The EUR / USD pair fell to its new lows for 2020, below 1.0700 levels, as the demand for the American currency remained strong this Thursday, despite the panic decline at least temporarily. The pair hit its highest levels at 1.0981 at the beginning of the day, as the European Central Bank announced a Facilitation Package worth € 750 billion called the Epidemic Emergency Purchase Program (PEPP) for the purchase of public and private securities, but the pair was unable to keep the gains, to finally break lower Its previous yearly levels are at 1.0777 to accelerate the decline. On Thursday, the dollar closed broadly unevenly, as European indices closed in the green, while US indices also recorded modest gains.

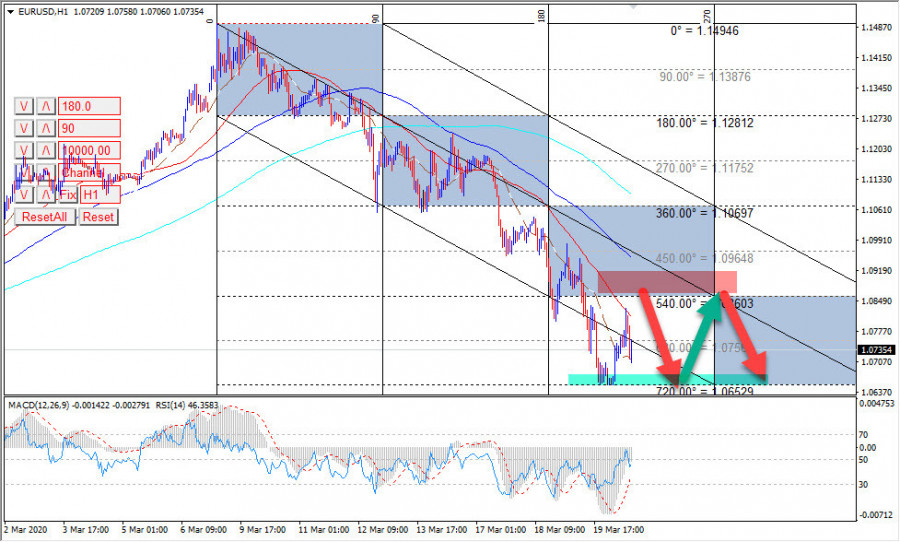

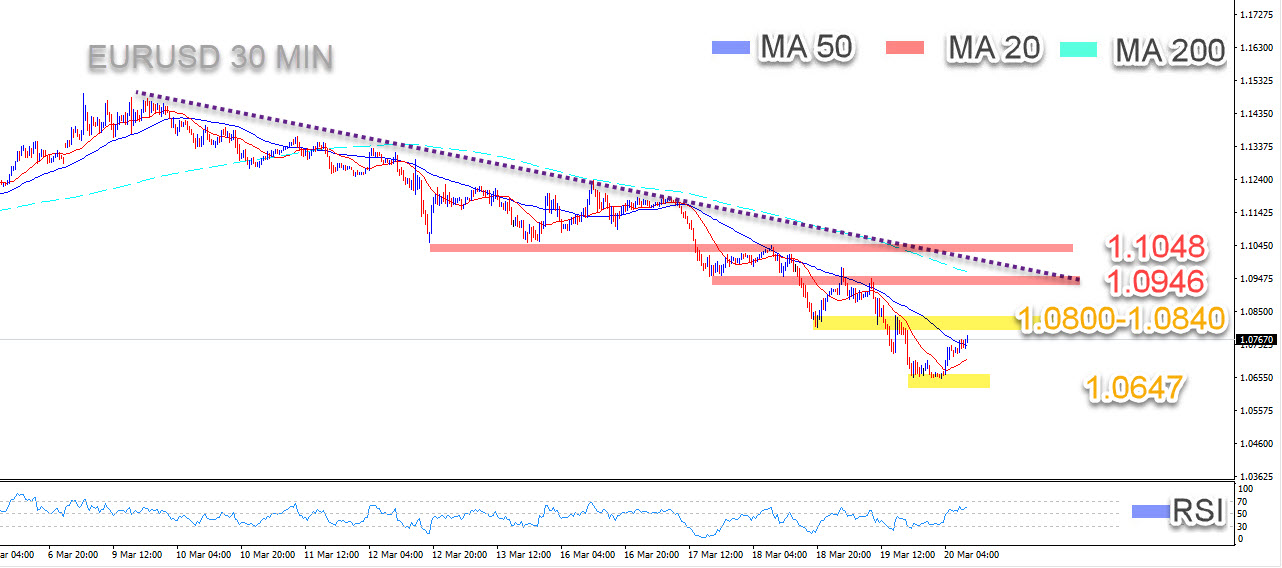

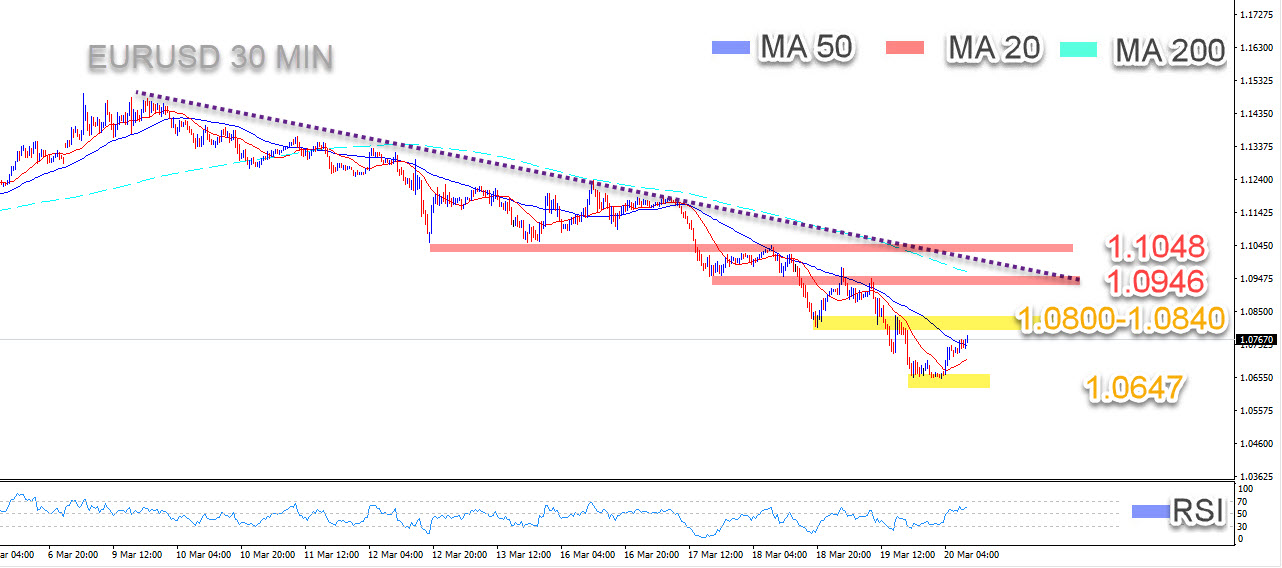

The EURUSD pair presented strong negative trading yesterday and reached the 1.0650 areas, noting that the price starts the day with an upward slope in a sign to start an expected bullish correction in the intraday and short term.

The EURUSD pair presented strong negative trading yesterday and reached the 1.0650 areas, noting that the price starts the day with an upward slope in a sign to start an expected bullish correction in the intraday and short term.

This ascending wave is expected to recede below resistance 1.0960 - 1.1048. Also, the direction of the euro towards the sideways levels between 1.0860 - 1.0660 during the period of potential leaders, which represents angle 540 and 720

Sell near 1.0860 with a target of 1.0760 and 1.0680 pastop above 1.0990 is good

The expected trading range for today is between 1.0650 support and 1.0860 resistance

.

Expected general tendency: lateral

The EURUSD pair presented strong negative trading yesterday and reached the 1.0650 areas, noting that the price starts the day with an upward slope in a sign to start an expected bullish correction in the intraday and short term.

The EURUSD pair presented strong negative trading yesterday and reached the 1.0650 areas, noting that the price starts the day with an upward slope in a sign to start an expected bullish correction in the intraday and short term.