Gold has long been a source of controversy and contention among economists and investors. Noted economist and statesman Lord John Maynard Keynes famously described gold as a barbaric relic of the past, referring to it as a commodity based solely on superstition and a primitive passion for the solid metal. Similar views were issued by Warren Buffett, the famous American investor in value assets, who criticized gold as an instrument driven solely by fear and speculation and not based on any clear foundations or predictable return profile.

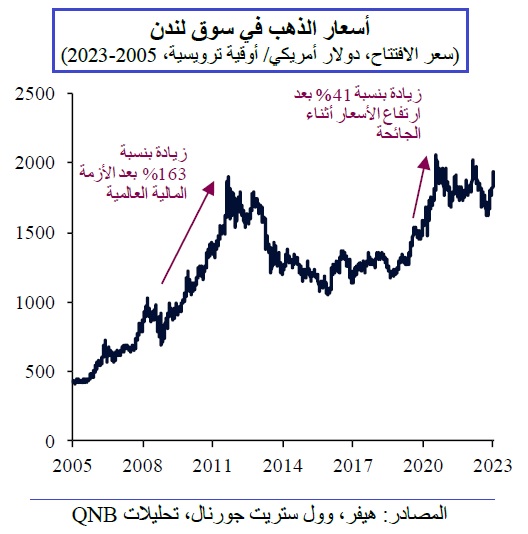

According to a report by the economics department at Qatar National Bank, today, Sunday, despite the lack of income generated by gold and the costs associated with its extraction and storage, investors, families, sovereigns and companies have been hoarding gold for generations, as it has served as a stable storehouse of value, as it protects portfolios from economic turmoil. and macro-systemic risks, such as the global financial crisis in 2008-2009 or the COVID-19 crisis in 2020-2022.

It should be noted that after the significant decline in gold prices that rose during the pandemic, gold has recently benefited from renewed demand. As a result, the price of this precious commodity is only 6% away from its all-time high of over $2,062 an ounce. It is noteworthy that this strong rise in gold prices comes at a time when cash or short-term government securities provide higher nominal returns, which increases the opportunity costs of owning gold. Our analysis delves into the three main factors behind gold's high and ever-rising price.

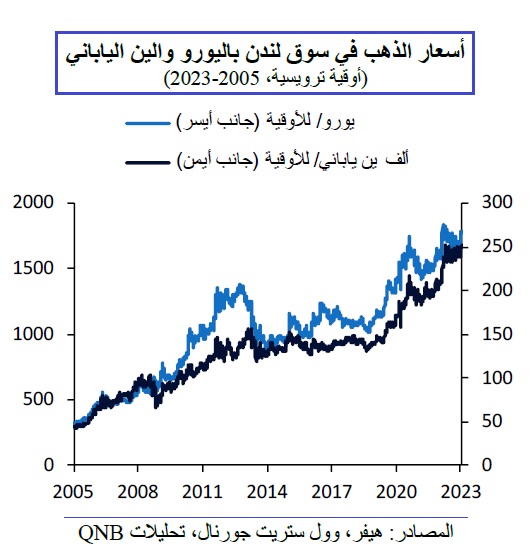

First, while nominal rates of return are now much higher than they were in the recent past in most advanced economies, they are still below inflation rates, meaning real returns are still negative. This means that short-term cash and government securities are less attractive as investment options in terms of nominal returns, and this favors alternative investments such as gold, which is considered a bulwark against inflation. This is particularly important for Japan and Europe, because their real interest rates are considered to be at much more negative levels than they are in the United States. In fact, gold prices in euros or Japanese yen have reached all-time highs in recent weeks.

Second, the global economy faces a slew of geopolitical uncertainties, including the Russia-Ukraine war and escalating tensions between China and the United States in the Taiwan Strait. This situation has led to higher risk premiums in traditional assets and increased demand for alternative safe havens. In addition to the general trends, such as the intensification of economic competition between the United States and China, the decline in international cooperation, the outbreak of trade conflicts, the increase in political polarization and the imposition of sanctions, these events boosted the demand for non-jurisdictional safe-haven assets such as gold. In the context of mounting geopolitical pressures, gold is gaining more importance, as it is a jurisdiction-neutral tangible asset that can be used as collateral across different markets. Central banks around the world are accumulating gold reserves at a historic pace. in the last year,

Major central banks have accumulated gold holdings at a rate not seen since 1967, when the global monetary system was still dependent on the precious metal.

Third, the global macro economy is facing a difficult situation represented by a combination of low growth, mounting debt and high inflation, especially in some of the major advanced economies. In the past, these conditions often led to fiscal constraint, as governments implemented policies to rein in public debt and finance their deficits. This could include keeping interest rates below inflation, increasing the money supply, and imposing capital controls. The result is a transfer of wealth from savers to the government through inflation, lower returns to savings, and diminished purchasing power. Gold usually performs well in such scenarios of financial constraint, and cautious long-term investors have begun to adjust their positions partly in anticipation of these conditions.

Overall, we believe that long-term trends support the return of gold as a diversifying and stabilizing component of global investors' portfolios. This trend is gaining momentum and is in the middle of its early stages, which provides ample opportunities for growth in gold prices in the long term or in the next decade.