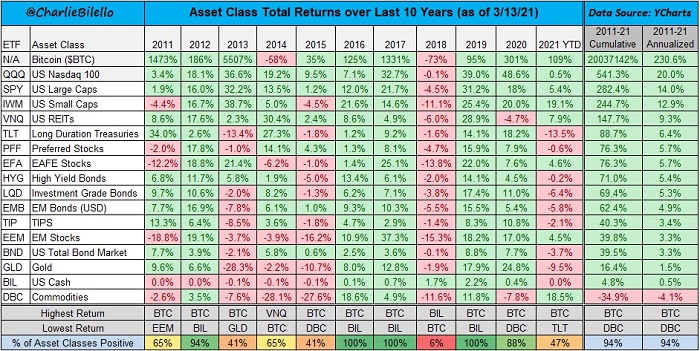

Over the past 10 years, Bitcoin has outperformed all asset classes by a factor of at least 10.

According to Queen Telegraph, Charlie Bellilo, CEO and founder of Compound Capital Advisors, noted that this was an achievement that combined the performance of higher asset classes using data from yCharts.

In response to the results, Masari researcher Roberto Talamas explained that Bitcoin produced an average annual return of 230% - more than 10 times higher. From the asset class in second place.

The US Nasdaq 100 index ranked second, with an annual return of 20%, followed by large American companies - shares in US-based companies that exceed their market value $ 10 billion - with an average annual performance of 14%. US small cap stocks were the only other asset class to record double-digit annual returns over the past 10 years, at 12.9%.

The data also shows that gold has made a negligible annual return of 1.5% since 2011, with five out of the past 11 years resulting in a loss to the asset. According to gold prices, the precious metal has decreased by 8.5% since the start of 2021, much to the dismay of Bitcoin critic and gold investor Peter Schiff.

Since 2011, Bitcoin's cumulative gains have been equivalent to a whopping 20 million percent. 2013 was Bitcoin's best performing year, during which it gained 5,507%.

The data also shows that Bitcoin recorded an annual loss for only two years of its history, with Bitcoin declining by 58% and 73% during 2014 and 2018 respectively.

>

since the start of 2021, Bitcoin has risen by 108%, with the market reaching an all-time high of just over $ 6,1500 on Sunday, March 14th. < / p>