Tensions in the world's second-largest economy began to affect the gold market in China, as residents' purchases declined, mainly due to accumulated demand after 3 years of restrictions to contain the Corona epidemic, and waning optimism that the Chinese economy will recover quickly. This is the latest sign of a stalled economic recovery in the country.

China rivals India as the world's largest consumer of bullion, gold coins and jewellery. Its central bank also recently joined the purchases, as it boosted its reserves for 7 consecutive months after a 3-year hiatus.

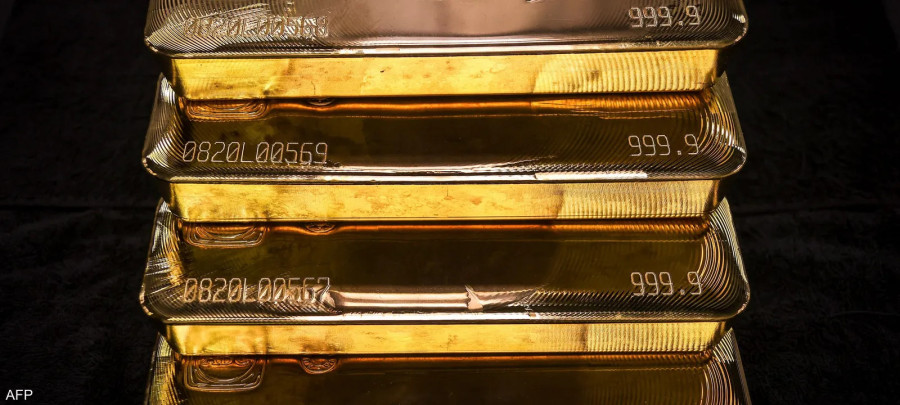

Although the majority of gold trading stems from viewing it as a financial asset - as a safe haven for investors in times of risk, or as a way to hedge against high inflation rates - China's real demand for the precious metal helped support its superiority since the beginning of this year, and its price exceeded $2,000 an ounce.

Jewellry sales

It seems that the rapid expansion of individual sales of gold and silver jewelry has reached its peak, as it rose 24% on an annual basis during last May, recording 26.6 billion yuan ($3.7 billion). This is slower than the growth rates of about 44% and 37% during the past two months. The same period last year also included extended lockdowns in Shanghai, when demand for goods and services collapsed across the economy.

JPMorgan recommends cash and gold and reduce stock holdings

The main demand indicator for the precious metal shows a further decline during this June. Gold is currently trading on the Shanghai Stock Exchange at less than the global market, after recording a price premium of about $44.20 an ounce last March, according to the World Gold Council.

Jiang Xu, general manager of the precious metals department of Shanghai Shandong Gold Industrial Development, said: People are cautious in spending money at present with various uncertainties about the economy, and we may not see a rapid increase in purchases again without falling prices. gold.

Continuing problems

In a related context, the concerns that kept global prices close to record levels continue, including the war in Ukraine, tensions between Washington and Beijing, and fears of inflation and recession around the world. Meanwhile, other domestic factors, such as weak markets for other investments such as stocks and real estate, can help support demand.

Zhang Ting, analyst at Sichuan Tianfu Bank, believes that despite the decline in the wave of buying in China, individual sales may remain high in the near term, as gold remains a good investment in light of persistent inflation fears, especially in the United States. .

Jiang from Shanghai Shandong concluded that additional purchases from the People's Bank of China could also offset any potential decline in retail sales.