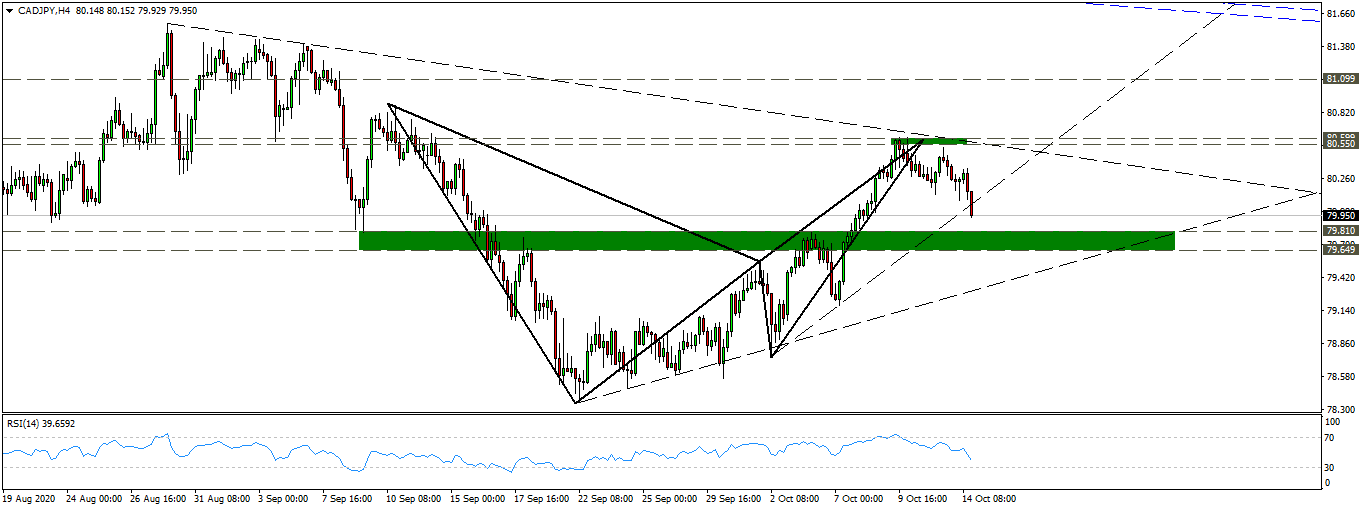

Pivot point: 80.10

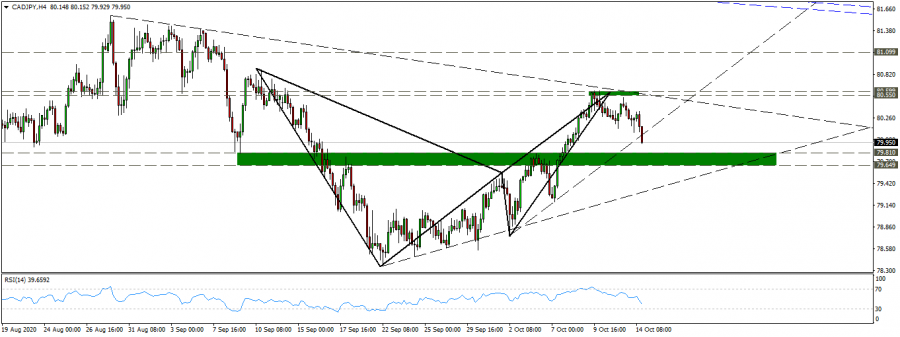

Preferred scenario: Short positions below 80.10, targeting levels 79.80-79.65

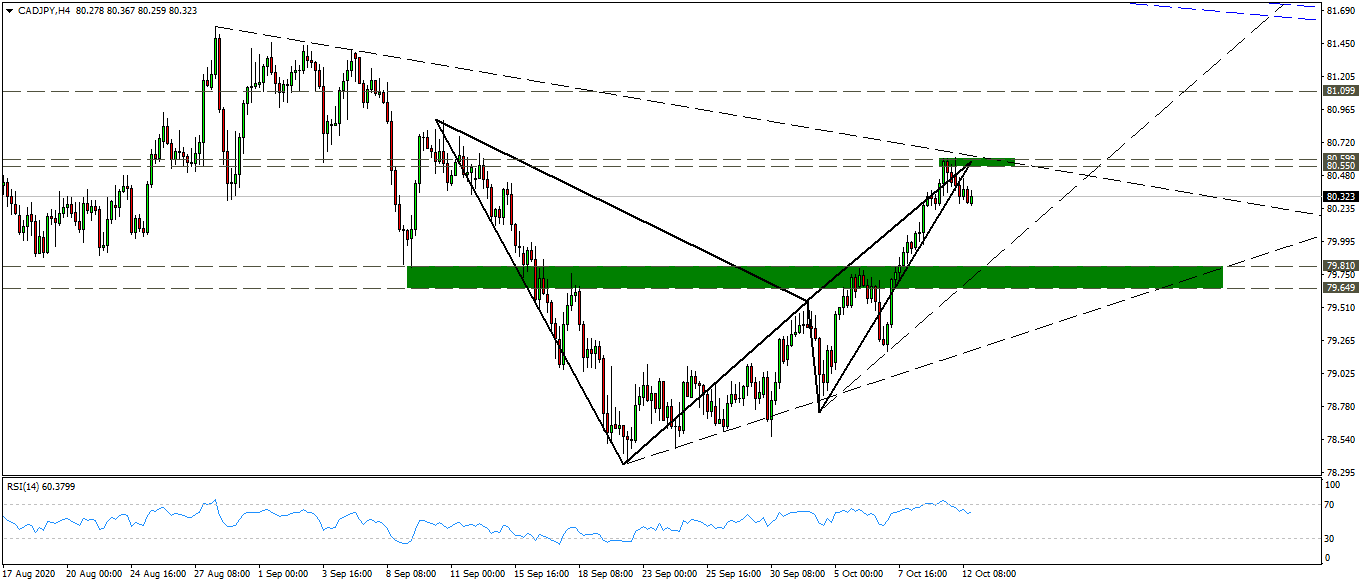

Alternative scenario: Long positions above 80.10, targeting 80.50-80.60 levels

Comment: We had published an analysis of the Canadian yen pair and his potential decline through this Analysis

Where the price reached on the four-hour frame the resistance zone 80.60-80.50, which coincides with the descending trend line from the top of last August The price had fallen below 80.60, indicating some expected downside, with an overbought momentum RSI

With the Harmonic BAT pattern with 88% Fibonacci retracement of the XA leg to support the idea of landing

Indeed, the price started to decline, and he expected more of it to reach its targets at the 79.80-79.65 area, and from there we await the reversal signals and the end of the decline.