special report

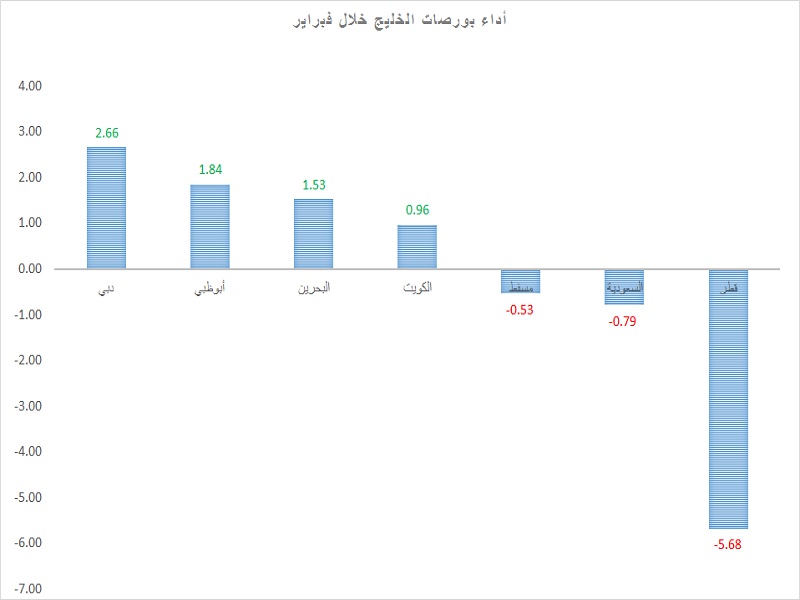

The performance of Gulf stock markets varied in February, with a tendency to positivity, in light of the anticipation of the movement of global oil markets, corporate results and dividends.

4 exchanges recorded gains in February, led by the Emirates markets, compared to the decline of 3 markets led by Saudi Arabia and Qatar.

The Dubai Financial Market achieved monthly gains of 2.7%, topping the winning markets, and ascending to the level of 2,635.78 points in the last February sessions.

The second highest gain for the Abu Dhabi Financial Market, which increased by 1.84%, in February, rose it to 5,137.81 points.

In contrast, the Qatar Exchange came in the forefront of losses, after falling by about 5.7% during the month of February, to reach the level of 10,111.62 points.And the second position was in terms of the highest losses for the Saudi Stock Exchange, which witnessed a decline of 0.8%, falling to the level of 8,492.70 points.

Oil prices fell by about 2% on Friday, ending the week's trading down by 3.3%, in light of concerns about the growth of global demand.

The announcement of the companies ’financial results and dividends announcement season dominated the performance of the Gulf markets during the month of February, especially the major companies.

The anticipation situation of results and distributions is expected to continue during the month of March, with the extension of the grace period to the end of March, in some markets.

The performance of global markets, especially American indicators, is among the strong influences on the performance of the Gulf markets, in addition to the oil movement.

for more

81 years since the discovery of Saudi oil