In an event not seen in 20 years, the euro is approaching parity with the US dollar, after the US currency received support over the past months; As investors resort to safe haven assets, amid concerns about the Russia-Ukraine war, accelerating inflation and monetary tightening, what does break-even mean for investors and the economy and why? This is what we will highlight in the next article,,,

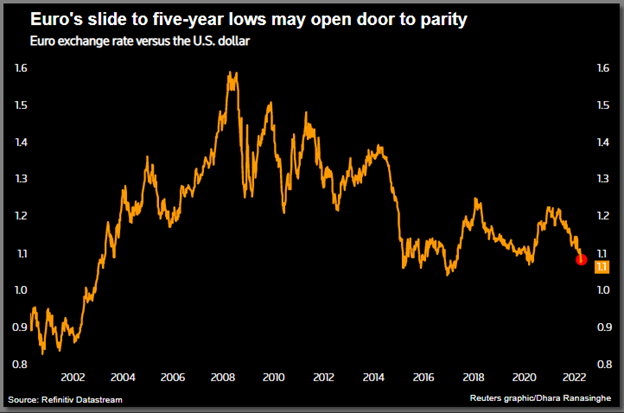

There was a lot of talk about the parity between the euro and the dollar last week, after the price of the euro reached $1.03, the lowest level in 5 years, before rising relatively to $1.07 at the present time, after the green paper reduced its gains somewhat and retreated from the highest level. In 20 years.

Despite that, the downward trend of the euro against the dollar is not the result of this year only, after the Russian invasion of Ukraine, but it began since May 2021, when the euro reached $1.23, and has since fallen back, as talk began about the Federal Reserve’s direction to end its accommodative monetary policy. With the economy recovering from the repercussions of the Corona virus.

The euro is under pressure

At a time when the single European currency was already under pressure against the strength of the dollar, the Russian invasion of Ukraine and the ensuing crisis in the energy sector came to make matters worse, as the euro lost 7% of its value against the green paper since the beginning of this year, and more than 12% during the past 12 months.

These losses increased speculation that the euro would reach the level of parity with the dollar, which happened last time in 2002 at the level of 0.86 dollars, and since then the European currency has not fallen below the parity rate. We saw this in late 2016, when former US President Donald Trump won the presidency and expectations of a rapid US interest tightening rose, the euro then reached $1.04. Then it went back to the 1.25 . level

Nevertheless, expectations of a break-even faded, after the European economy regained its strength from the great pressures inflicted on it against the backdrop of the sovereign debt crisis that hit the eurozone between 2012 and 2015. Reaching the euro to one dollar would deepen the crisis, because it would increase the cost of imports.

What is driving the trend towards breakeven?

One of the main pressures on the euro is the difference in monetary policy between the Federal Reserve and the European Central; The US central bank is moving aggressively to raise interest rates, to face inflation, which stands at the highest level in 40 years, while the European Central has not taken any decision on raising interest rates so far, despite the inflation that surrounds the euro area.

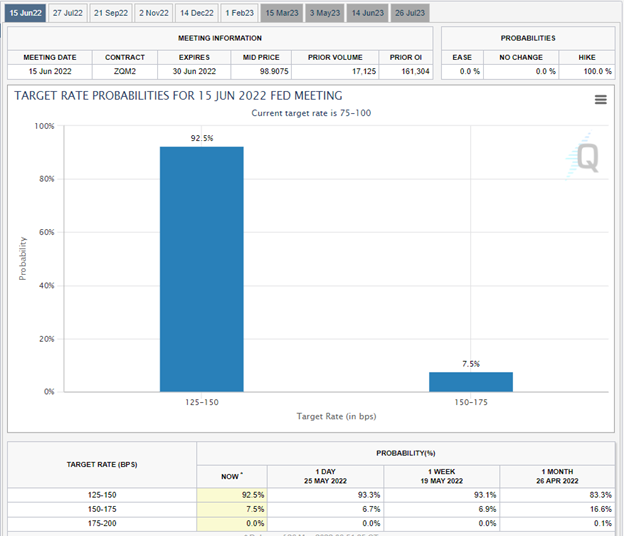

The Federal Reserve began raising interest rates by a quarter of a percentage point last March for the first time since 2018, in addition to ending the asset purchases program, and followed that with the largest interest rate increase in 20 years, when it raised it by about 50 basis points in May, to range from 0.75 1% and 1%, and even plans to raise more operations that may bring borrowing costs to 3% by the end of this year.

Expectations of a rate hike at the next Fed meeting

In contrast, the European Central Bank did not raise interest rates despite record inflation in the euro area, which exacerbates the gap between the policy of the US Central Bank and the European Central Lagarde, the possibility of exiting from negative interest and raising interest rates next July, for the first time in more than a decade, but she ruled out raising it by half a percentage point amid fears of stagflation.

The second motive behind the possibility of achieving a breakeven is closely related to the first factor, because the interest rate hikes by the Federal Reserve pushed investors towards holding the dollar as a safe haven, in light of the economic fears of stagflation.

The third factor is related to the pressures on the euro, as a result of the European energy sector crisis, which was exacerbated by the Russian invasion of Ukraine, with the rise in energy prices and Russia's announcement of dealing in rubles in payments for Russian gas, the main source of Europe's supplies.

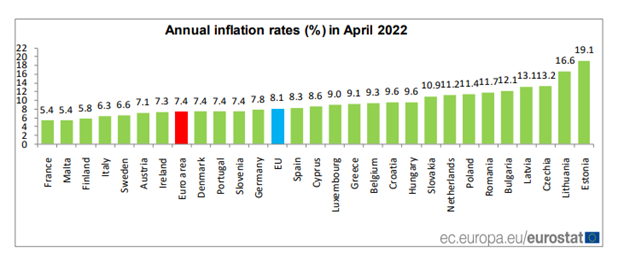

*Annual inflation index in Europe

Inflation in the euro area reached a record high of 7.4% last month, with the jump in energy prices, and a continuation of this should prompt the European Central to tighten monetary policy aggressively, which could negatively affect the economic growth outlook for the region, an additional factor pressing on The euro pushes it to parity with the dollar.

In the end, the occurrence of parity between the euro and the dollar, would exacerbate the crisis of the European economy, because it would make the value of imports higher, and this would lead to higher inflation, which means additional pressures on the European Central Bank.

It will also make the euro less valuable and less purchasing power abroad, which will push investors to dump euro-denominated assets in exchange for higher-yielding assets such as the dollar. The Eurozone even to achieve the levels of growth that were previously reduced to 2.3%, thus making the European continent one of its most difficult stages in the current periods!!

Iyad Aref

Founder of the Namazon website