Special report - Amazon:

The positivity dominated the Saudi banking sector during 2018, and expectations of expert homes tend to continue the optimistic atmosphere in the first quarter of 2019.

Al-Rajhi Capital expected continued good growth in net profits in the Saudi banking sector in the first quarter of 2019 on an annual basis, given that the interest rate between Saudi banks remains at a high level. p>

The research company said this was translated into higher net interest margin levels with potential support from lower provisioning costs.

She indicated that high asset quality and good provision coverage ratios for banks are likely to put the allocation costs under control.

As I noted, it is likely that the revised Zakat rules will have a slight impact on the book value of the sector more than previously expected, given that most Saudi banks will eventually pay zakat at the limit The lowest is 10% of net profit.

For its part, Al-Jazira Capital expected that the performance of the Saudi banking sector will continue to improve in the first quarter of 2019, especially banks that comply with Islamic law.Quarterly Performance

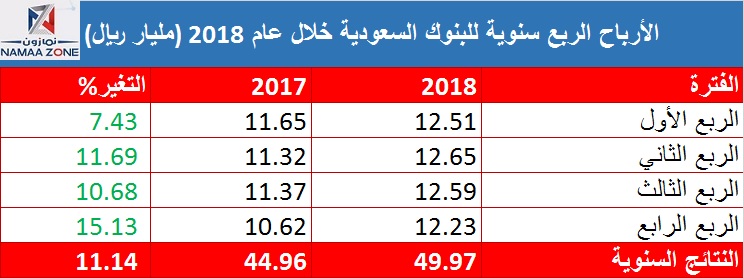

Saudi banks' quarterly performance witnessed a remarkable advantage during 2018, compared to 2017, especially the fourth quarter, which witnessed the highest growth rate during the year.

According to a statistic for Namazon, the consolidated profits of banks in the fourth quarter of 2018 increased to about 12.2 billion riyals, compared to 10.6 billion riyals for the same quarter of 2017, with a growth rate exceeding 15%. p>

Billionaires

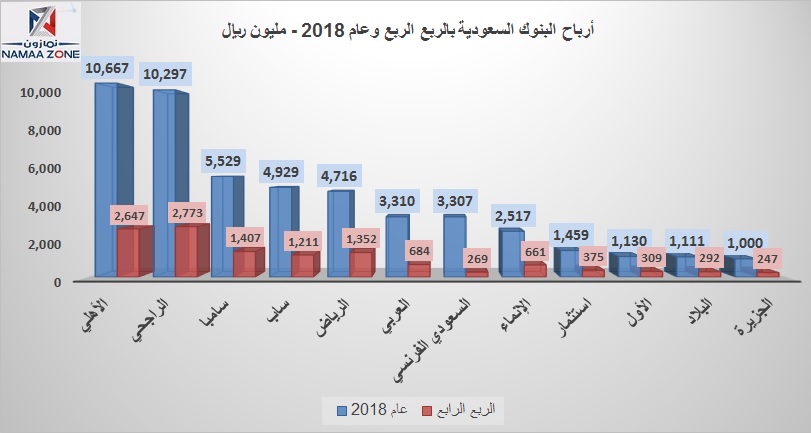

And all Saudi banks announced profits exceeding one billion riyals in 2018, compared to billion profits for 10 banks in 2017.

At the level of the fourth quarter of 2018, profits exceeded the barrier of one billion riyals in only 5 banks, with the leadership of the leader of the Saudi banking sector, Al-Rajhi Bank.

All banks recorded net profit growth during 2018, with the exception of only two banks, the Banque Saudi Fransi and the first bank, and this was the case in the fourth quarter.

The National Bank Excellence

Al-Ahli Commercial Bank was the owner of the highest profits on the level of annual results, outperforming Al-Rajhi Bank and other major banks.Al Ahli Bank announced a net profit of 10.7 billion riyals in 2018, representing 21.4% of total profits, compared to 9.8 billion riyals in 2017, an increase of 8.8%.

Al-Rajhi Bank came in second place, with net profits of ...