There is no doubt that Tesla's stock is the star of this year. After it stole the limelight with unprecedented gains that made it live in a bubble, many wondered about the timing of its explosion. It seems that the answer to this question has begun to become clear after the strong losses in recent days, in the Tuesday session In the past, the electric carmaker's share tumbled more than 21 percent, to close at $ 330.21, the biggest daily drop since Tesla first traded on the stock exchange in 2010, wiping out about $ 82 billion of the market value of the world's largest car maker. p>

The decline pushed Tesla's stock to a three-week low amid widespread sell-offs on Wall Street that hit major tech companies, but the carmaker was the worst performing of any component of the Nasdaq 100 on Tuesday, The losses were not the result of one session. Rather, since Tesla's stock hit an all-time high on the 31st session last August at $ 498.32, it has taken a bearish trend, losing about 34% since then.

* Tesla stock performance since the start of the year *

But of course there are reasons behind the recent losses in Tesla's stock other than the selling wave plaguing Wall Street in general, which we review below.

Sharp rise in the stock

It is no secret to anyone that the strong gains of a share make it a reason to sell it at a high price, which is exactly what happened with Tesla's stock, which jumped nearly 300% after rising six times since the beginning of the year - a rise that made it earlier More than twice the equivalent of Japan's Toyota Corporation, the world's second largest automaker.

A week ago, Tesla itself announced that it would sell $ 5 billion worth of shares at market prices from time to time, before announcing on Tuesday that it had completed this sale until Friday, but the exact number of shares sold was not disclosed. Thus the average price of each sale, and this offer is the second of its kind that Tesla has made this year to take advantage of the share price increase after the company raised in February 2.3 billion dollars by selling 3 billion shares, at an average price of 151.60 dollars per share after The amendment is due to the company’s recent 5-for-1 stock split in order to make the stock accessible to small investors.

Tesla not listed in S&P index

After Tesla achieved its fourth consecutive quarterly earnings and jumped in the market value of the electric car maker, investors have built high hopes for the company to join the Standard & Poor's Index, which measures the performance of the 500 largest American companies, for the first time since the start of the stock exchange More than a decade ago.

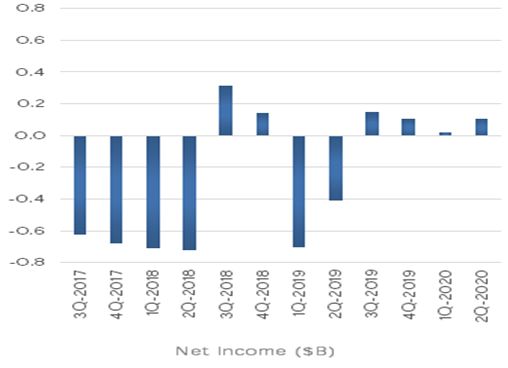

* Tesla posts profit for the fourth consecutive quarter *

To be eligible to join Standard & Poor's, the company must be headquartered in the United States, have a market capitalization of at least $ 8.2 billion, be highly liquid, and have at least 50% Of its shares available to the public, the total profits of the four consecutive quarters are positive.

and it was ...