An annual report published yesterday showed that the assets held by sovereign wealth funds and government pensions increased to a record level of 31.9 trillion dollars in 2021, thanks to the rise in US stocks and oil prices, while investments reached the highest level in several years, despite the continuing fears of Corona

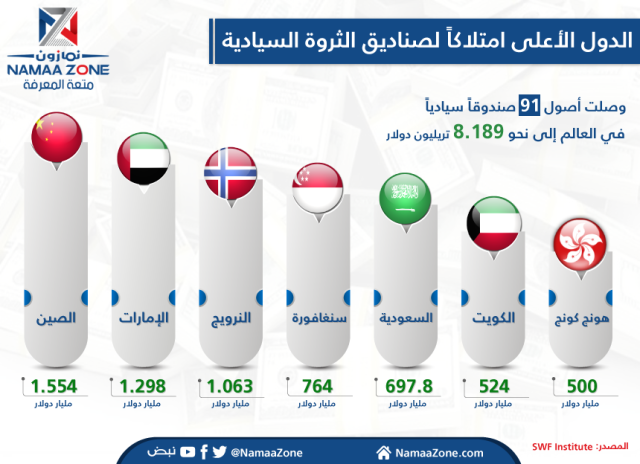

According to Arab Net, the state-owned investment tools report, prepared by the global sovereign wealth fund platform, showed that assets managed by sovereign wealth funds increased 6% during the year to $10.5 trillion, while government pension funds jumped 9% to $21.4 trillion.

The report also found that government institutional investors used more money, both in number and size of deals, at a six-year high. About $215.6 billion was spent, about half of it by sovereign wealth funds.

Singapore's sovereign wealth fund came out on top, as its percentage of deals increased 75% to $31.1 billion, spread over 109 deals. One third of the capital was invested in real estate, mainly logistics.

Emerging markets have lagged far behind, attracting only 23% of capital this year, one of the lowest ratios in the past six years, wrote Diego Lopez in the report.

Investors continued to monitor China closely, especially the crackdown on Chinese technology companies, the report said.

The report concluded that despite geopolitical tensions and regulatory concerns, most (SOEs) are optimistic about Chinese stocks.

Overall, the assets have been buoyed by the launch of four new sovereign wealth funds this year. The platform's annual report analyzes data from 161 sovereign wealth funds and 275 government pension funds.