It seems that Tesla stock is on a date with a prosperous year during 2023, to return to strong gains as usual, after an unprecedented setback last year, after the company showed strong financial performance despite economic and geopolitical challenges, in addition to the continued strong demand for electric cars from Tesla, as a brand. Distinguished by customers.

Despite the continued high rate of inflation and other economic challenges, Tesla's stock shows no signs of slowing down, as expectations indicate that the electric car maker's stock will continue to rise by the end of this year, but also in the long term.

The US company remains well positioned to capture a larger share of the fast-growing electric vehicle market, with a strong portfolio of new products and continued investment in technology and innovation.

Strong rebound for Tesla stock

Tesla shares have risen by about 60% since the beginning of this year, with improved investor sentiment towards technology stocks and high demand for electric cars, after a year of forgetting for Tesla.

Where the shares of the electric car giant lost more than 65% of its value in 2022, with concern about the company’s management, after the US billionaire Elon Musk’s acquisition of Twitter, in addition to the negative repercussions on the stock market in general against the backdrop of raising US interest rates to counter the acceleration of inflation. Motivated by these pressures, the stock recorded $102 in January 2023, which is the lowest price in two years, then a strong upward rally began.

And the stock took an upward path since then until it reached the level of $ 215 in mid-February, benefiting from the strong business results announced, as Tesla shares jumped by more than 75%, bringing the market value to $ 626 billion, and despite the recent gains, the stock is still much less than Its recorded peak is in November 2021, near $410 a share, with a market capitalization of over $1.2 trillion.

*Tesla stock performance over the past 12 months

Strong financial performance

Tesla shares benefited from the company achieving strong financial performance at the end of last year, despite economic pressures and supply chain disruptions affecting the industry in general with high prices and shortages of components.

Tesla achieved a better-than-expected net profit during the fourth quarter of last year, amounting to $ 4.10 billion ($ 1.19 per share), up 43%, compared to $ 2.87 billion ($ 0.85) in the same quarter of 2021, to record the best quarterly performance ever. .

The electric car company's revenues also recorded a record level of $24.31 billion in the last quarter of 2022, compared to $17.71 billion during the comparative period of 2021, representing an increase of 37% year-on-year.

On a full-year level, Tesla also achieved record performance, with net profit of $14.11 billion in 2022, up 85% year-on-year, and annual revenue of $81.46 billion, up 51%.

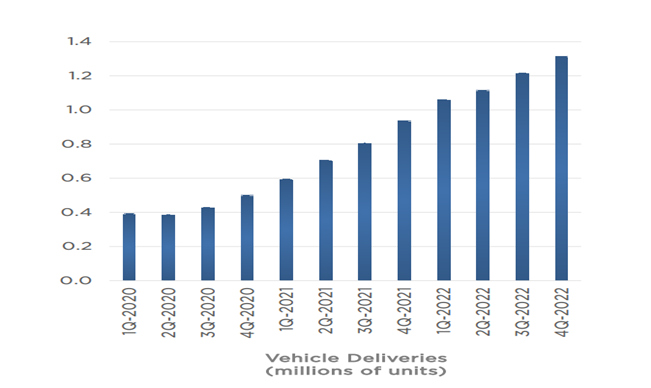

And in continuation of the record numbers, the rate of delivery of Tesla cars increased by 40% on an annual basis, to reach 1.3 million units last year, compared to 936.3 thousand cars the previous year, and only about 245.5 thousand units in 2018, as shown below:

The current year witnessed a remarkable increase in sales within China, which is the largest market for electric cars in the world, during February by about 32% on an annual basis, which supported the stock, after investors were frustrated by the passing of the Investor Day without announcing plans to issue electric vehicles.

Tesla is working to attract more buyers to its cars, as it lowered the prices of the Model S and Model X in the United States early this month, after a week of lowering its prices in China.

On the other hand, Tesla expects to produce 1.8 million cars this year, compared to 1.36 million units in 2022, indicating that it is able to maintain a compound annual growth rate of 50% for car production in the long term.

Amid strong fundamentals such as production and sales and an optimistic financial outlook, Jefferies analyst Philippe Hoshua raised his price target for Tesla stock to $230 from $180 previously, while maintaining a Buy rating, along with many Wall Street analysts, amid an optimistic view, especially after it was hit Short selling owners (short selling) in the first two months of 2023 who lost more than $ 7 billion, according to the analysis of the data company S3 Partners.

Technical analysis of the stock path

Last October of 2022, I published a detailed report entitled ((The specter of losses haunts Tesla stock, so where is the target??)) Prices were at the time at the level of $216 and I expected prices to fall to the level of $108, which happened less than two months later by reaching $102

Now, after the strong launch of the stock from the level of $102 to 217 in the middle of last February, we look at this rise as a promising rise and a motive for the stock that came after a well-defined three-way correction of DZ WXY, and the most important thing in my opinion is the depth of correction from the historical peak of November 413, 2021. It is likely that it is a correction of the entire course. Since its launch in 2013

Consequently, this means that Tesla's stock may, God willing, see a major breakthrough for it and a new price cycle, with price targets that exceed the level of the historical peak, and may reach $775 and even $1,200 in the next few years.

When is the entry date and at what price level??

The most important question remains that we will answer and present in the form of investment advice to the followers of the Namazon economic website, with the closing of yesterday’s session, Monday, March 6, 2023. The stock closed at the level of $193, noting the end of the impulse wave from the bottom of 102 and the correction began, which is expected to reach $145 to close a gap. The price was in its previous course, and at the same time it is equivalent to a correction of 62%, during the period of March

Therefore, we recommend owning the stock with an investment goal at the level between $160 and $145, with goals of $775 and $1200 over the next few years.

My best wishes to all of you

Iyad Aref

Founder of the economic site Namazon