This is not an advertisement or a joke about simulation, because digital currencies are watching the historical date of division, which is the most important event in the course of digital currencies that occurs every four years and is awaited by investors in the middle of a month. Next May 2020, its Halving Time be ready

But what does that mean ?? What is its effect on prices ?? How can we benefit from this historical event ??

When Satoshi Nakamoto wrote the Bitcoin code in 2009 he was aiming to create an integrated community of Bitcoin traders and suppliers that included the success and development of the spread of the bitcoin idea and cryptocurrencies and this was already done later. , Then the suppliers (prospectors) had to obtain a monetary incentive represented by a certain number of bitcoin units for each block created to cover mining costs and achieve an attractive profit margin that drives them to continue, provided that this award is reduced to half every four years upon the successful completion of 210 thousand blocks, The start was with a 50 bitcoin unit prize per block Excavated, and wait for the day the important date in the month of May next fair to be reduced mining prize to 6.25 units Bitcoin for each block is created successfully

But what does all this mean? What is its effect on price movements ??

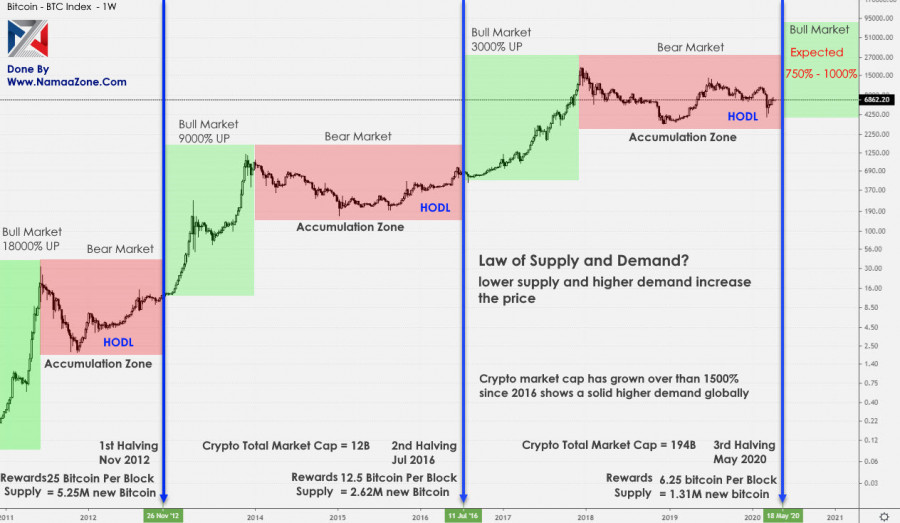

The market is governed by the law of supply and demand, which states ((The decrease in the supply of quantities with the increase in demand will lead to an increase in prices)) And this is actually what happens when Bitcoin is launched The quantities supplied were 10.5 million units, then the quantity decreased to 5.25 million units with the first split in November 2012, then the second split occurred in June 2016 so the quantities decreased to 2.62 million units, and now we look for a new decrease in the supply chain to 1.31 million new units from Bitcoin

This indicates a decline in supply while demand is increasing historically, and this is confirmed by the expansion of institutional investment spending in the digital currency industry, in addition to the large demand from investors from around the world, it has The market size doubled from $ 12 billion in 2012 to $ 194 billion today, and therefore, in light of increased demand and lower quantities, it is expected that prices will rise and the market will grow more, especially with its strategic financial solutions in light of today's challenges and the global demand for digital transformation

The important answer remains, how to benefit from this historical event?

As is the price cycle of all commodities, it moves from the ascending phases to the phases of landing and grouping and then continuing to rise, in the attached chart for the history of the Bitcoin movement was subjected to the same approach, so I found many One of the opportunities for smart money to enter is quiet assembly and then reap huge profits. In 2011, prices decreased by 93% after achieving an increase of 18,000%, and then also in 2015, they decreased by 86% after achieving an increase ...