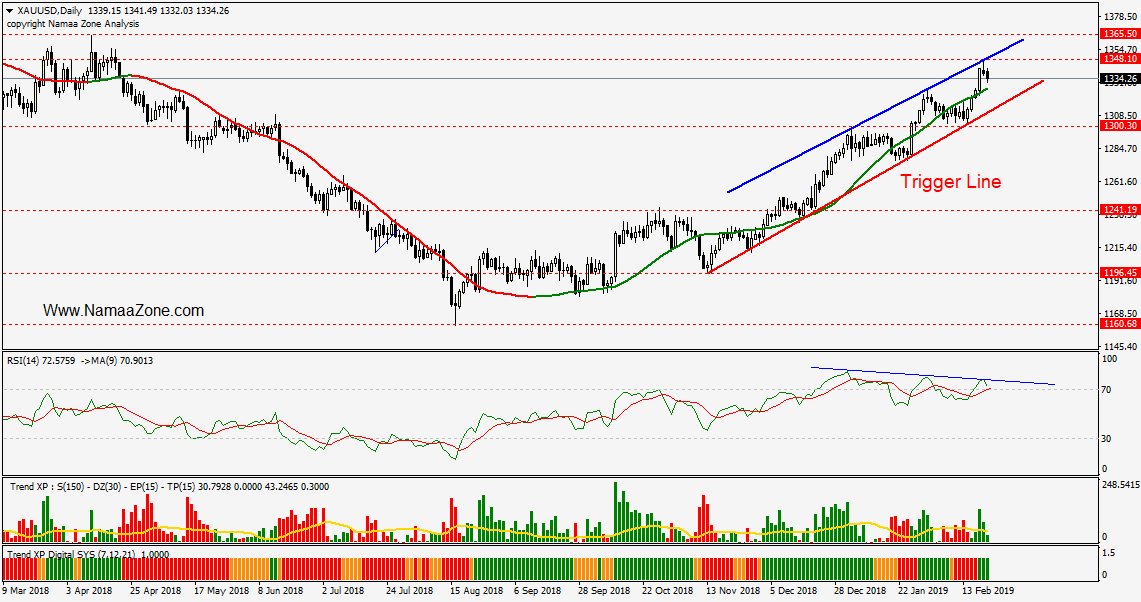

So this decline in gold prices does not come from a vacuum but rather from a number of technical and economic reasons, and it is also apparent on the chart pages of the presence of clear negative breakthroughs on the indicators of relative strength and also A hitting the top of the ascending channel, as mentioned above, it is important to follow the trigger line or as I like the name Trigger LIne, which is located during the upcoming sessions at $ 1315, so closing outside this bullish track and outside the trigger line will push gold prices to more rapid declines towards 1240 Dollars and 1196 dollars minimum

Recommendation: Sell from the current levels of $ 1335 with a stop at $ 1365, with a first goal of 1240 and a second goal of $ 1196.

My best wishes to all friends, good luck!