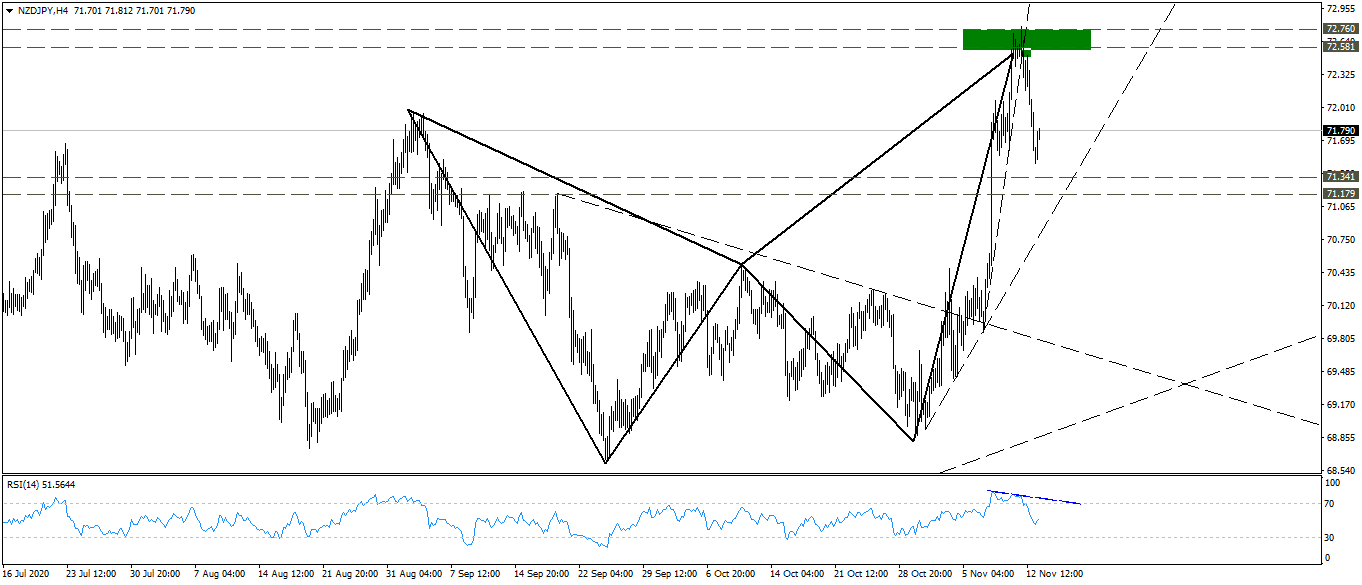

Pivot point: 72.30

Preferred scenario: Short positions below 72.30, targeting 71.15 levels

Alternative scenario: Stop loss and change direction by breaking the level of 72.45 with targeting levels of 73.15

Comment:

We have published an analysis of the New Zealand Yen pair from here

The pair moved in an upward direction on the four-hour frame, as it rose from 68.80 levels, with the breach of the descending trend line from the September high, with the breach of 71.35-71.20 < / p>

The price formed the harmonic alt bat pattern with a correction of 113% fibo of the xa leg at levels of 73.60-73.75 with the divergence on the RSI indicating some decline to levels 71.35-71.20

Indeed, the pair has declined, and it is expected to complete the decline, reaching the level of 71.15