The risk appetite was the main driver on Friday, which led to some losses in the dollar against all currencies. The EUR / USD pair closed the day with gains, but closed with losses on a weekly basis, below the 1.0900 mark. Positive sentiment was stimulated by U.S. President Trump, who unveiled a three-stage approach to reopening the economy, although the decision was left in the hands of state governors. Also, studies on Remdesivir, an experimental drug, have shown some promising data on COVID-19 emerging. Stocks registered significant gains globally, which put pressure on the dollar. However, the single currency was unable to benefit significantly, as the union continued to face difficulties with the outbreak of the Corona virus, without a clear common pathway.

technical outlook

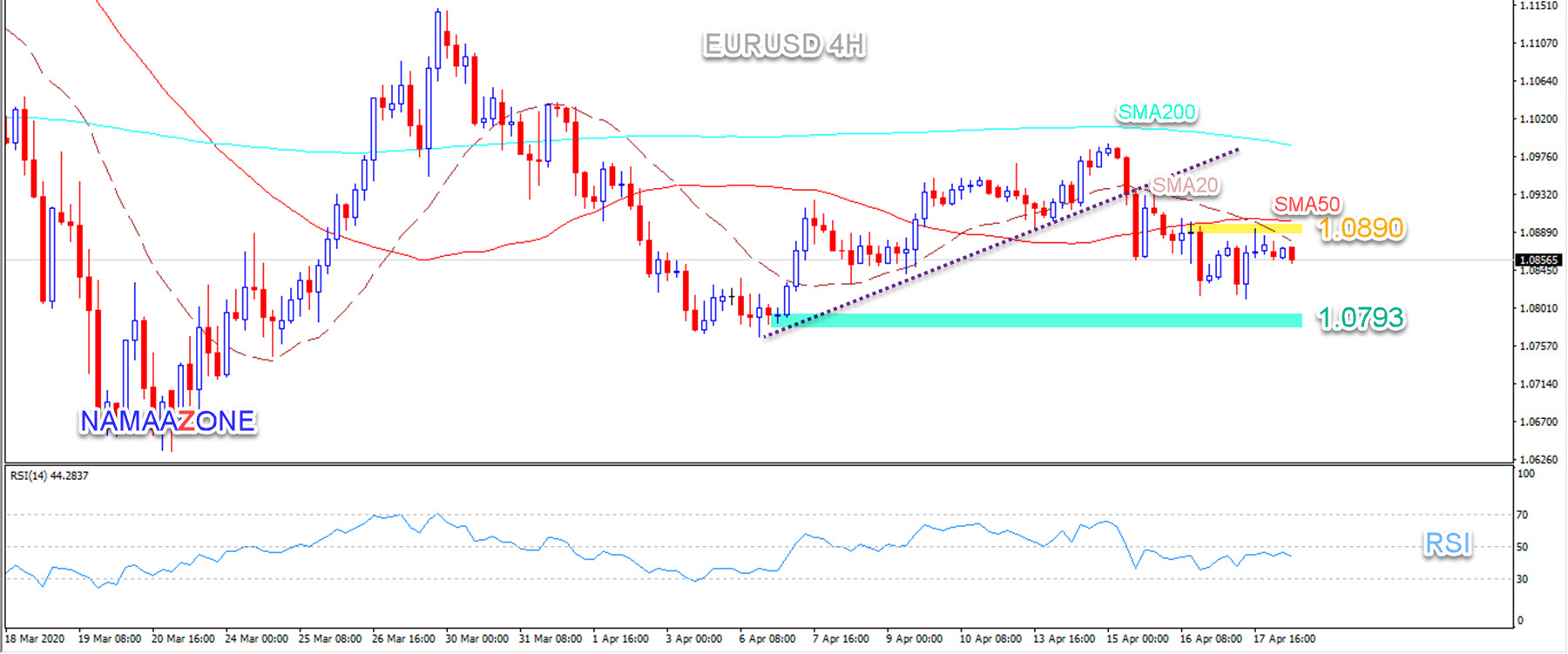

EUR / USD is trading below the 50 50 200 averages on the 4-hour time frame, so that the bearish trend scenario remains active by trading below the 1.0940 resistance.

With stability below the mentioned resistance, the pair targets the bottom of 1.0790, and the success of the bears by breaking this bottom is important to confirm the rush towards our target 1.0670, noting that the breach of 1.0940 will stop the suggested drop and press the price to rise again.

The expected trading range for today is between 1.0790 support and 1.0905 resistance

.

Expected trend for today: Downside