The performance of Asian stocks was mixed, Tuesday, after Wall Street suffered in the wake of the rise that put the S&P 500 index (S&P 500) near overbought levels, while Treasury bonds maintained their gains.

Japanese stocks fell at the opening session, amid speculation of profit taking, which led to a strengthening of the yen. Meanwhile, the MSCI Asia-Pacific Index - a measure of the region's major indexes - rose in early trading, erasing Monday's losses. Hong Kong futures saw a weak open, and US stock futures were little changed.

Since Japanese and US stocks are at high levels driven by rising bonds, profit-taking selling is likely to occur, said Ryota Otsuka, strategist at Toyo Securities. However, hopes for an end to deflation and improved corporate capital efficiency still provide a strong outlook for Japanese stocks.

Treasury bonds continued the rise that began on Monday, causing the yield on two-year bonds, which are considered sensitive to the path of the federal interest rate, to fall by more than three basis points to 4.85%. The 10-year benchmark yield stabilized after falling eight basis points to about 4.4%. Australian and New Zealand bonds fell during the first hours of Asian trading.

The world's largest bond market has returned to activity after spending long periods of 2023 at the bottom, heading towards its best month since March, and the Bloomberg US Treasury Index recently turned positive for the year, as signs of slowing inflation and measuring job growth unleashed a rise in... It led to a decline in yields from their highest levels in more than a decade.

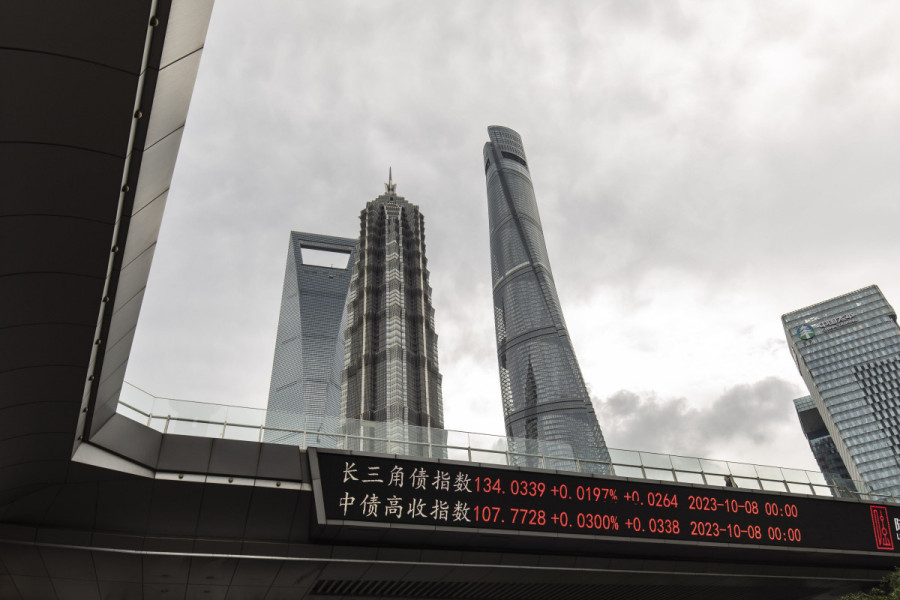

China's recovery

Swaps data shows that investors are pricing in a rate cut of about 95 basis points from the January meeting until the end of next year.

In Asia, there are signs that China's economic recovery remains fragile, with industrial corporate profits rising at a much slower pace than a month ago as deflationary pressures persist. The fallout from the criminal investigation into Zhongzhi Enterprise Group Co, the shadow banking giant, continues, with one lawyer estimating investor losses could reach $56 billion.

“The market appears to have embraced the idea that slowing economic data will precipitate market-friendly rate cuts, although the Federal Reserve has continued to send messages to the contrary,” said Chris Larkin of Morgan Stanley's E*Trade. He added: This week will provide many opportunities for traders to decide whether their assessment is correct or not.

Expected data

Yesterday, Monday, US government debt sales were met with mixed reactions, as the auction of five-year bonds worth $55 billion witnessed strong demand, while demand for the sale of two-year bonds worth $54 billion was weak.

The dollar fell for a fourth day with declines against all its major counterparts, while the yen led the gains.

Traders will be closely watching another batch of economic data this week, including the Federal Reserve's preferred measure of core inflation. New home sales in the United States fell in October after a downward revision to the previous month's data, as decades-long high mortgage rates weighed on demand. The Dallas Fed's manufacturing index for November came in weaker than expected.

US interest bets

Bets that US monetary policymakers have finished their cycle of rate hikes have fueled a rally in the S&P 500 this month, lowering expectations for short-term volatility. While some have taken advantage of the opportunity to hedge cheaply, such moves are not widespread, despite growing calls that the market environment has become too calm.

Matt Maley, chief market strategist at Miller Tabak + Co, said: The technical context in the stock market is currently very important. This does not mean that we are about to see an important top in the stock market, noting that this may mean that we will witness A slight pullback or even a sideways correction at some point over the next week or two, with the aim of overcoming the current overbought condition.

Stocks versus bonds

More than 60% of respondents in the latest MLIV Pulse survey expect stocks to provide better returns than bonds over the next month. This is the highest level of enthusiasm for stocks the survey has recorded since the question about both assets (stocks and bonds) was first asked in August 2022.

Wall Street observers have also become more optimistic about the outlook for next year, with investor sentiment improving and recession expectations declining.

Regarding corporate earnings, Crowdstrike Holdings Inc. will confirm. How companies are prioritizing cybersecurity after recent high-profile corporate hacks Salesforce and Dell Technologies Inc are expected to report slower sales growth when they report earnings this week, with overall corporate spending tightening.

In another context, the price of gold stabilized near the highest level since May, supported by a decline in Treasury yields and bets that the Federal Reserve will begin lowering interest rates. Oil rose after a series of losses, as the market weighs the possibility of deeper production cuts from the OPEC+ alliance against signs that supply exceeds demand.