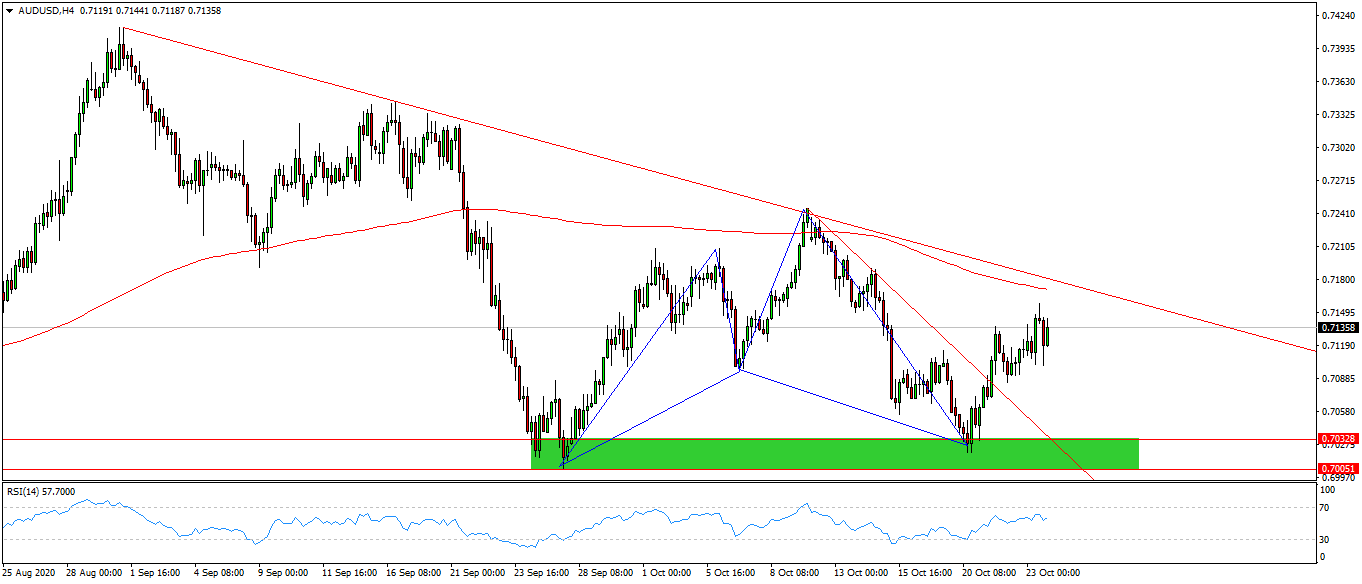

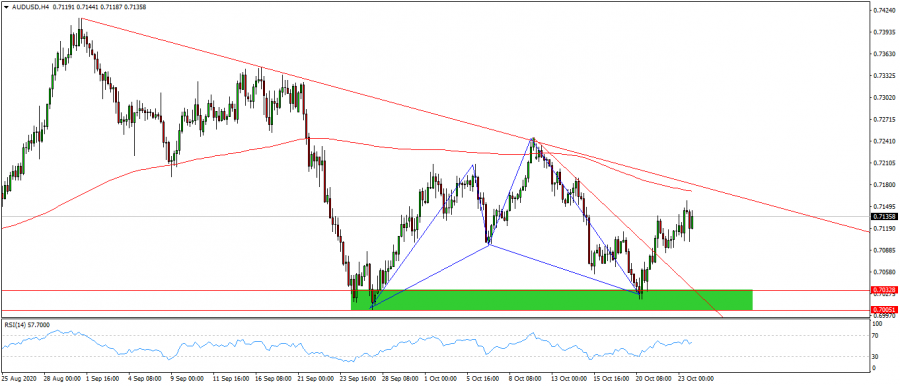

Pivot point: 0.7170

Preferred scenario: Short positions below the level of 0.7170, targeting levels 0.7030-0.7000

Alternative scenario: Long positions above 0.7170, targeting 0.7245 levels

Comment: We have published an analysis regarding the Australian dollar pair from Here

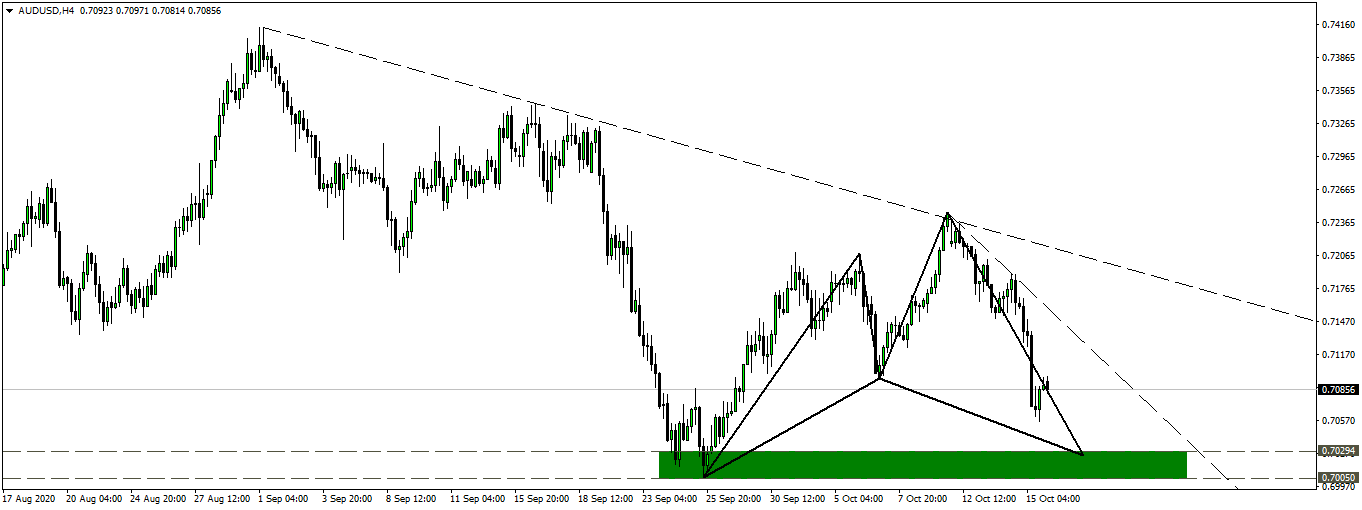

Where the price fell from the descending trend line from last September's top from the 0.7240 resistance level and moved in an expected harmonic shark pattern with a correction of 88% fibo from the xa leg after breaking point b at the 0.7090 level

It was expected to complete the decline to the target of the pattern at support levels 0.7030-0.7000, then from there the activation of the pattern and the beginning of the rise according to the pattern to levels of 0.7170-0.7200

Indeed, then the price fell to the levels of the pattern, and then rose from it to targets. It is expected that if the 200 EMA remains below 0.7170, it will fall again to 0.7030-0.7000 levels.