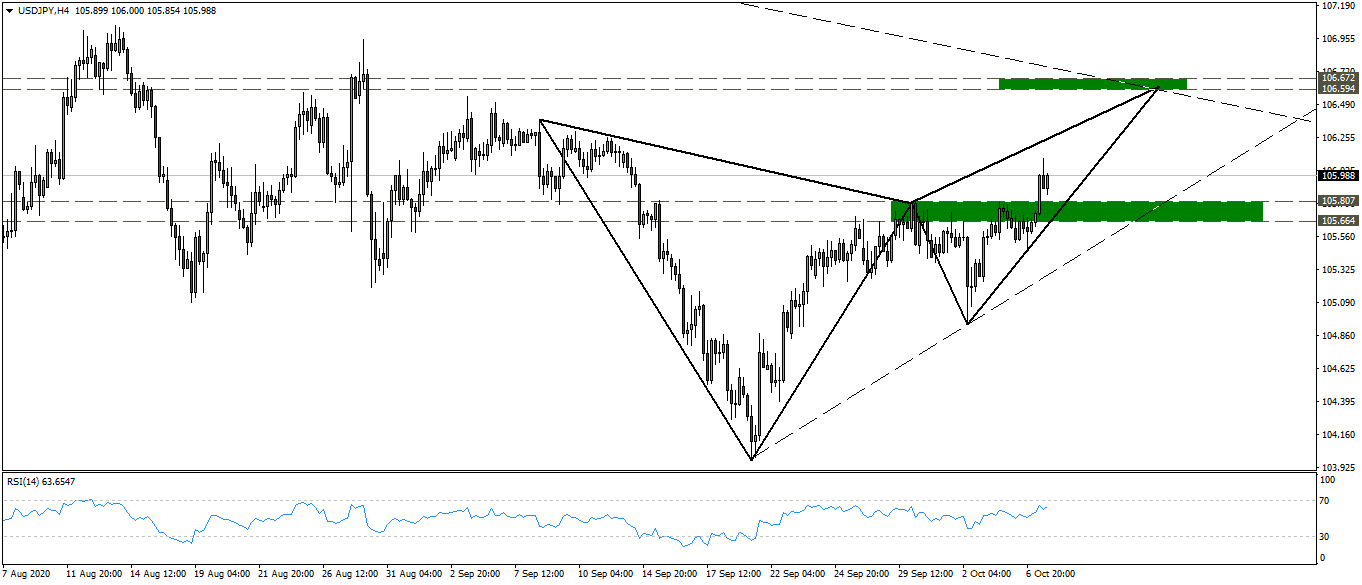

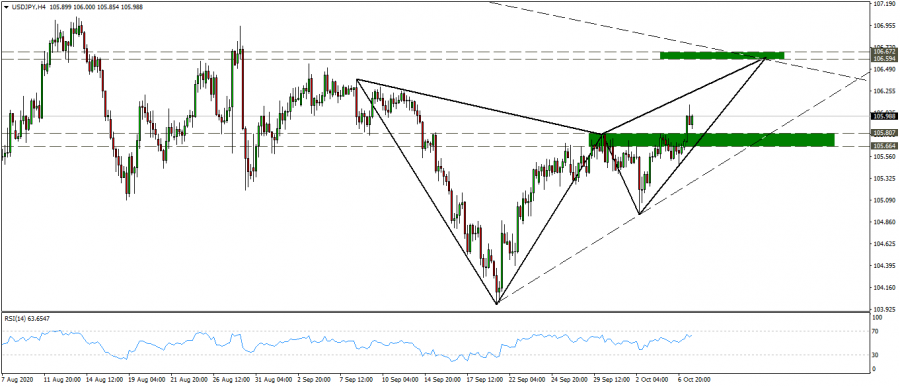

Pivot point: 105.80

Preferred scenario: Long positions above 105.80, targeting 106.60-106.70 levels

Alternative scenario: Short positions below 105.80, targeting levels 105.20-104.90

Commentary: The US Federal Reserve will meet today to determine the next monetary policy, especially in light of developments in inflation rates and after his hints in the last meeting that there is no intention to change interest rates

On the one hand, US President Donald Trump announced that he did not intend to provide any financial aid to stimulate the economy, as Jerome Powell, director of the Federal Reserve asked in his testimony before the US Congress.

Technically, the pair rose on the four hour frame of support levels 105.20-104.90 to move in an upward direction from last September's low, penetrating with it Resistance zone at 105.80-105.65

levels

The pair is also moving in an expected harmonic butterfly by 127% fibo, waiting for the price to break the point b of the pattern to indicate the continuation of the rise at the target of the pattern at the levels