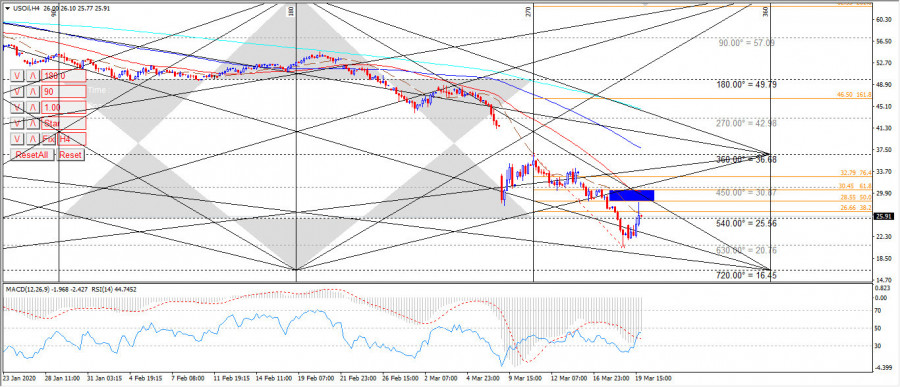

The breakdown of the crude oil price yesterday stopped at the level of 20.53 represented by the 630 angle, to start a correctional wave targeting the areas of 28-30 at the upper boundary of the triangle and the Fibo levels 50 and 61.8 for the wave 36.38-20.53.

The breakdown of the crude oil price yesterday stopped at the level of 20.53 represented by the 630 angle, to start a correctional wave targeting the areas of 28-30 at the upper boundary of the triangle and the Fibo levels 50 and 61.8 for the wave 36.38-20.53.

Steady below 32.90, the bearish slope is expected to continue, especially with fraction 26 to target 24.40.

breaking the bottom 20.53 opens the way for further downside targeting 19.20 and 360 corner at 16.45.

The expected trading range for today is between 24.00 support and 30.00 resistance

32.90 Expected trend: Downward stability