The Saudi Cabinet approved an agreement signed between the Federation of Saudi Chambers and the Office of the Economic and Cultural Representative of Taipei in the Kingdom, to avoid double taxation with regard to taxes on income, and to prevent tax evasion, According to Asharq Al-Awsat newspaper.

Official information indicated that the Saudi side will apply taxes on zakat and income, including natural gas investment, while the Chinese side will be on the income of projects aimed at making profit, and income standard for individuals, in addition to the basic income tax.

The Saudi Shura Council had recently approved a draft agreement between the Federation of Saudi Chambers and the Office of the Economic and Cultural Representative of Taipei to avoid double taxation with regard to taxes on income, and to prevent tax evasion, And the accompanying protocol, to be subsequently carried out according to Saudi regulations approved by the Council of Ministers.

and, according to the draft Agreement, its provisions shall apply to any tax the same or substantially the same, to be levied in either territory after the date of signature, in addition to or in place of the existing taxes of them, and inform each competent authority in the two countries of any material change in their tax systems.

According to the Agreement, the competent authorities of the two territories will exchange information which is expected to be relevant to the implementation of the provisions of the Agreement, or to the administration and enforcement of the rules of procedure regarding taxes of every kind or quality imposed On behalf of the two States or their local authorities, as long as those taxes do not conflict with the Agreement.

The agreement clarified that if the competent authority in one territory requested information, its counterpart in the other territory would use its data collection procedures to obtain the requested information.

This Agreement shall remain in force for an indefinite period, but either Contracting Party may terminate it by giving written notice to the other Party not later than 30 June in Any Gregorian year, beginning 5 years after the entry into force of the Agreement.

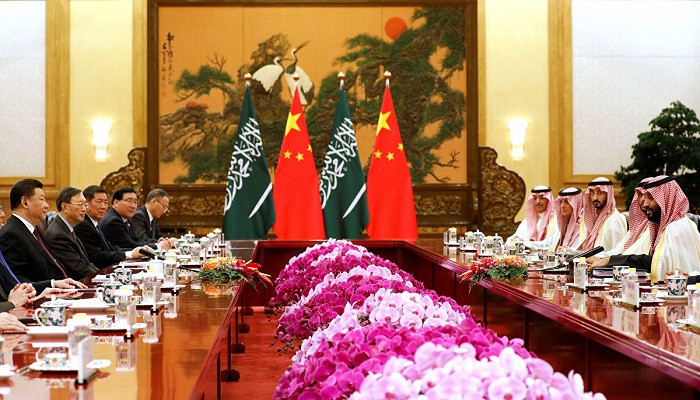

China's investments in the Kingdom during the period from 2005 to 2020, amounted to about $39.9 billion, and the Kingdom recorded an increase in non-oil exports and imports to the People's Republic of China, bringing the value of exports to 39 billion riyals ($10.4 billion), while the value of imports reached 28.5 billion riyals, making China the first for Saudi exports and imports.