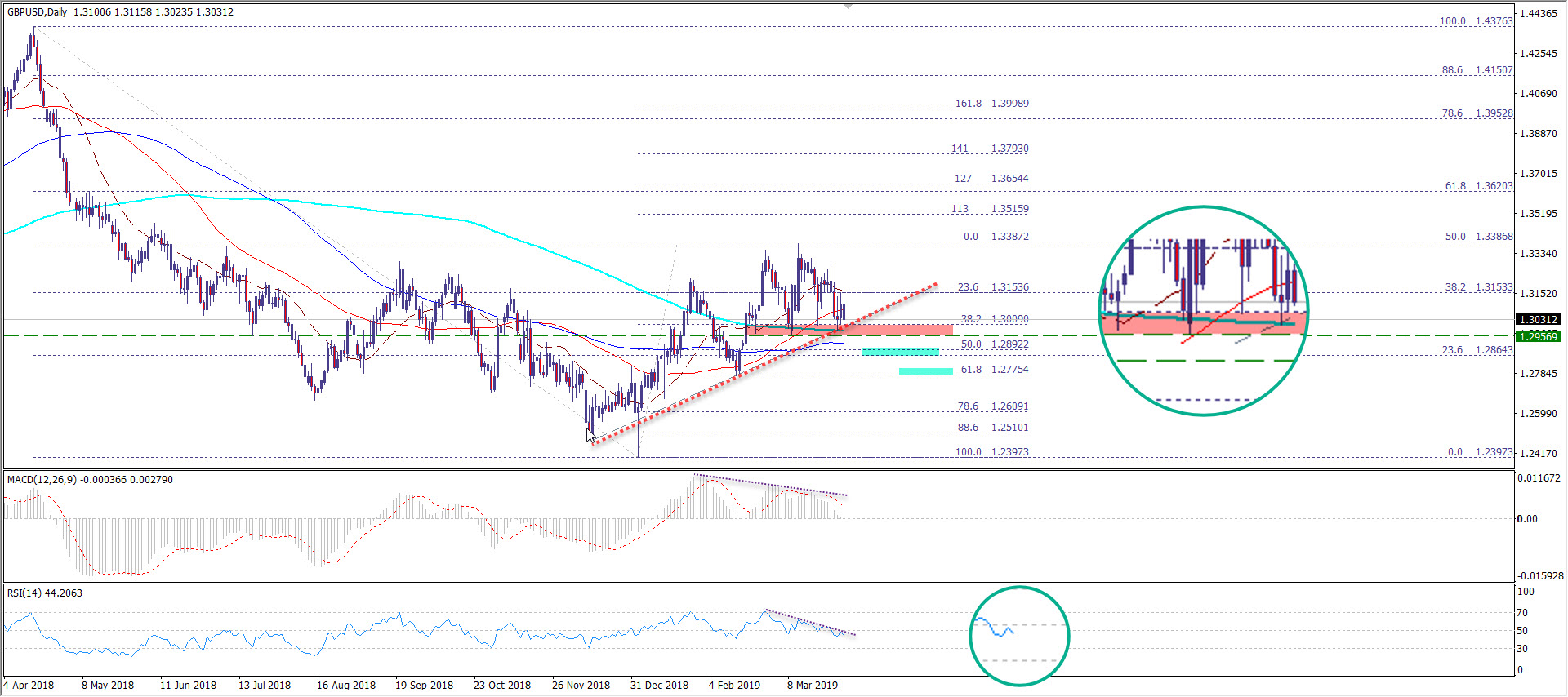

In the short term, the GBP trades below the broken and average trend line 4 200 hours. The cable re-tested the trend yesterday at 23.6 levels for the uptrend (1.2397 - 1.3381) at 1.3150 and started to fall, but was unable to because the Fibonacci 38.2 and corner 90 at 1.3005 preferred so it is preferable to take a portion of the profits and wait for the support to break 1.3005 to renew the sale with a target of 1.2840 .

Looking at the daily chart, we wait for the average break of 200 and the main bullish trend to target 1.2890 at 50 Fibonacci levels for the wave (1.2297 - 1.3381).

On the other hand, penetration of resistance areas 1.3150 opens the way to target targeting 1.3200-1.3260.

There is a weak momentum on the MACD with the Divergence forming on the RSI and trading is still below 50.

Telegram

https://t.me/SAMERBADDAR