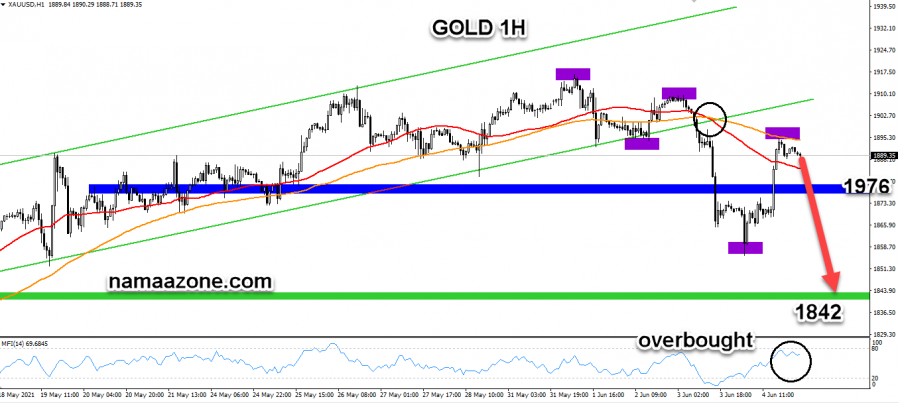

Pivot point: (1876 : 1900 ) .

The preferred scenario: Entering short positions in case the price breaks the levels of 1876 dollars, with setting 1842 as an initial price target.

Alternative scenario: In the event of the price stability above the levels of 1900 dollars, it is possible to enter into buying deals with placing the 1932 dollars as an initial price target.

Commentary: The yellow metal, gold, witnessed a violent downside wave at the end of last week's trading, noting that the price broke the ascending channel, and started forming a series of bearish waves, Where gold recorded its lowest levels since May 19 at $ 1855, to rebound before the markets closed at the end of trading last Friday, in the context of a short-term corrective rebound, and by looking at the liquidity flow index, we find that it is about overbought levels, which supports the negative outlook for gold trading on the long The short term, especially in light of the price breaking the moving averages, with the deviation of the moving average 50 below the moving average 100, which indicates the presence of more declines in the short term.