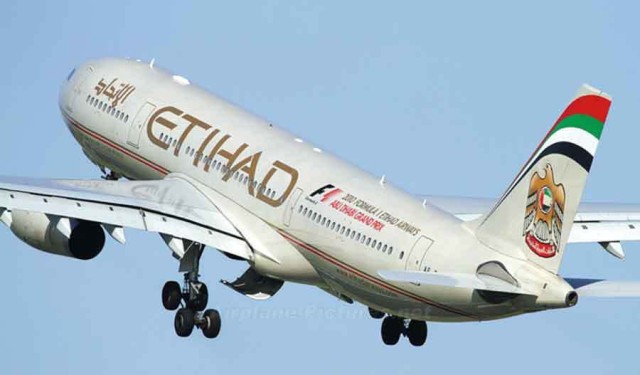

Etihad Airways issued a US $ 600 million sukuk, which is the world's first sustainable aviation transfer and financing sukuk.

According to Al Bayan newspaper, this step comes on the heels of the issuance of the first funding in the aviation sector related to the United Nations sustainable development goals during the month of December of last year, which confirms the position Etihad Airways' leader in sustainable finance.

The deal will contribute to supporting Etihad Airways 'march in the sustainable aviation sector by linking the terms of the sukuk to Etihad Airways' carbon reduction goals, which are the commitment to reduce net carbon emissions to zero By 2050, reduce 50 percent of net carbon emissions by 2035 and cut 20 percent of carbon emissions from the company's passenger fleet by 2025.

said Adam Boukadida, Chief Financial Officer at Etihad Aviation Group: Sustainability and responsible climate action represent the most important challenges facing the aviation sector, and as the national carrier of the UAE, it is committed to Etihad Airways is promoting sustainable growth in the aviation sector, in line with Abu Dhabi's vision.

He added: By issuing the instruments related to sustainability, Etihad Airways is seeking to reinforce its current commitment in accordance with the Carbon Offsetting and Reduction Scheme in International Aviation (CORSIA) and has also committed To reduce carbon emissions by 20 percent since 2017.

It is worth noting that HSBC and Standard Chartered banks have been appointed as global coordinators and joint agents for sustainable structuring, while Abu Dhabi Islamic Bank, Dubai Islamic Bank and Emirates Dubai have been appointed NBK Capital, First Abu Dhabi, HSBC and Standard Chartered as Principal Organizers and Registered Bookrunners. Abu Dhabi Commercial Bank has also been selected as Joint Principal Regulator and Mashreq Bank as Financial Advisor.