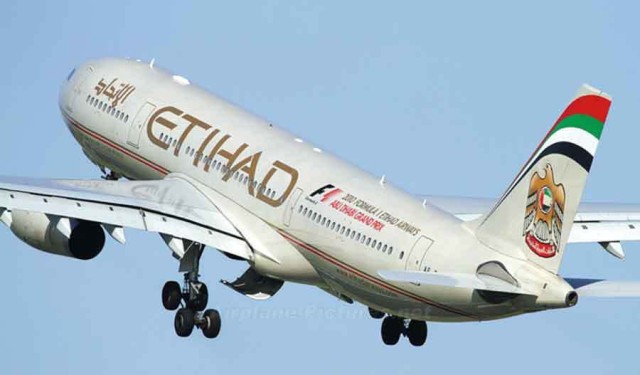

A New York court sent summons to Etihad Airways and Fitch Ratings; The request for a document that is at the center of a $ 1.2 billion debt dispute issued by Etihad Airways and airlines partly owned by it, according to legal documents seen by Reuters.

Investors, including Blue Bay Asset Management specializing in fixed income instruments, require access to a debt bearing agreement signed by the Italian Federation and carrier Alitalia in 2016, before Alitalia is declared Bankruptcy.

Etihad issued bonds in 2015 and 2016 through a special purpose company based in Amsterdam, EA Partners, which then distributed the money to Etihad and other airlines, from Alitalia among them.

According to the disclosures provided by the EA Partners to the London Stock Exchange and a report by Fitch issued in May 2017, the union agreed to cover the debt owed to Alitalia under the debt-bearing agreement. p>

Investors believe the document will help them recover a portion of the money they invested in bonds and requested access to them in a lawsuit they filed on June 16 in the US District Court for the Southern District of New York. . Reuters has seen a copy of the lawsuit.

Judge B. Kevin Castle accepted their request and issued hand-over summonses to the registered agents of Fitch and the Union in New York ordering them to disclose the debt agreement in accordance with legal documents seen by Reuters. < / p>

A source familiar with the matter said that the federation has before Fitch until July 7 to respond to or oppose the matter.

Fitch declined to comment and Alitalia has not yet responded to a request for comment.

After the story was published, an Etihad Airways spokesman told Reuters, Etihad Airways has not issued bonds through EA Partners but is one of several borrowers from E.A. A Partners.

A Blue Bay spokesman referred the request for comment to the investor group, which it said was considering engaging in consultations with Etihad and its airlines.

We are exploring our options, but we remain open and willing to engage with the union, ”the group said in an emailed statement.

The bondholders ’request comes after previous attempts to find solutions to restructure debt, including ...