Technical Analysis

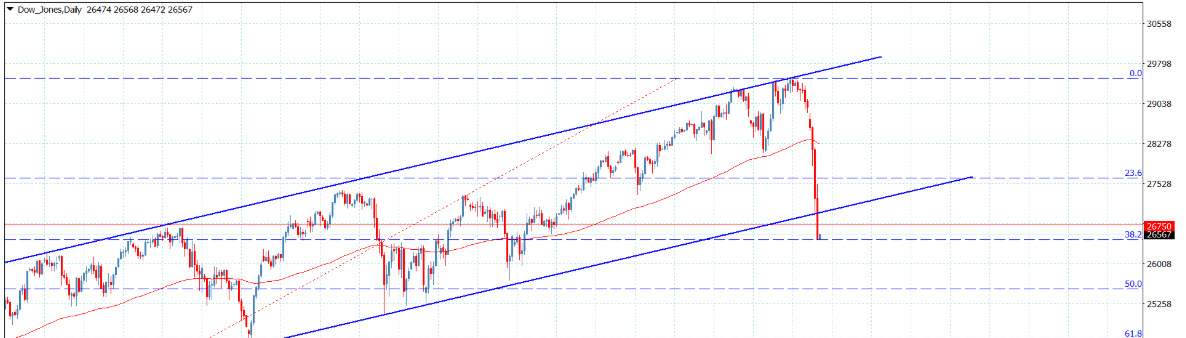

Repeat the price of the index in yesterday's trading, its formation for a negative attack, to notice from the attached chart that it completely exited the bullish path by breaking it to support the main bullish channel, stationed at 26960, facing the 38.2% correction level. Fibonacci and stable at 26467.

Currently, the price may have to form an upward corrective bounce based on the stability of the 26470 level, and this provides an opportunity to test the 26750 level to reach the previously mentioned broken support, but in the event the price infiltrates below this Support and stability below it will increase the chances of resuming the negative attack, which in turn may target 26070 and 25528 levels, respectively.

On the weekly chart, the index was unable to penetrate the 270 angle to rebound strongly with the weekly candle for support 26500 at angle 225, because of the persistent selling pressure, it has to break this support first to open the way to target the main angle 180 and the price 24315.