Biden, OPEC and the bone-breaking war in the oil market, and does the withdrawal from the strategic reserve affect oil prices? , And why did oil prices not fall after the decisions of the US administration?? What does technical analysis say about the oil track, and what does it expect?? Questions that we will answer in detail in the next report. Follow up, enjoy with knowledge

It seems that the US administration is fed up with its repeated calls to OPEC to increase oil supplies, and decided to move to withdraw from the strategic oil reserves, in order not only to face the rise in gasoline prices, but also persuaded US President Joe Biden, major consumers of crude, to take the same step, to increase pressure On OPEC, in what appears to be a bone-breaking war in the global oil market, which reacted positively to the release of the strategic stockpile!!

In the past few months, we've seen Biden and his administration officials at other times appeal to the OPEC+ alliance - the oil-exporting organization, and allies from outside - again and again to increase the supply of crude, after oil prices reached their highest levels in 7 years, and increased Speculations that Brent will exceed $100 per barrel, at a time when inflation has reached the most severe around the world, and countries, especially Europe, are suffering from a record rise in gas and electricity prices, due to lack of supplies.

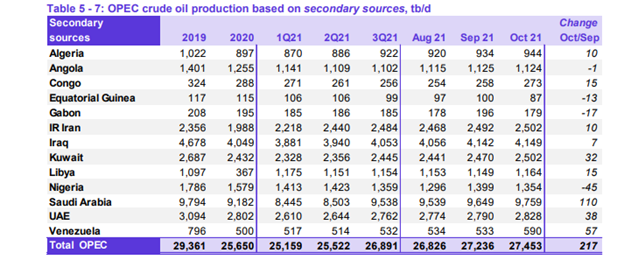

Despite all this, the OPEC + alliance did not bow down on the pretext that the oil market does not need to increase production more than what is scheduled under the current agreement, which provides for a gradual increase of 400,000 barrels per day every month, with the organization expecting a surplus in supply during the first quarter of 2022.

strategic reserve

In a move that was widely expected, the United States announced on Tuesday, November 23, the release of 50 million barrels of strategic oil reserves next month, and the US administration justified this decision by its desire to reduce gasoline prices for American consumers and overcome the shortage of supplies, after the failure of supply. Oil in meeting the increasing demand as the economy recovers from the shock of the Corona epidemic

The decision to withdraw includes about 32 million barrels through exchange with oil and gas companies, so that these companies submit bids to obtain oil, and then the government grants them contracts, provided that the quantities of oil received are returned to the strategic reserve in the next three years, in addition to an additional amount that depends Over the period of holding the oil by the companies, as if it were a loan with interest.

While the US Department of Energy is scheduled to sell the remaining part, i.e. 18 million barrels, no later than December 17, under a mandate by the US Congress, in accordance with the budget law, and this comes with the fact that the United States has a strategic stockpile of crude oil that exceeds 600 million barrels. , according to the latest data from the US Energy Information Administration, as well as the world's largest oil producer and consumer.

The locations of the strategic oil reserves in the United States

Although the decision of the United States is more robust in terms of the declared amount of oil, many other major consumer countries are considering or have already decided to withdraw from the strategic stockpile, in conjunction and in coordination with the American administration in order to have double pressure on OPEC.

Where India announced the release of 5 million barrels of strategic reserves, in a move that occurs for the first time ever in New Delhi, after it was badly affected by the high prices in recent months, and accused OPEC of causing this, as India is the third largest consumer of oil in the world, At approximately 5 million barrels per day, this means that the amount that India will release from the reserve is only one day's consumption.

Besides India, the UK allowed companies to voluntarily release 1.5 million barrels of privately owned strategic reserve, South Korea and Japan also announced their willingness to join the US decision, along with China, which was the first to actually take this step when it was put in place Last September, the first public auction of about 7.38 million barrels of government crude oil reserves to a select group of local refineries, in order to achieve stability in energy prices.

OPEC+ position

After the decisions to withdraw from the strategic oil reserves of a number of consuming countries, reports have emerged indicating that the Organization of the Petroleum Exporting Countries and its allies from outside are considering reassessing the current production policy related to, but it is not expected that OPEC will take any additional action at least at its next meeting scheduled early next month. .

OPEC sees that the oil market is heading to balance, starting from next year, and there is no need for any change in its plans. The increase late this year, which rose 1.74 million barrels per day last month, on a monthly basis, to reach an average of 97.56 million barrels per day, according to OPEC's monthly report.

This comes with continued uncertainty about demand, as major producers fear the possibility of restoring movement restrictions in the coming months, especially in Europe, which is currently witnessing an increase in epidemic injuries. million barrels per day, bringing the total to 100.7 million barrels per day, exceeding pre-pandemic levels, which is largely in line with the expectations of the International Energy Agency.

Oil price forecast

After nearly a month of losses, oil prices pushed below $80 a barrel, we saw oil prices shine and rise by more than 3%, on Tuesday's session, after the United States announced the release of strategic stocks, unlike the usual in the crude market, which is declining with increased supplies But what are the reasons for that?

Brent crude performance since the beginning of this year

In fact, the oil market has already priced the decisions to withdraw from the strategic stockpile in recent weeks, as they were expected, which led to a strong drop in prices recently, and the amount of oil that the United States will release -50 million barrels- came less than expected for For some, as well as most of it, as mentioned earlier, by exchange, and the companies will return it again, as well as an additional amount.

This means that withdrawing from the strategic reserve will have a small impact on oil prices, in the end it is a reserve and should not be used to influence prices, bearing in mind that the declared quantity is equal to only two days' production by OPEC, whose production exceeded last month 27 thousand barrels per day, while Biden himself admitted that the release of the strategic stockpile will not reduce gasoline prices overnight, and this is what makes the US administration confirm that it will not stop pressuring OPEC, to increase supplies.

*Opec production last October*

Major investment banks are still showing a positive view of oil prices, as Goldman Sachs expects Brent crude to maintain levels of $85 a barrel in the fourth quarter of this year, and Bank of America even sees that prices can exceed $100 a barrel in the winter of 2022, especially with the lack of gas supplies. Naturally, which encourages the transition to oil in electricity generation and so on.

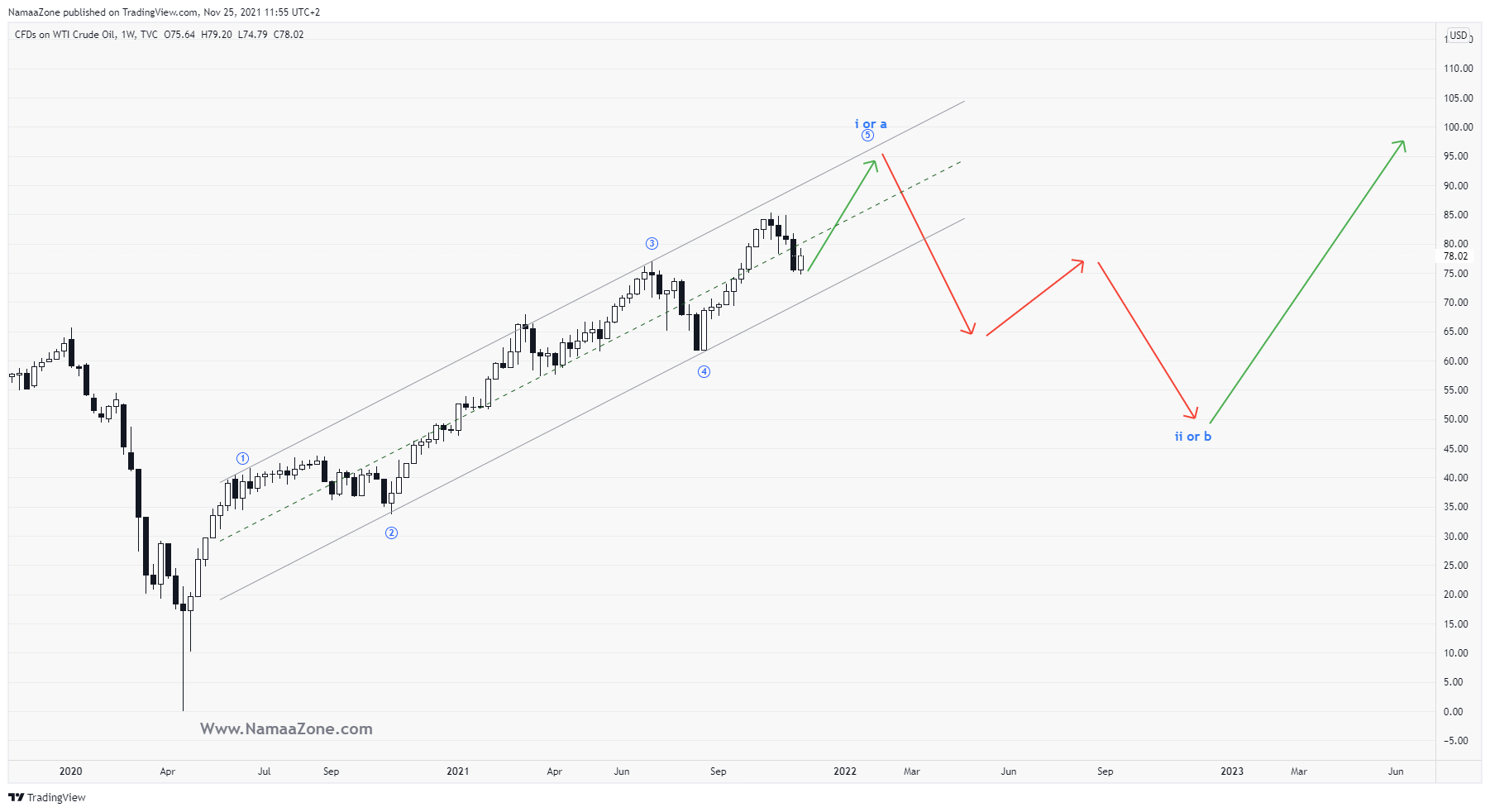

Technical Analysis

The attached chart above tells us what is going on behind the scenes in the price battle that the October 25 summit near $85 a barrel, in my opinion, will not be the last for oil, and that we will actually head towards the atmosphere of the nineties, and we may see a repulsion of the stubborn $100 barrier before mid-2022, and this means that the policies of the American administration on In the short term, you will not do any good by clicking on prices!! , but the technical chart also tells us that this expected upward process will not last long!! , where I think technically that we are at the end of the fifth ascending wave, and therefore we are looking forward to a recent rise, then the prices will return to correct, and a bearish path has begun to extend over the next two years, and I think that the level of $50 will be targeted to stabilize around it.

In the end, prices will watch with caution OPEC's reaction to the procedures for withdrawing from the strategic stockpile at the next meeting of the organization, and the most important thing in our opinion is the serious messages sent by the US administration and its allies to reduce oil prices soon and that they are ready to take other measures if necessary!!!

Written by Iyad Aref

Founder of the Namazon website