The global macroeconomic environment is experiencing some of the most challenging situations that have not occurred in decades. Rare macroeconomic imbalances, such as rising inflation combined with sluggish activity, lead to major bouts of market turmoil and stress, and this can be seen in most asset classes and countries.

As central banks raise interest rates to fight rising inflation, the attractiveness of cash against other types of assets is increasing, which leads to downward pressures in the overall value of both stocks and bonds, said the research unit at Qatar National Bank.

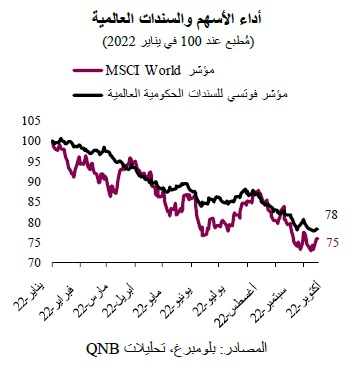

Indeed, the global asset sell offs that have prevailed throughout the year have intensified in recent months. Since the beginning of the year, % to date, the performance of global bonds and stocks has declined by 22% and 25%, respectively.

These market movements have led to a significant decrease in the value of balanced investment portfolios for investors who used to benefit from stable positive returns. According to Bank of America, the return to date from the traditional asset allocation strategy, which splits the portfolio into 60% equities and 40% bonds, represents the worst annual performance in a century.

In other words, this year we are witnessing the largest and fastest demolition of financial wealth ever. The damage has become so evident that financial stability concerns are beginning to come to the fore.

The UK monetary authorities were forced to shore up the domestic bond market amid historic turmoil in late September. With long-term yields soaring to a 20-year high, above 5%, UK bond prices collapsed.

This has pushed leveraged pension funds to the brink of bankruptcy after a wave of margin calls forced them to liquidate their bonds. So the Bank of England announced that it would intervene in whatever way is necessary to calm the markets. This required the purchase of bonds on a large scale.

The UK incident opened the debate on financial instability and the potential need for other central banks to provide financial support. In mid-October, US Federal Reserve officials held discussions with institutional investors, bankers and financiers to understand the potential for outbursts in US markets similar to those in the UK, and similar discussions took place in Europe.

It should be noted that these discussions occur at a time when major central banks are withdrawing balance sheet support from the bond markets. The monetary authorities have been reluctant to expand the balance sheet to adopt a more neutral or restrictive position on the balance sheet.

Last month, the US Federal Reserve began implementing the maximum pace of reducing its balance sheet by $95 billion per month. This means a significant decrease in the demand for bonds, which leads to higher yields across various periods and a depletion of the money supply.

In QNB's view, major central banks will likely have to separate interest rate policy normalization from balance sheet reductions. Inflation is too high and this threatens the credibility of the monetary authorities, given their responsibility for managing inflation.

In the past, most central bankers believed in the need to harmonize monetary policy instruments, meaning that interest rates and the balance sheet should go in the same direction or at least should not conflict with each other – whether it was easing, neutrality or tightening. This has led to the rule of combining raising interest rates and stabilizing or reducing the balance sheet, in contrast to the expansion of the balance sheet, which increases the money supply and liquidity in the economic system.

Despite these past practices and beliefs, QNB believes that the current conditions require the adoption of a different approach in the use of monetary policy tools by the major central banks, meaning that interest rate policy should be the main tool to combat high inflation, while the balance sheet policy should be adjusted. target, to provide potential support to stressed asset markets. This would allow for a more orderly and sustainable process of monetary policy adjustment.