Almost 10 months after the start of the Russian war in Ukraine, Russian stocks are still suffering from poor performance, and recovery is far from being reached. after the migration of investors due to Western sanctions; This made Russian shares the worst performers in the world.

According to Arabiya.net, Russian stocks were excluded from global standards and exchange-traded funds that track Russian stocks were frozen or closed.

Russian investors could not save the domestic market from the war-induced slump, although most foreigners are still prohibited from selling their local shares.

The sell-off in February led to a record close for the Moscow market, as the dollar-denominated RTS index has so far fallen by 35% in 2022, making it the worst performing indicator out of 92 Bloomberg tracks globally in terms of local currency and the third worst in dollar terms.

The MOEX Russia index, denominated in rubles, also fell 44%, on track for its biggest annual decline since 2008. And with war stress mounting, more losses may lurk in the market, according to Bloomberg.

For his part, said the chief currency analyst at InTouch Capital Markets Ltd, Piotr Mattis: Russian stocks reflect a bleak outlook as Western sanctions began to weigh on the local economy.

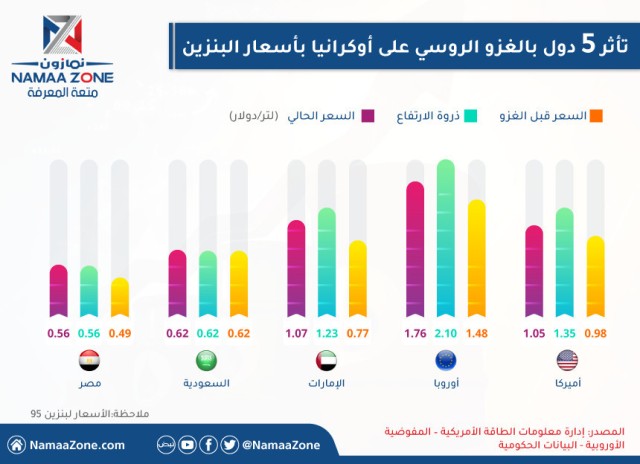

The European Union and the Group of Seven major countries have agreed to prevent companies from within the bloc from providing key services, including insurance, to ships carrying Russian crude if they are bought above a price ceiling of $60 a barrel. Meanwhile, stocks of Russian oil companies have also been hit hard by volatile crude oil prices, with benchmark Brent crude down nearly 40% from its March high.

Lukoil and Gazprom, the heaviest members of the MOEX index, have fallen by 30% and 53%, respectively, since the beginning of 2022. Meanwhile, shares of the largest listed lender, Sberbank of Russia PJSC, fell by 54% as international sanctions affected all of them. Something from Russia's access to foreign reserves to the SWIFT messaging system.

Concerns that Putin might expand reservists from the 300,000 mobilized in September have also reduced the confidence of domestic retail investors that they have the funds to work in the stock market.

For his part, Iskander Lutsko, chief investment analyst at ITI Capital in Moscow, said: “In a way, I find the Russian stock market’s underperformance surprising as all geopolitical risks are priced in at the start and late penalties, even the price cap, are not game-changers for Russian stocks.” . He attributed the continued decline in the market to the lack of support from local institutional funds, while the weakness of individual demand was due to mobilization risks and deposit outflows.

European Union member states on Thursday reached an agreement on the ninth package of sanctions against Russia, targeting banks and new officials as well as the country's access to drones.

Without new capital inflows, restricted by Western sanctions, Russian stocks are likely to underperform again in 2023, said Mattis of InTouch Capital Markets.